If the healthcare M&A market is the only gauge you use to assess the U.S. economy, you’d be surprised to learn that other countries are entering or bracing for economic slowdowns or outright recession. Monthly deal volumes across all healthcare sectors are holding up fairly well (with the usual ups and downs). Some large national platforms have come on the market (BayMark Health Services being the most recent), stirring up some lively auctions. More are expected in the fourth quarter.

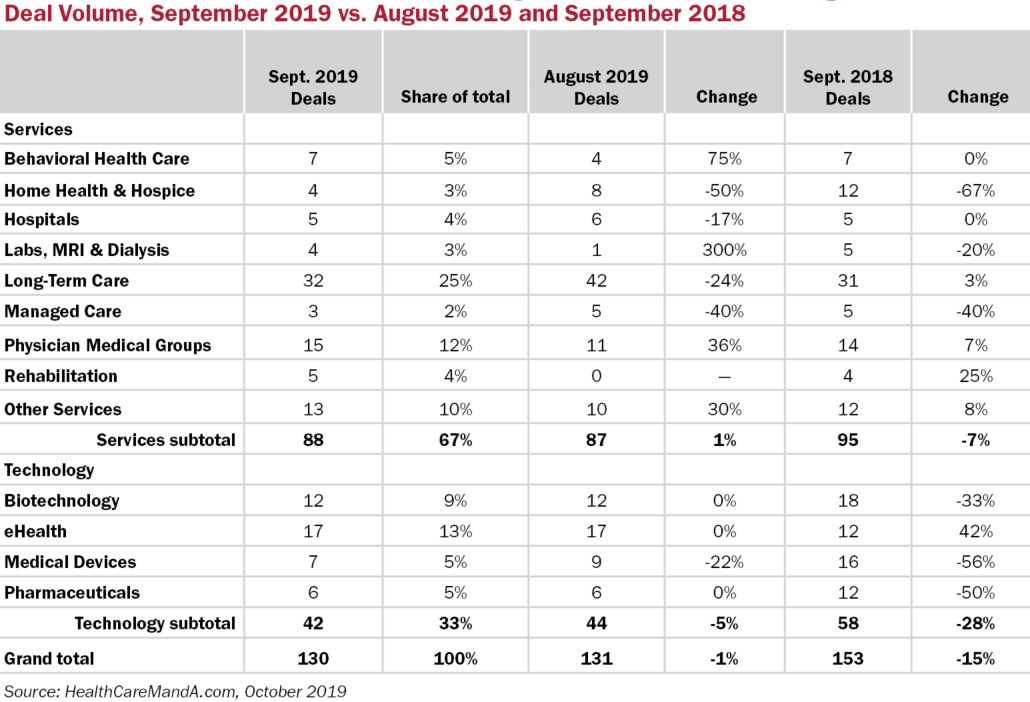

September deal volume didn’t surprise. With 130 transactions already on the books, it’s virtually tied with August’s total of 131. Compared with the same month in 2018, deal volume dropped 15% against 153 deals back then. That’s expected when comparing a strong month in 2019 with a near record-breaking month in 2018.

The services sectors made up 68% of September’s total, a stronger result than the 66% in August and the 62% a year earlier. That’s not surprising, either, given the very public pressure on high drug prices and on drug companies caught up in lawsuits surrounding the opioid crisis.

October 1 marked the start of the Patient Driven Payment Model, which directly affects the Long-Term Care sector. The CMS finalized the rule in July 2018 as a major overhaul to the prospective payment system. It also restricts the use of group and concurrent physical therapy services in skilled nursing settings. While the rule doesn’t appear to have dampened investors’ taste for senior care—September’s deal volume in the sector equalled that posted a year ago—the Rehabilitation sector has seen some slow months (there were zero deals in August). Private equity firms are still building out platforms in the rehab market, probably banking more on sports, occupational and workman’s comp therapies, for the time being.

The Physician Medical Group sector has been mostly unfazed by charges in the media that private equity-backed companies like Envision and Team Health are the villains behind sky-high “surprise medical bills.” Deal volume is still strong and the only problem for investors is the shrinking pool of sizable medical groups that would add scale to a platform.

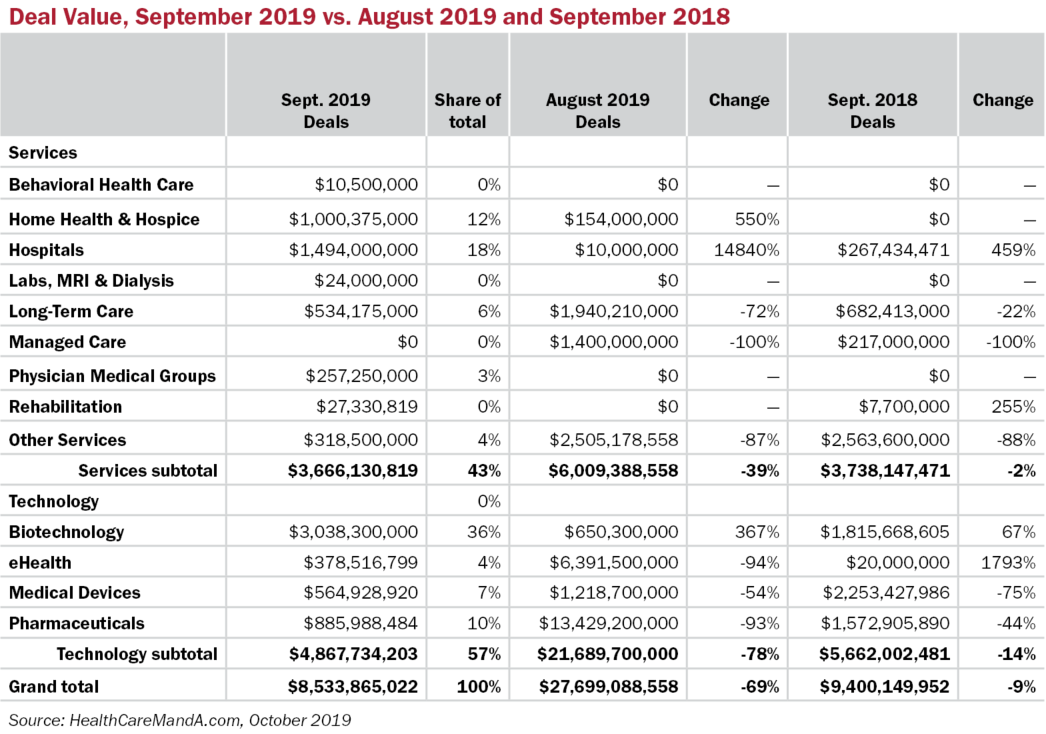

Spending in September, at $8.5 billion, couldn’t match August’s huge $27.7 billion—the latter being the result of the $13.4 billion paid by Amgen (NASDAQ: AMGN) for the global rights to Celgene’s (NASDAQ: CELG) psoriasis treatment Otezla. By contrast, the biggest deal by price announced in September was the $1.95 billion acquisition of Alder Biopharmaceuticals (NASDAQ: ALDR) by the Danish drug maker H. Lundbeck A/S (OMX: LUN). Minus the Otezla deal, August would have clocked in at $14.3 billion. Still higher than September’s disclosed spending, but it’s just that. Disclosed, not buried in SEC documents. We’ll get to those as they come out.

October is usually a tough month for the equity markets and this year it roared in with two straight days of deep declines in the DJIA and NASDAQ. An abrupt turnaround on October 3 and 4 may be reassuring, but we’re witnessing the chaos theory with these markets going into Q4. You know, where a butterfly coughs or sneezes in Argentina, Mongolia or the Midwest and the cascade of events goes from snowball to avalanche in jig time. Politcal and global trade uncertainty in the form of impeachment inquiries and trade wars will not help, only hinder, the overall economic view. Where are your bets?