The Managed Care sector witnessed a dynamic year in 2023, with key players navigating various challenges and opportunities. This analysis explores the financial trajectories of major companies, including Humana, Cigna, UnitedHealth Group, Elevance Health, Centene and Molina, shedding light on the trends, challenges and strategies currently shaping the market.

Market Overview:

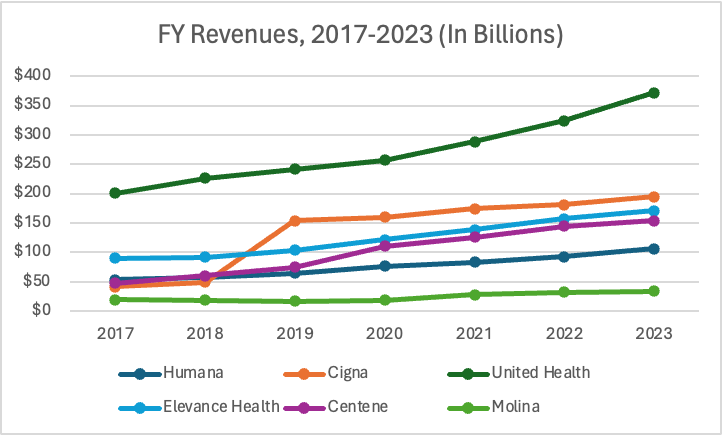

Over the years, Managed Care companies have demonstrated resilience and growth. The market has consistently followed an upward trajectory, with most of the major players experiencing revenue growth each year.

Source: Macrotrends

UnitedHealth Group stands out as the revenue leader, with consistently strong revenue growth over the past few years. Starting at around $200 billion in 2017, its revenue climbed steadily, reaching nearly $400 billion by 2023. This sustained growth, especially through its Optum and UnitedHealthcare businesses, reflects UnitedHealth Group’s market dominance in the Managed Care market. While most Managed Care companies have seen a slowdown in their revenue growth since 2019/2020, UnitedHealth Group’s growth each year only rose.

Humana’s revenue also follows an upward trend, starting at $150 billion in 2017 and reaching around $250 billion by 2023. Despite facing challenges in Q4 2023, including a loss per share of $4.42, Humana remains committed to its Medicare Advantage annual membership growth, projecting an increase of approximately 100,000 members or 1.8%. While not as steep as UnitedHealth Group’s growth, Humana maintains a positive trajectory each year.

Cigna had an unusual pattern. Its revenue started around $50 billion in 2017 and then jumped by nearly 200% to about $150 billion in 2019 after its March 2018 acquisition of Express Scripts, which integrated pharmacy services into its portfolio. By 2023, Cigna’s revenue stood at approximately $250 billion. This substantial increase sets Cigna apart from the other companies in its sector.

Elevance Health, another player in the Managed Care space, has exhibited steady growth over the years. The company has gone from generating almost $100 billion in revenue during 2017/2018, to more than $170 bilion by 2023.

Centene has also demonstrated consistent revenue growth over the years. Starting from nearly $100 billion in 2017/2018, it has steadily climbed to approximately $150 billion by 2023, a 6.5% increase year-over-year.

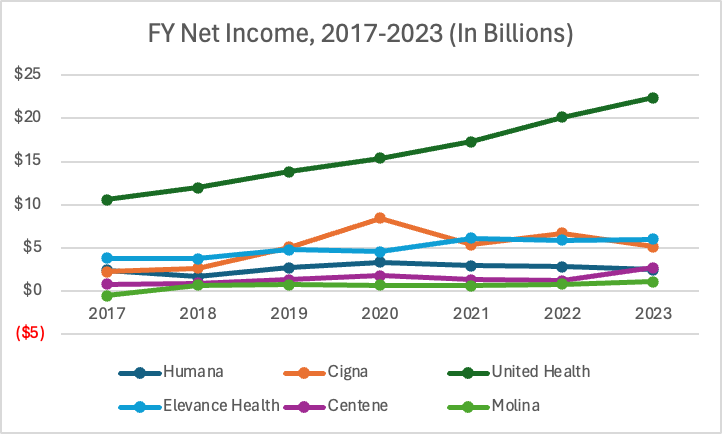

Finally, Molina has lagged behind the other companies in terms of revenue growth in recent years. The company had a few years of declining revenues between 2017 and 2019, but since then, it has been on a gradual climb upwards. During 2023, the company announced revenues of more than $34 billion during 2023, a more than 6.5% increase over the nearly $32 billion announced in 2022. However, revenue doesn’t always tell the full story. Net income is also important to look at to better understand each company’s performance during 2023.

Source: Macrotrends

Earnings Round-Up’s:

Humana

Humana saw some significant challenges in the last quarter of 2023. The company reported a loss per share of $4.42 on a GAAP basis for Q4 2023, with an adjusted loss per share of $0.11. These results were influenced by an additional increase in Medicare Advantage medical cost trends. The main driver behind this was the unexpectedly high inpatient utilization during November and December, likely attributed to seasonal respiratory illnesses. Furthermore, non-inpatient trends also contributed to the cost escalation.

In light of these cost pressures, Humana provided an initial FY 2024 EPS guidance of approximately $14.87 on a GAAP basis and approximately $16 on an adjusted basis. The company projected that the higher Medicare Advantage medical costs experienced in Q4 2023 would persist throughout 2024.

In prepared remarks, Humana acknowledged “greater inherent uncertainty” in its 2024 outlook due to a spike in utilization that negatively impacted its finances in Q4 2023. It emphasized its willingness to adjust guidance if the situation improves over the course of the year.

Susan Diamond, CFO of Humana, emphasized the importance of monitoring utilization trends in the coming months, stating, “We’re watching utilisation trends very closely, as well as the annual Medicare Advantage rate notice. With uncertainties surrounding regulatory changes and the potential impact on Medicare Advantage payouts, we remain vigilant in assessing competitors’ pricing strategies and adjusting our plans accordingly.”

CEO Bruce Broussard also commented on these challenges, saying, “I think the whole industry will possibly reprice, alluding to the challenges posed by increased utilisation and ongoing regulatory changes anticipated in 2025 and beyond.”

The company’s financial outlook for 2024 has raised concerns among investors and analysts. Humana’s stock experienced a 2.5% drop in the first 24 hours since its forecast was first announced, and has since fallen by nearly 16% as of March 12 following the release of the disappointing fourth-quarter results. The company reported a $541 million loss for Q4, yet still managed to surpass revenue expectations, reporting $26.5 billion for the quarter, compared to $22.4 billion in the prior-year quarter. Humana’s called-off merger with Cigna at the end of 2024 may have also rattled investors when it was announced that two payers couldn’t agree to a price tag. It’s speculated that a heightened antitrust focus from the Biden administration has also played a role. Many Managed Care players are under pressure due to rising utilization, slowing growth and changes to the Medicare Advantage program.

It seems there is some merit to this theory, as the Wall Street Journal recently reported that Humana’s competitor, UnitedHealth Group, was being investigated for antitrust allegations, with a specific focus on the ties between UnitedHealthcare and Optum.

Cigna

Cigna reported a strong fourth quarter and full-year performance, with earnings surpassing expectations. Notably, its net income profit in Q4 reached $1 billion, or $3.49 per share, including a net after-tax loss of $552 million, or $1.88 per share, primarily associated with the loss on sale of businesses, a deferred tax benefit, as well as a charge for the organizational efficiency plan. Although this is a slight decline from a profit of $1.2 billion in 2022, it is still quite impressive.

CEO David Cordani said on the company’s earnings call that the Medicare segment accounted for about $12 billion in revenue and that while Cigna still sees “the seniors market as an attractive growth market,” the existing business would have required investments, focus, capital and resources that were “disproportionate to their size within the Cigna Group’s portfolio.”

For now, Cigna sees opportunity in engaging with Medicare through its Evernorth business, rather than offering Medicare Advantage, Part D and other coverage.

Cigna reaffirmed this with its recently announced deal to sell its Medicare business to Health Care Service Corporation. Evernorth is signed on to administer pharmacy benefits to the former Cigna Medicare plans for the next four years. According to Cordani, the company will continue building relationships in the Medicare space through Evernorth.

“We’ve been quite deliberate now for several years, working to expand the service portfolio and the value proposition within Evernorth for health plan partners as it relates to their government services, be it Medicare, be it duals, be it Medicaid, etc.,” Cordani said. “And we’re demonstrating a very attractive proven track record of growing our government reach but through the services franchise, and we will continue to fuel that on a go-forward basis and see that as an attractive trajectory for us.”

This shift to Evernorth has raised both investor interest and concerns, leading to a slight decline in its stock in the first 24 hours following its earnings announcement. However, the company’s recent transaction and its plans to further strengthen its position in the healthcare market may well shape its future growth trajectory. By focusing on Evernorth’s services franchise, Cigna aims to enhance value for health plan partners across government services, including Medicaid and duals. Perhaps investors see the long-term potential, too, as the stock quickly picked back up in no time. As of March 12, Cigna’s stock has risen by 6% since its early February earnings announcement.

UnitedHealth Group

Despite a positive performance in the fourth quarter, UnitedHealth Group faced challenges that impacted investor confidence. The company reported $5.5 billion in profit for Q4, exceeding the prior-year quarter’s $4.8 billion. Additionally, Q4 revenue reached $94.4 billion, up from $82.8 billion in the same period in 2022.

However, the spike in utilization during Q4, attributed to factors such as increased respiratory syncytial virus (RSV) vaccinations and elevated COVID-19-related costs, led to a medical loss ratio (MLR) of 85% (compared to 82% in 2022). This increase, coupled with the ongoing trend of patients, particularly seniors, addressing deferred healthcare needs, contributed to a decline in UnitedHealth’s stock price. Chief Financial Officer John Rex highlighted that seniors responded strongly to RSV vaccinations, leading to additional primary care visits.

Despite the stock’s initial decline, CEO Andrew Witty reassured analysts that the full-year MLR was within target at 83.2%. He emphasized that the utilization spike in Q4 is not expected to have a significant impact on the company’s outlook for 2024. The company’s overall outlook remains positive, as it reported $22.4 billion in profit for the full year 2023, compared to $20.1 billion in 2022.

UnitedHealth Group’s growth was fueled by double-digit expansion at both UnitedHealthcare and Optum. UnitedHealthcare’s revenue for 2023 reached $281.4 billion, a 12.7% year-over-year increase, driven by growth in Medicare Advantage and commercial plans, although Medicaid rolls saw a decrease due to ongoing redetermination processes. Optum experienced robust growth, with full-year revenues of $226.6 billion, a 24% increase from 2022, propelled by various segments, including Optum Health, Optum Insight and Optum Rx.

Elevance Health

Although most of its competitors have been hit by the rise in care utilization, executives at Elevance Health, formerly known as Anthem, Inc., said its quarter performance generally aligned with what they expected to see.

Chief Financial Officer Mark Kaye said during the company’s earnings call that the company had a benefits expense ratio of 89.2%, landing at the midpoint of its expected range. This ratio represents the proportion of premium revenue spent on healthcare services. Centene’s stability in this area demonstrates its ability to managed medical costs.

Elevance Health also identified certain areas with increased utilization, which aligns with reports from other payers. The insurer saw an increase in orthopedic services and other forms of care which had been delayed during the pandemic. Additionally, there was a rise in services related to respiratory conditions toward the end of the fourth quarter. Elevance Health factored in this trend in the second half of the year as part of its cost trend estimates, having already identified it in its Q2:23 earnings earlier in the year.

The company posted $42.6 billion in revenue for Q4, which is up nearly 7% from the $39.9 billion in revenue reported for the prior-year quarter.

By the end of the year, Elevance Health’s membership was 47 million, declining by 1% (approxiately 570,000 members). The company attributed this decline in part to ongoing Medicaid redeterminations and decreases in its employer group risk-based plans. During Q4 in particular, the company lost 364,000 members because of the Medicaid eligibility rulings, which was partially offset by commercial segment growth.

Operating revenue at Carelon was $12.4 billion in Q4 and $48 billion for the full-year 2023. The company saw growth in membership at Carelon Rx, its pharmacy benefit management arm, and touted the acquisition of specialty pharmacy company BioPlus as key drivers. That transaction was first announced in November 2022 and closed in February 2023.

Due to its positive revenue Elevance Health’s performance during the fourth quarter led to a boost in its stock. In the 24 hours after it released its earnings, Elevance Health’s stock increased by 1.5%. As of March 12, the company’s stock has risen by nearly 7% since its January earnings call.

Centene

For the final quarter of 2023, Centene reported $45 million in net income profit. This is an improvement over Q4:22, when the company posted a $213 million loss. For 2023 as a whole, Centene logged $2.7 billion in profit, a significant improvement over a $1.2 billion profit in 2022.

CEO Sarah London said the performance is slightly ahead of the company’s previous guidance, giving the company momentum heading into this year.

“Looking ahead, we are excited by the opportunities we see within our core businesses as we execute against our strategic plan, fortify our foundational assets and drive cost savings,” she said. “With increased focus and reduced complexity, Centene is well positioned to continue navigating the dynamic operating landscape while creating shareholder value.”

In the fourth quarter of 2023, premium and service revenues for Centene increased by 5% to $35.3 billion, driven by membership growth in the Marketplace business and overall market expansion. However, the health benefits ratio rose from almost 89% to 90%, primarily due to a $250 million premium deficiency reserve related to the 2024 Medicare Advantage business. In Q4 2023, the company disclosed a cash flow from operations amounting to $217 million. This was predominantly driven by favorable net earnings but was partially mitigated by a reduction in unearned revenue, a consequence of receiving payments from the Centers for Medicare and Medicaid Services earlier than expected.

For the full year, premium and service revenues increased by 3% to $140.1 billion, driven by an 88% membership growth in the Marketplace business. Despite divestitures, Medicaid membership redeterminations and pharmacy carve-outs in early 2023, Centene’s strong performance led to an upward adjustment in the 2024 premium and service revenues guidance range by $2.5 billion, now ranging from $134.5 billion to $137.5 billion.

Centene has shown resilience in the face of challenges, including a significant loss of Medicaid members during the redetermination process. The recent divestitures, such as the sales of Magellan Specialty Health to Evolent Health for approximately $600 million, Circle Health to PureHealth for $1.5 billion, Apixio to New Mountain Capital and Operose Health to HCRG Care Group have been key drivers of Centene’s performance in its pursuit to optimize its portfolio for future growth.

Molina

Several factors contributed to Molina’s successful quarter, including an almost 6% increase in premium revenue to $8.36 billion. This growth in premium revenue played a pivotal role in surpassing analysts’ revenue expectations. Additionally, Molina’s quarterly medical loss ratio stood at 89%, lower than the estimated 90%, contributing to the positive financial results.

Despite a nearly 5% decrease in Medicaid plan memberships to 4.5 million, Molina experienced a more than 10% growth in Medicare memberships, reaching 172,000. These membership figures provide insights into Molina’s customer base and shifting demographics.

Looking ahead, Molina is optimistic about its future prospects, projecting premium revenue of approximately $38 billion and adjusted earnings of at least $23.50 per diluted share for the full year of 2024.

“Our 2023 performance reflects the successful execution of our growth strategy, which positions us to achieve sustainable and profitable growth in 2024 and beyond,” said Joseph Zubretsky, President and Chief Executive Officer of Molina Healthcare.

Investors closely monitored Molina Healthcare’s financial updates during its February 2024 earnings call, and evidently, the results boded well for the company’s stock. In the first 24 hours after its February 2024 earnings call, Molina saw its stock rise by almost 2%, and since then it has risen by more than 5% as of March 12, 2024, indicating growing investor confidence. Whether it’s institutional investors or individual traders, they’re placing their bets on Molina’s future prospects.

Final Thoughts:

The consistent financial resilience and growth exhibited by the major Managed Care companies signal a broader trend of stability and adaptability within the sector. Despite facing challenges such as rising utilization rates, regulatory changes and shifts in consumer behavior, the Managed Care market demonstrated positive financial trajectories. Every single company highlighted in this report had positive revenue growth over the prior year, and net income remained stable.

The expansion of Managed Care is reshaping the healthcare industry by driving a transition towards more integrated and efficient care delivery systems. This growth means a stronger focus on value-based care, where reimbursement aligns with patient outcomes, leading to higher-quality care at lower costs. It also encourages innovation in care models, such as the use of digital health tools and telemedicine, to improve access and convenience for patients.

For other sectors, the implications are equally significant. The eHealth sector, for instance, may see increased demand for technological solutions, ranging from electronic health records to data analytics platforms that support managed care objectives. The pharmaceutical industry might experience changes in drug pricing and distribution models as managed care organizations seek to control costs and improve patient care. Moreover, the growth of managed care could spur new partnerships between healthcare providers and payers with entities outside the traditional healthcare space, such as retail or wellness companies, to create a more holistic approach to health and wellness. This could lead to cross-sector collaborations that blend healthcare with lifestyle, fitness, nutrition and other aspects of daily living.