Of course, we have to suggest that February’s abysmal deal volume—just 96 reported so far—may be the result of fears about the coronavirus. The reality is that the stock markets began swooning in late January, but managed to post a few bounce-back days here and there. They really didn’t tank for consecutive days until February 20, when the virus claimed its first U.S. victims and was spreading through communities. And with no sign of a coronavirus containment, it’s hard to say when the alarm will calm.

We attended a few healthcare-related meetings in a couple of major cities during the final weeks of February. Attendance was high at every event. Only now are we hearing that conferences are being canceled, including the annual HIMSS20 show in Orlando in mid-March. The announcement came just a few days after President Trump agreed to be the keynote speaker. Some dealmakers we spoke with acknowledged that deal flow was lighter than expected in February, after a busy January (134 deals). Only one said things were “crazy” at his firm.

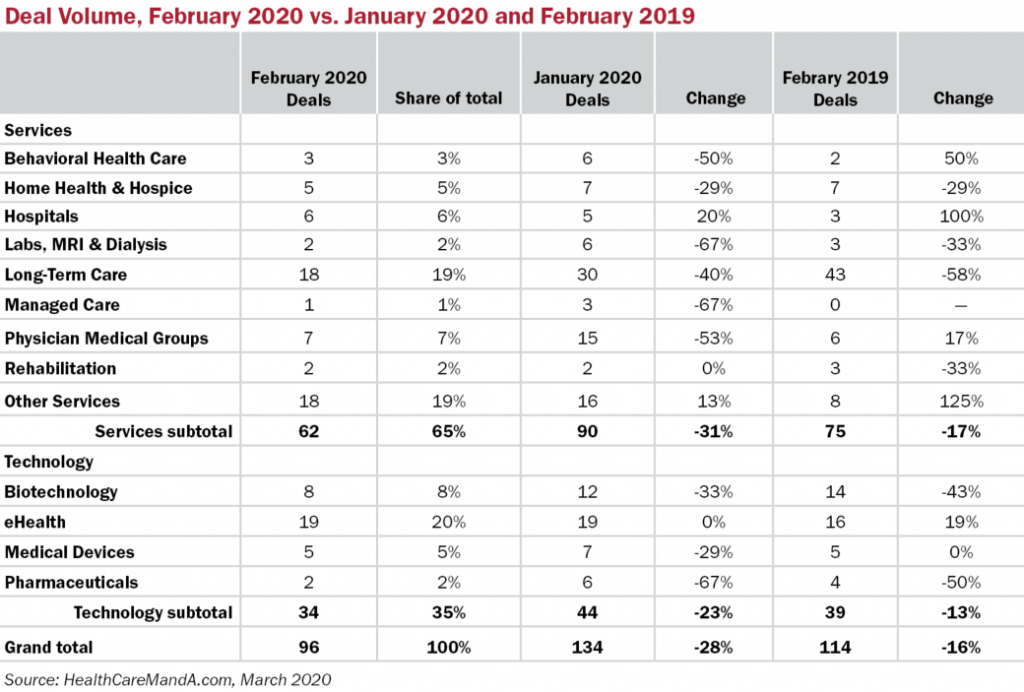

The entire first quarter of 2019 was slow, just for reference. At this time last year, we only had 102 deals on the books in February, a figure that now stands at 114. We expect to hear about a few more transactions from the month and have to add that March 2020 is starting off much busier than expected.

Here are some notable trends from February’s volume. The Long-Term Care sector, which typically beats out every other sector in deal volume, saw deal volume fall by 40% between January and February, to 18 deals. The senior housing and care sector could take a beating in the coming months, as 10 of the 11 U.S. fatalities attributed to the coronavirus occurred in a single skilled nursing facility outside Seattle. Hospital deals were strong in February, for reasons more closely related to finances than disease states. That’s not to say the sector won’t be affected by coronavirus’s inevitable spread to all areas of the country. If hospitals’ financial situations worsen, M&A activity will take a hit, for sure.

On the technology side, eHealth deals powered on, with 19 transactions. That equaled January’s total and was 19% higher than in March 2019. Already, telemedicine is seen as a “winner” in this coronavirus scare. Only one telehealth deal was reported in February, though. Patient engagement platforms were the hottest targets in the sector. That could change quickly.

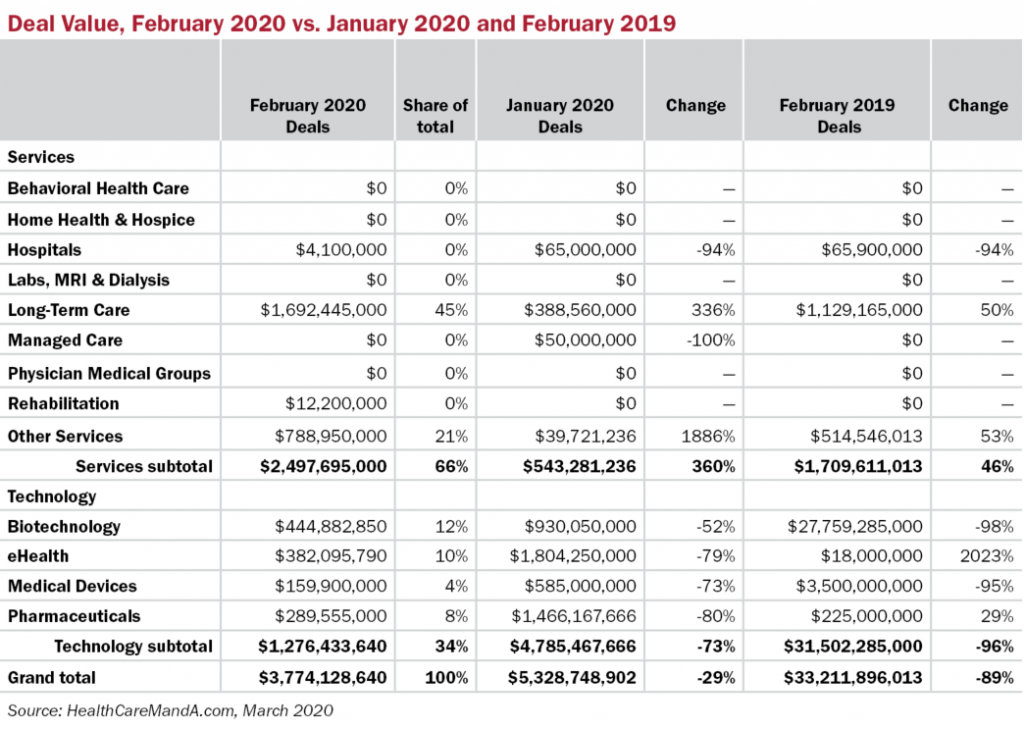

Disclosed spending was also very low, at $3.8 billion. That’s 29% lower than January’s light $5.3 billion total and almost 90% off from a year earlier. The largest deal was only $740 million, as Welltower Inc. (NYSE: WELL) is selling a seniors housing portfolio to an undisclosed buyer. Hmm. What did Welltower know, and when?

The Democratic presidential primaries were certainly a factor in February, as the Iowa caucuses imploded due to technology failures and Sen. Bernie Sanders (D-VT) claimed victory in New Hampshire. Post-South Carolina and Super Tuesday, the race is suddenly down to Sanders and former Vice President Joe Biden and managed care stocks are popping at the prospect of no “Medical for All” distractions. We’ll see how that plays out by 2021.