October is typically a flighty month in the annual investing cycle. Spooky things can happen as the month winds down to Halloween. With the now-hot/now-not sentiments swirling around the equity markets, it was a relief not to witness a meltdown after all ended the month at or near new highs.

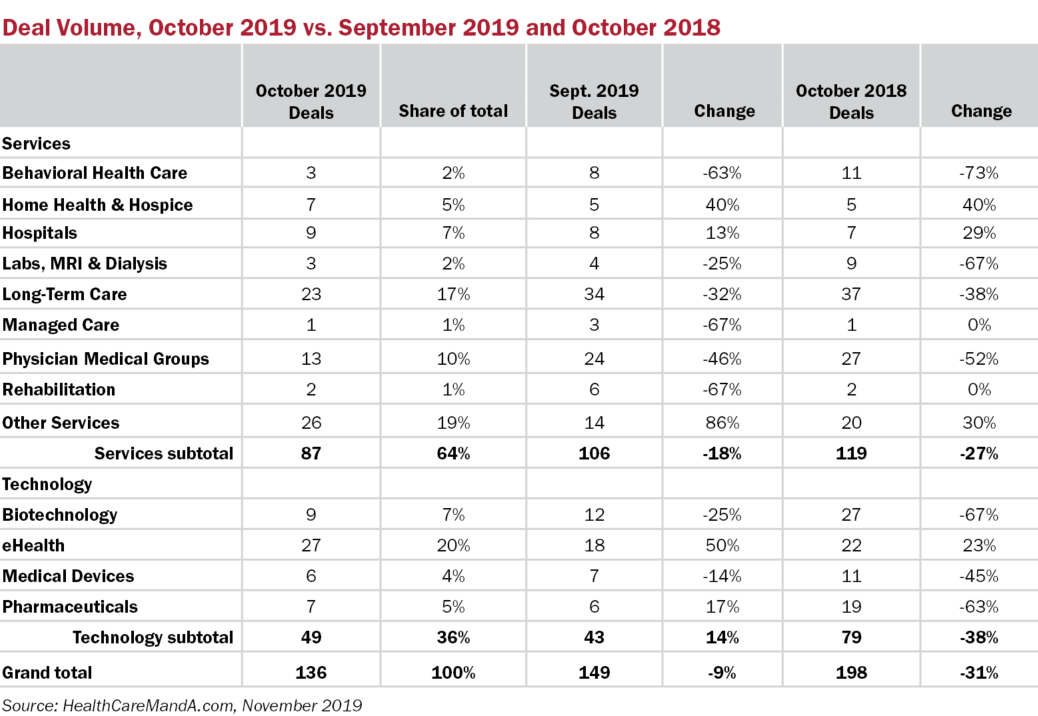

The healthcare market wasn’t nearly so robust. Third quarter deal volume, now at 447 transactions, is still down 5% compared with the second quarter’s 471. Preliminary data for October 2019 doesn’t demonstrate a renewed vigor in the healthcare space. At 136 transactions, it is 9% lower than September deal volume, and a thumping 31% below October 2018, with 198 deals.

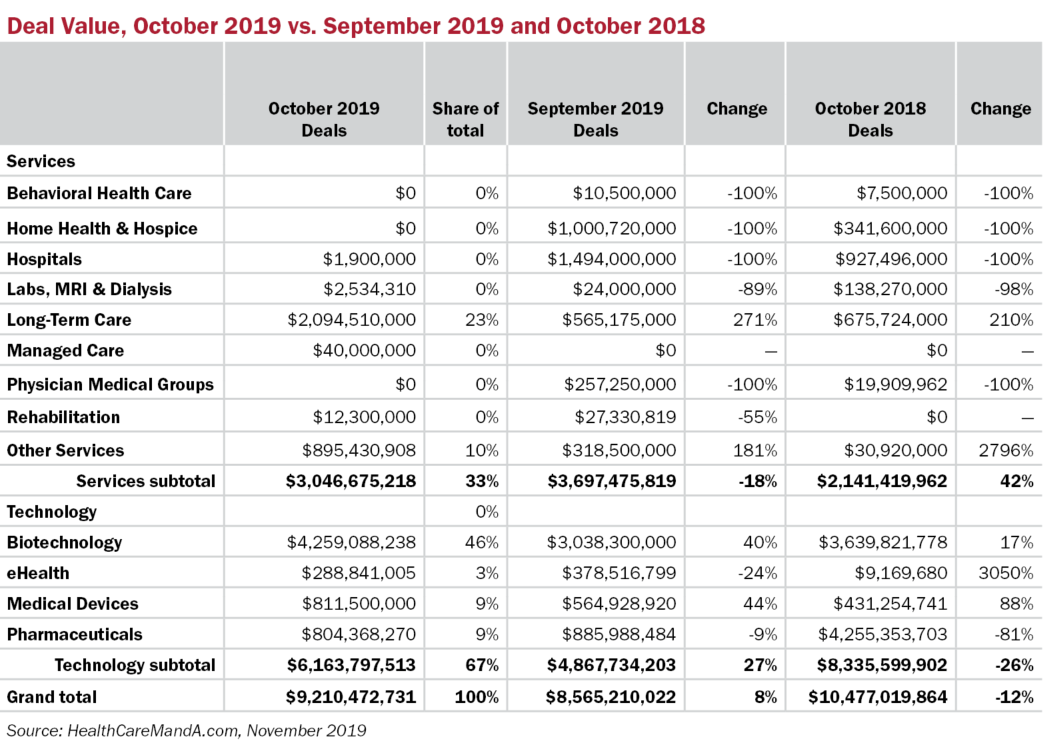

With only one billion-dollar-plus deal, spending was in a normal range. Disclosed prices in October 2019 reached $9.2 billion, up 8% compared with September’s $8.5 billion but 12% behind the $10.5 billion disclosed a year ago.

The two biggest deals landed in the Biotechnology sector, not surprisingly. UCB S.A. (Brussels: UCB) announced its acquisition of Ra Pharmaceuticals (NASDAQ: RARX) for $2.1 billion. And Alexion Pharmaceuticals (NASDAQ: ALXN) is acquiring Achillion Pharmaceuticals (NASDAQ: ACHN) for $930 million.

At the start of November, U.S. stocks hit new highs on trade optimism regarding the U.S.-China trade talks and strong Q3 earnings reports. For now, it’s the bank and energy sectors driving the action in the markets. We’ll see if healthcare adds to the optimism.