Hospitals are the subject of intense national attention this year, thanks to the coronavirus pandemic. When Covid-19 hit hard in March, several hospitals and health systems were overwhelmed with critically ill patients. Elective surgeries were canceled, emergency room and hospital visits plummetted and revenue streams dried up. Congress quickly passed the Coronavirus Aid, Relief and Economic Security Act, which sent $100 billion to healthcare providers in the form of loans and grants.

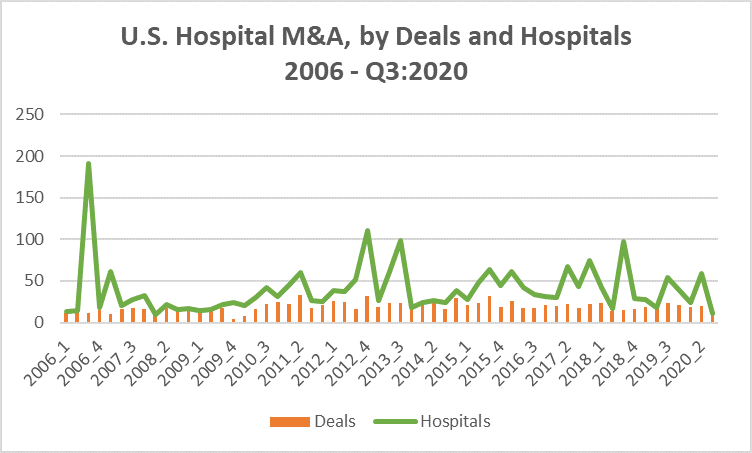

Mergers and acquisitions already underway at the beginning of the year kept moving forward, mostly. The first quarter of 2020 saw 19 transactions reach the definitive agreement stage, the same number reported in the first quarter of 2019. In the second quarter of 2020, ending June 30, another 20 transactions closed or moved to the definitive agreement phase. That figure actually topped the year-earlier second quarter, which had 17 hospital deals.

The summer of 2020 saw the coronavirus spread throughout the Sunbelt states, particularly Arizona, Florida and Texas, and hospitals were once again under pressure both physically and financially. By the end of the third quarter, just 10 deals were announced in the sector, far below the 23 deals made in the third quarter of 2019, a 57% drop year over year.

Some deals have been postponed or called off this year, not surprisingly. ProMedica pulled its Coldwater Regional Hospital in Michigan off the market in June, citing the uncertainties around the pandemic. Ventura County (California) officials ended months of partnership talks with Dignity Health involving the sale of Ventura County Medical Center in late July. Two of the most notable cancellations involved a single system, Beaumont Health, in Southfield, Michigan. In January 2020, Beaumont signed a definitive agreement to merge with Summa Health, a four-hospital system in Akron, Ohio. Beaumont called off the merger in late May even after all the necessary regulatory approvals were granted. Soon after, Beaumont executives announced a merger with Advocate Aurora Health, a 28-hospital system spanning northern Illinois and southern Wisconsin. Those talks ended in early October 2020.

But don’t set off the alarm bells. We checked our Deal Search Online database, going back about 15 years to 2006, before the start of the Great Recession in December 2007. A quarterly total of only 10 deals hasn’t been seen since the first quarter of 2008, the first quarter following the start of the recession. In fact, the same number of hospital deals (10) were reported in the first quarter of 2007, a year earlier.

The Great Recession took a toll on hospital transactions, as it did on most other healthcare sectors. The lowest number of hospital deals reported in a single quarter was at the end of 2009 (four). The recession was officially over in June 2009, by definition, although it was hard to see at the time. The following quarter, Q1 2010, posted eight deals, a 100% increase that would be hard to celebrate, given the total.

The number of hospitals changing hands in the first three quarters of 2020 (96 hospitals) is virtually the same as in the first three quarters of 2019 (100). The most hospitals involved in a single quarter’s transactions was reported in the third quarter of 2006. Only 11 deals were announced then, but one was the take-private deal of HCA, Inc. by a private equity consortium that included Bain Capital; Kohlberg, Kravis, Roberts & Co.; Merrill Lynch Global Private Equity and HCA management for $33 billion. HCA at the time operated 176 hospitals (41,850 beds), 92 outpatient surgery centers and affiliated services.

No other deal since has come close to it in size or price, although there was a flurry of for-profit mergers in the summer of 2013, first between Tenet Healthcare Corporation and Vanguard Health Systems (28 hospitals, 7,081 beds), then between Community Health Systems and Health Management Associates (71 hospitals, approximately 11,000 beds). In Q3:2018, RCCH HealthCare Partners and its sponsor, Apollo Global Management, took LifePoint Health (68 hospitals) private in a $5.6 billion deal.

Hospital deals are already popping in the fourth quarter of 2020. We’ve recorded nine transactions in the month of October. Some are fairly sizable deals, too.

On October 1, Wilmington, North Carolina-based New Hanover Regional Medical Center (677 beds) signed a definitive agreement to be acquired by Novant Health, a 15-hospital system, for $1.5 billion. The same day, Vanderbilt Medical Center in Nashville announced its acquisition of two Tennessee-based hospitals (118 beds, combined) from Community Health Systems for an undisclosed price. On October 9, the merger between two more North Carolina-based organizations, Atrium Health and Wake Forest Baptist Health (1,535 beds), was finalized.

Then came news on October 26 that Salt Lake City-based Intermountain Health signed a letter of intent to merge with Sioux Falls, South Dakota-based Sanford Health. If the deal gets all the necessary approvals, the combined organization will operate 70 hospitals, many in rural communities, as well as 435 clinics across seven states. It will also provide senior care in 233 locations in 24 states. Both organizations run their own insurance plans, which will combine to cover 1.1 million people.

The year’s not over yet, although neither is the pandemic. We’re still betting on the deal makers.