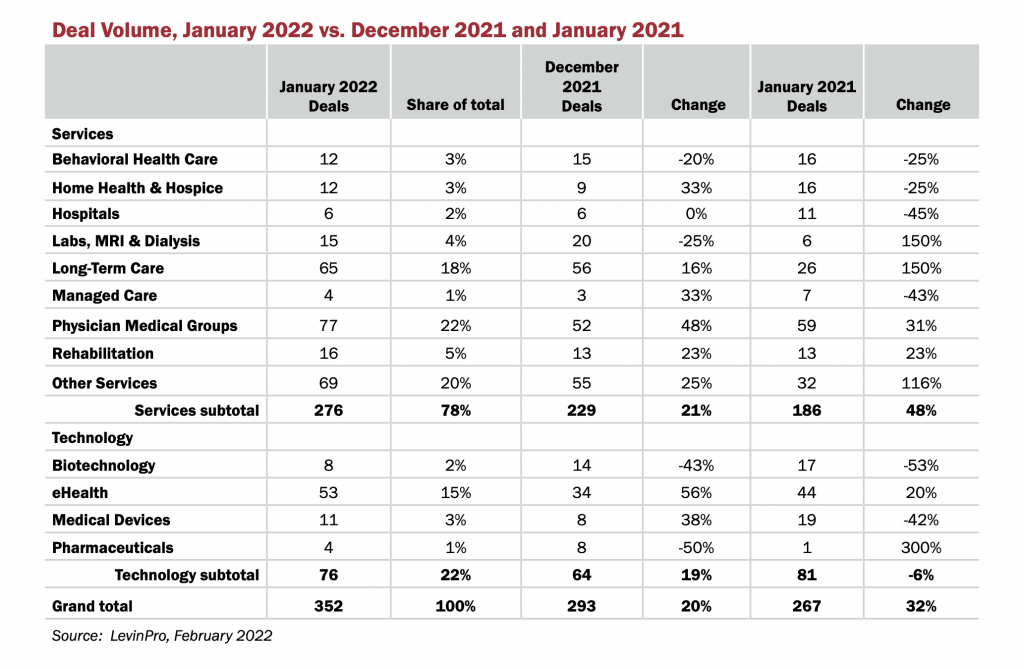

The new year is already off to a strong start. Deal activity in January hit a record high with 352 deals across all sectors, beating out the previous record of 293 deals in January 2021. An impressive feat, considering the many headwinds currently facing the market. We expect this number to continue to rise as more January deals continue to be announced.

2021 was a record-breaking year for deal activity, with 2,599 deals on the books so far. However, if January’s strong showing foreshadows the rest of the year, 2022 may shatter the prior year’s record.

The busiest sector during January 2021 was Physician Medical Groups (PMG), with 77 announced deals, making up 22% of all deals across both the Services and Technology segments. This is a healthy 48% increase from December when there were only 52 deals announced within the PMG sector. Ophthalmology was the busiest subsector during January, with 17 deals.

The largest acquirer in the PMG space was GI Alliance, the largest, physician-led gastroenterology network in the United States, which made four partnerships during January. The group is backed by Waud Capital Partners, and private equity backed groups are the most active buyers in the market.

After such a strong December, it was hard to imagine the PMG sector could get any busier. But it would seem there is no end in sight to the private equity capital available for investment in the PMG sector. We expect activity to remain high throughout the year.

Investor interest in the eHealth sector grew by almost 56%, jumping from 34 deals in December 2021 to a whopping 53 deals in January 2022. The eHealth deal total accounted for 15% of all deals during January, and nearly 70% of all technology deals.

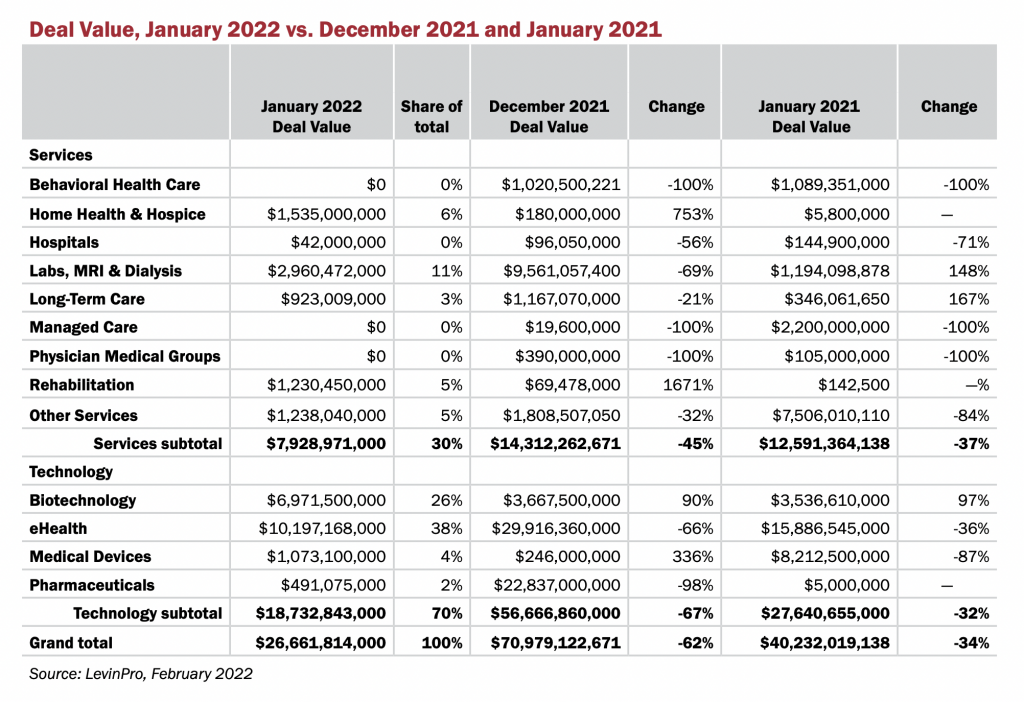

The eHealth sector took the prize for total purchase price last quarter coming in at nearly $10.2 billion, which is more than all of the services sectors combined.

However, although it had the most announced deal value, eHealth purchase prices did not reach the level seen during December 2021, when disclosed purchase prices reached more than $29.9 billion.

Overall dollar volume, however, was rather low in January, hitting only $26.6 billion, a 62% drop compared with December and a decline of 34% compared with January last year.

The largest deal of the month, based on disclosed price, was when R1 RCM Inc. acquired Cloudmed for $4.1 billion. Cloudmed is a healthcare technology company focused on revenue intelligence and data-driven insights. Cloudmed partners with over 3,100 healthcare providers in the United States and recovers over $1.5 billion of underpaid or unidentified revenue for its clients annually.

It’s clear that regardless of the headwinds facing the industry, such as labor costs, the workforce shortage and new Covid variants popping up across the country, there continue to be investors looking to strengthen their place in the market. Tailwinds, such as demographic changes and a still highly fragmented healthcare market seem to be outweighing any worries that might give investors pause.