Explore the financial performance of key players in the Home Health and Hospice (HH&H) sector during 2023. From Amedisys’ steady growth to Addus’ fluctuations, discover the ups and downs, strategic moves and investor interest that defined the industry.

2023 Quarterly Stock Performance of Publicly Traded HH&H Companies:

| Company | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

| Amedisys | $73.55 | $91.44 | $93.40 | $95.06 |

| Encompass Health | $54.10 | $67.71 | $67.16 | $66.72 |

| The Pennant Group | $14.28 | $12.28 | $11.13 | $13.92 |

| Addus HomeCare | $106.76 | $92.70 | $85.19 | $92.85 |

| Enhabit | $13.91 | $11.50 | $11.25 | $10.35 |

| Aveanna Healthcare | $1.04 | $1.69 | $1.19 | $2.68 |

Amedisys: Amedisys is a leading provider of home health and hospice services in the United States. The company operates in 39 states and the District of Columbia, and provides care to more than 465,000 patients each year. In June 2023, UnitedHealth Group’s Optum announced that it would acquire Amedisys for approximately $3.7 billion.

Amedisys experienced steady growth throughout the year, with its stock price increasing from $73.55 in Q1 to $95.06 in Q4, indicating positive performance and investor confidence following the Optum deal announcement.

Encompass Health: Encompass Health offers both facility-based and home-based patient care through its network of inpatient rehabilitation hospitals, home health agencies and hospice agencies. The company has a national footprint of 161 hospitals in 37 states and Puerto Rico. After making one acquisition in 2022 in the Rehabilitation sector, the company made no M&A deal announcements during 2023.

Encompass Health demonstrated a relatively stable trend in its stock during 2023, starting at $54.10 in Q1 and ending at $66.72 in Q4, suggesting consistent but moderate growth.

The Pennant Group: The Pennant Group, Inc. is a holding company of independent operating subsidiaries that provide healthcare services through 99 home health and hospice agencies and 51 senior living communities located in Arizona, California, Colorado, Idaho, Iowa, Montana, Nevada, Oklahoma, Oregon, Texas, Utah, Washington, Wisconsin and Wyoming. During 2023, the company announced five acquisitions between May and December. The company announced acquisitions in Arizona, Idaho, Colorado, Oklahoma and Texas.

The Pennant Group faced challenges, with its stock declining from $14.28 in Q1 to $11.13 in Q3, although it showed a slight recovery to $13.92 in Q4.

Addus HomeCare: Addus HomeCare is a provider of home care services that primarily include personal care services that assist with activities of daily living as well as hospice and home health services. Addus HomeCare provides home care services to approximately 45,500 patients through 206 locations across 22 states. The company made one acquisition announcement in 2023. In June, it acquired Tennessee Quality Care in Parsons, Tennessee for an undisclosed amount.

Addus HomeCare experienced fluctuations in its stock end-price each quarter, starting at $106.76 in Q1, dipping to $85.19 in Q3, and recovering to $92.85 in Q4, indicating a mixed performance over the year.

Enhabit: Enhabit is a home health and hospice provider with a nationwide footprint spanning more than 250 home health locations and 100 hospice locations across 34 states. Enhabit’s stock price declined steadily from $13.91 in Q1 to $10.35 in Q4. After announcing two home health deals in 2022, the company made no M&A announcements during 2023, which could have contributed to the decline in stock.

Aveanna Healthcare: Aveanna Healthcare, a portfolio company of Bain Capital and J.H. Whitney Capital Partners, is the largest pediatric home health care company in the United States. It was formed with the merger of Epic Health Services and PSA Healthcare in March 2017. Aveanna went public through a $100 million IPO in April 2021 but has not made any M&A announcements since December of the same year. Aveanna saw a substantial increase from $1.04 in Q1 to $2.68 in Q4 after a dip in Q3.

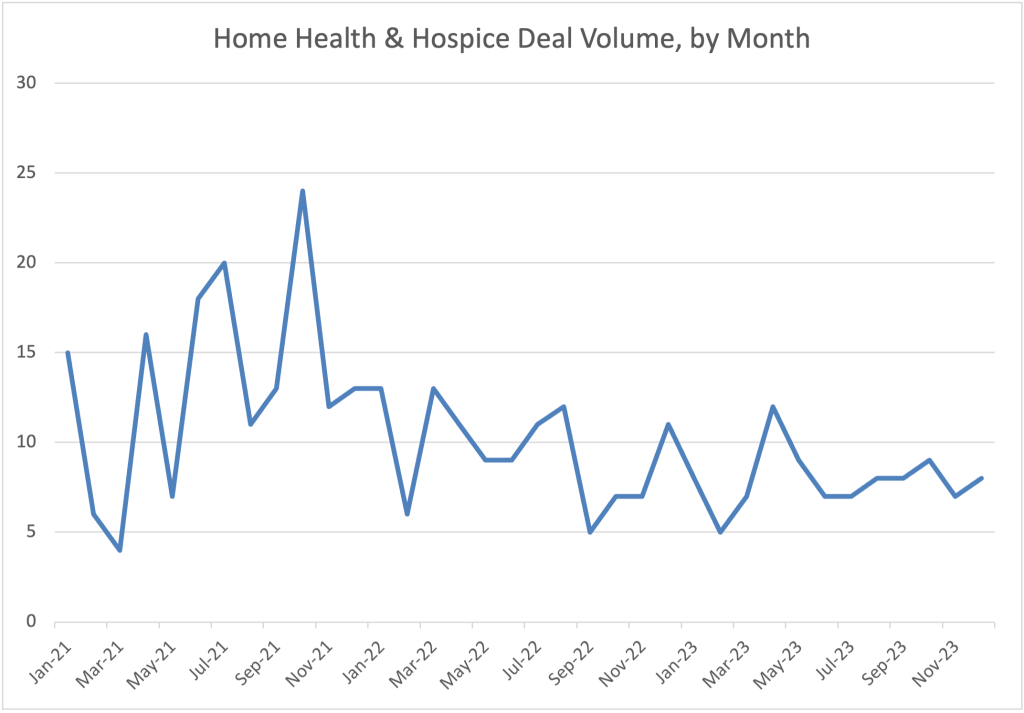

While some companies, like The Pennant Group, Addus HomeCare and Enhabit witnessed declining stock values throughout the year, others in the HH&H sector, such as Amedisys, Encompass Health and Aveanna Healthcare, have emerged on a positive note. Although M&A interest in the HH&H market has been on the decline since reaching its peak in 2021, as depicted in the graph below, there does appear to be ongoing investor interest in the space.

Source: LevinPro HC