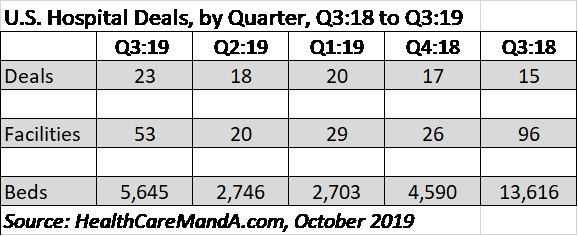

Mergers and acquisitions among U.S. hospitals and health systems rose 28% in the third quarter of 2019, posting 23 transactions versus 18 deals in the previous quarter. Deal volume compared with the same quarter in 2018 (15 deals) was up 53%. Q3:19 had the strongest M&A activity in the previous four quarters, according to our most recent data.

What factors boosted the most recent quarter’s results? A major contributor was Medical Properties Trust (NYSE: MPW), which announced three transactions in July, totalling $1.7 billion. The largest of the three deals, at $1.55 billion, was to acquire the real estate assets of 16 hospitals (2,383 beds) in California, Connecticut and Pennsylvania, owned by privately held Prospect Medical Holdings. In the Midwest, the REIT paid $145.4 million for seven newly constructed community hospitals (105 beds) in and around Kansas City, Missouri. The facilities were owned by Embree Asset Group and operated by Saint Luke’s Health System. On the West Coast, it paid $40 million for the real estate assets of Watsonville Community Hospital (106 beds), located on the coast south of San Jose, from the newly formed Halsen Healthcare LLC.

Several other large systems and hospitals changed hands in the quarter. KentuckyOne finalized negotiations with the University of Louisville, selling its Jewish Hospital System (738 beds) for $10 million and other considerations. Boca Raton Regional Hospital (400 beds) joined Baptist Health South; Glens Falls Hospital (363 beds) joined Albany Med; Good Samaritan Hospital, a 310-bed facility in downtown Los Angeles, joined PIH Health, a regional network based in Whittier, California.

On the smaller side, 10 hospitals with fewer than 100 beds teamed up with regional hospitals or systems. One growing system added two of those smaller hospitals. Peninsula Regional Health System, based in Salisbury, Maryland on the Delmarva Peninsula, agreed to merge with the 99-bed Nanticoke Health Services in Sussex County, Delaware as well as the two-bed Edward M. McCready Memorial Hospital in Crisfield, Maryland.

Year-over-year comparisons by hospital- or bed-count are skewed by the fact that, in Q3:18, LifePoint Health (then NASDAQ: LPNT) was acquired by RCCH HealthCare Partners, a portfolio company of Apollo Global Management. LifePoint had 68 hospitals (9,254 beds) in 22 states at the time of the announcement. That deal carried a $5.6 billion price, which is very high for most U.S. hospital deals.

We’ll have more news and numbers on all 13 sectors we cover in the upcoming Health Care M&A Report, Third Quarter 2019, scheduled to be published by the end of October.