Despite a recent uptick in M&A activity in Q1:24, the medical office building (MOB) market remains in flux. To understand the underlying dynamics, we spoke with industry expert Mindy Berman, Senior Managing Director in the Healthcare Capital Markets Group at JLL, a leading global commercial real estate and investment management company.

JLL is the top capital markets intermediary in both the United States and globally, as well as the leading MOB broker in the United States. Between 2017 and 2022, JLL advised on 35% of all medical office sales, amounting to more than $7 billion in disclosed prices. The company has remained active since then, with 26 transactions announced during 2023, and already five deals announced during the first quarter of 2024. JLL, the most active advisor in the MOB space, is 2x more active than the second most active advisor, CBRE.

The discussion with Berman delved into various aspects of the Q1:24 MOB market, analyzing recent market data and exploring industry dynamics that shape investment strategies. Berman shared her expertise on emerging trends, regional variations and the overarching outlook for MOB investments in 2024 and beyond.

Although LevinPro HC still uses the term ‘medical office building,’ it’s important to note the industry shift in terminology.

“We call it outpatient medical. We’re intentionally taking office out of the descriptor,” Berman said. “You’re still using the acronym MOB, but it’s medical outpatient buildings, not office. And the reason for that is in today’s real estate market, office properties are out of favor.”

High vacancy rates, declining rents and uncertainty about the future of office work due to remote work trends make ‘office’ a less attractive term for investors right now. In contrast, the medical outpatient market is perceived as more stable and has experienced positive trends like growing demand for outpatient services and an aging population. This creates a more positive connotation for ‘outpatient medical’ compared to ‘office.’

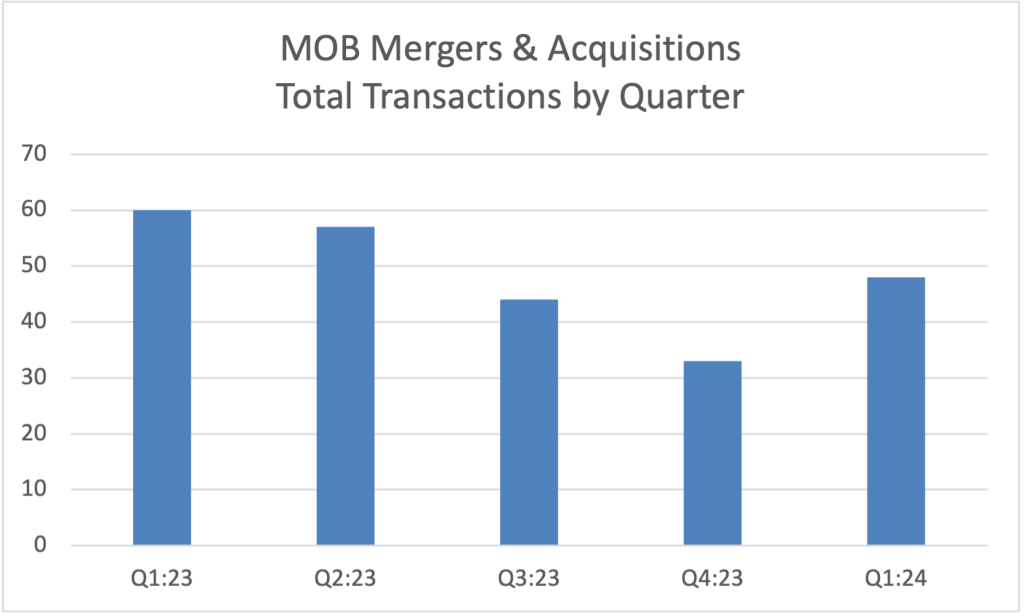

Berman also shed light on the recent fluctuations in M&A activity. While Q1:24 saw a 42% rise compared to the previous quarter, it remained lower than the year-ago period, by almost 22%. And 2023 as a whole was on the decline, as seen in the chart below.

Source: LevinPro HC, April 2024

“Overall, medical outpatient sales in 2023 fell 50%, but unlike the rest of real estate, what was driving decline in MOB sales was the level of portfolio sales were practically non-existent in 2023,” said Berman.

This suggests a shift in investor strategies, potentially favoring smaller, individual property acquisitions.

We certainly witnessed this in the data captured in the LevinPro HC database. Q1:24 had 14 transactions involving two or more properties, comprising approximately 29% of all MOB transactions announced during the quarter. This is a slight decline from Q1:23, when 19 MOB portfolio transaction were announced, making up about 32% of all MOB deals. During Q4:23, just eight transactions were MOB portfolio deals, making up about 24%.

During the entirety of 2023, there were 48 MOB portfolio deals, making up about 25% of all MOB deals announced that year. This represents a decrease from 2022, when 69 MOB portfolio deals were announced, comprising 32% of all MOB deals announced.

Traditionally, portfolio sales have been a significant driver of activity in the MOB market, offering investors economies of scale and potentially smoother due diligence processes. A shift away from these larger deals indicate a shift in investor strategies, potentially favoring smaller, individual property acquisitions. There could be several factors behind this change. Firstly, a focus on individual properties might allow investors to capitalize on specific regional growth or micro-markets within the healthcare sector. Secondly, smaller properties may offer more flexibility in terms of refurbishments or tenant mix, catering to the evolving needs of healthcare providers. Finally, the fragmented nature of the MOB landscape, with many smaller owners, could make individual acquisitions more readily available compared to large portfolios.

This trend towards smaller deals is likely to have a ripple effect on the market. We may see increased competition for individual properties, potentially driving up pricing for high-quality assets. Additionally, brokerage firms and lenders may need to adapt their services to cater to the specific needs of investors targeting smaller MOB acquisitions.

Berman also highlighted the regional variations in MOB market activity, with states like Texas, Illinois and Virginia emerging as hotspots for M&A transactions within the MOB sector.

“High population growth markets have outsized growth in the square footage inventory of medical properties,” said Berman.

She emphasized that these regions, characterized by high population growth and robust healthcare infrastructure, have attracted substantial investor interest, contributing to their prominence in the MOB market landscape.

While investors are targeting these hotspots for MOB activity, they should also be mindful of potential saturation risk. These markets might see increased competition for assets, potentially driving up valuations and squeezing cap rates. Investors should consider incorporating secondary markets with similar growth attributes to diversify their portfolios and potentially secure more favorable investment opportunities.

Looking ahead, Berman offered a look into the future trajectory of the MOB market, emphasizing the need for strategic diversification and risk mitigation.

“The tailwinds are the usual trends in healthcare,” she noted. “Growing demand for healthcare services due to growth in population, aging demographics, advances in technology driving outpatient care and the movement from the inpatient environment to the outpatient environment.”

While the tailwinds Berman highlights are positive for the overall MOB market, investors should implement strategic diversification within their portfolios to capitalize on these trends. This could involve targeting specific property types suited to outpatient care, such as imaging centers or surgical suites. Additionally, diversification across various geographic markets with favorable demographics and healthcare infrastructure can help mitigate risk and potentially unlock higher returns.

Berman also acknowledged the headwinds impacting the market, particularly regarding financing.

“Headwinds are principally around interest rate increases and volatility and availability of financing,” she stated. “That has been a challenge since last March when we had the notable bank failures like Silicon Valley Bank that’s crimped the availability of debt financing.”

Investors navigating the MOB market will need to consider these financing challenges in their strategies, as a tighter lending environment will likely impact deal structures and valuations in the MOB market. Rising interest rates and heightened caution from banks are making it harder to finance MOB deals. Consequently, investors may find themselves requiring greater upfront cash, engaging in lengthier deal negotiations and adopting a more selective approach, emphasizing properties with stable tenants and a strong track record.

While headwinds like rising interest rates and financing challenges pose obstacles for the MOB M&A market in 2024 and beyond, the long-term outlook for outpatient medical real estate remains positive. Berman anticipates a navigable landscape for strategic investors with creative financing solutions and a long-term view. The key will be identifying which assets are the real diamonds in the rough.