It’s a new year, a new decade, and not much has changed in healthcare mergers and acquisitions. January was a strong month for deal flow, which isn’t unusual because deals that didn’t close in December often spill over into the following month, which just happens to launch a new fiscal cycle, for many entities.

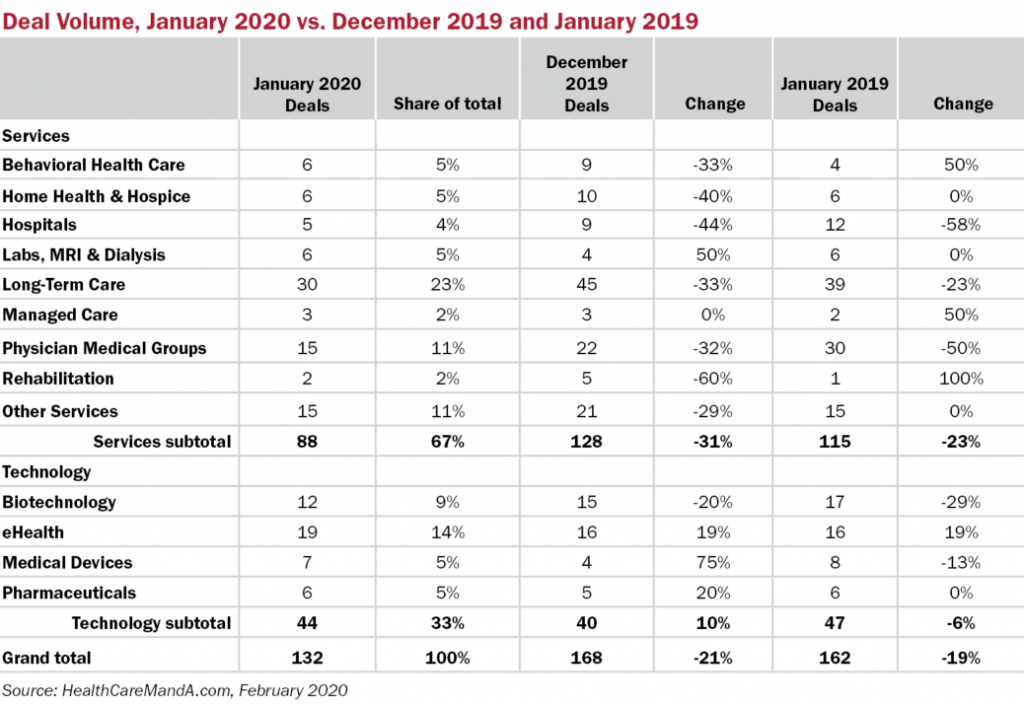

January 2020 opened with a strong showing for deal volume. At this writing, 132 deal are in our database and we’ll be adding more as earnings reports and other documents come to light. Looking back at December, we now have 168 deals on the books, as more Long-Term Care, Physician Medical Group and other transactions came to light. So the fourth quarter of 2019 finished in grand style.

One trend we’re tracking is the growing power behind the services sectors. Private equity firms are jumping into the healthcare space with abandon, because it’s easier to build a platform of dental or ophthalmology practices than to fund the next promising PD-1 inhibitor in oncology, right? Yes and no, we hear you. Much depends on what you know (fuzzy versus techie) or who you trust for information.

To cut to the chase, eHealth transactions are continuing the upswing. There’s no shortage of investors who want to brag about their healthcare innovation. Last year, digital health deals hit a new record of 222 transactions (see other story on page 1), based on the multiple races to provide the best patient engagement platform, the best and most secure provider platform and to see the promise of blockchain and artificial intelligence deliver, maybe.

Investors are still tracking the Physician Medical Group sector, although deal flow slowed a bit compared with previous months’ performances. It’s no surprise that ophthalmology is the specialty of choice recently. Everyone seems to buy the meme that “10,000 boomers turn 65 every day,” so of course they’ll need cataract surgery or treatments for macular degeneration.

Following that logic, the Long-Term Care sector posted its highest annual deal volume yet in 2019, with 450 deals. January 2020 doesn’t look as if that streak will continue, with just 30 deals versus 39 a year ago. But don’t be fooled, because private investors aren’t. This is still a hugely fragmented sector offering something for everyone, or every family. Skilled nursing facilities and some CCRCs may be experiencing some headwinds, but it’s tough to bet against demographics in a business plan.

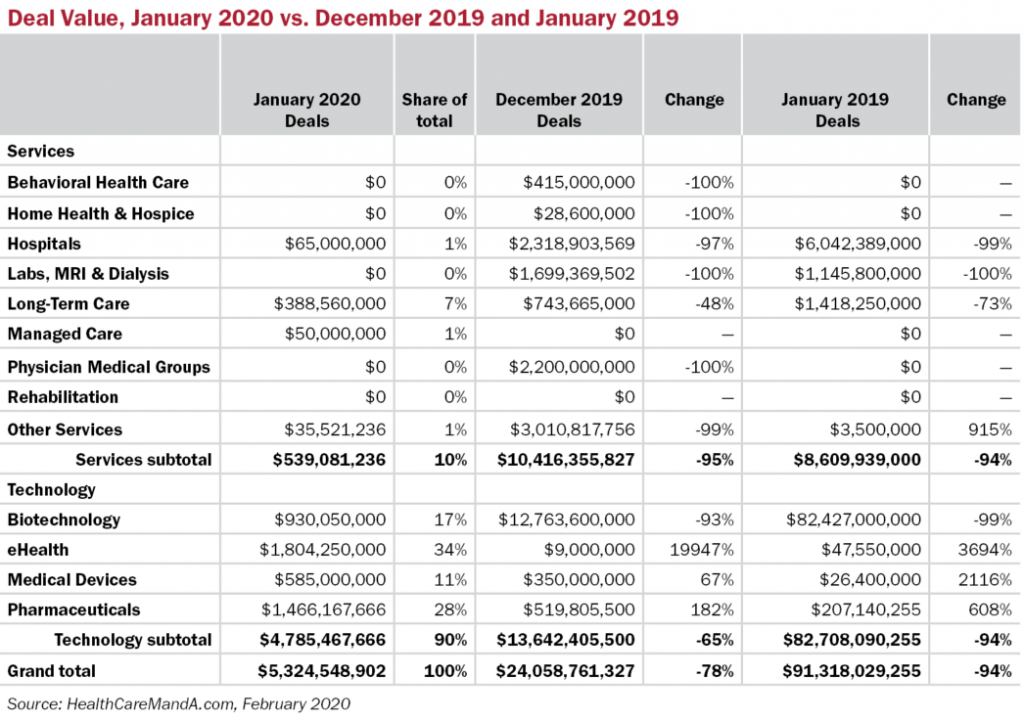

Spending was very low in January ($5.3 billion), as few transactions reported financial terms compared with previous months. That wasn’t the case a year ago, when the $74 billion Bristol-Myers/Celgene (NYSE: BMY) deal was announced on January 3.

So this is how 2020 begins for healthcare M&A. With the Democratic presidential campaigns in full swing, we’ve already seen dips and peaks in various providers’ and payors’ stock prices, reacting most recently to the semi-results from the Iowa caucuses and more often to consumer polls. Will Bernie Sanders (D-VT) carry the day with his “Medicare for All” platform? Probably not. But with Super Tuesday looming in March, this will be a long ride. Hang on to your hat. □