Enough about slowdowns and recession. August is typically a roller-coaster month in the equity markets and August 2019 didn’t disappoint in that regard. The bond markets’ inverted yield curve persisted into September and that’s never a good sign. We’re moving on.

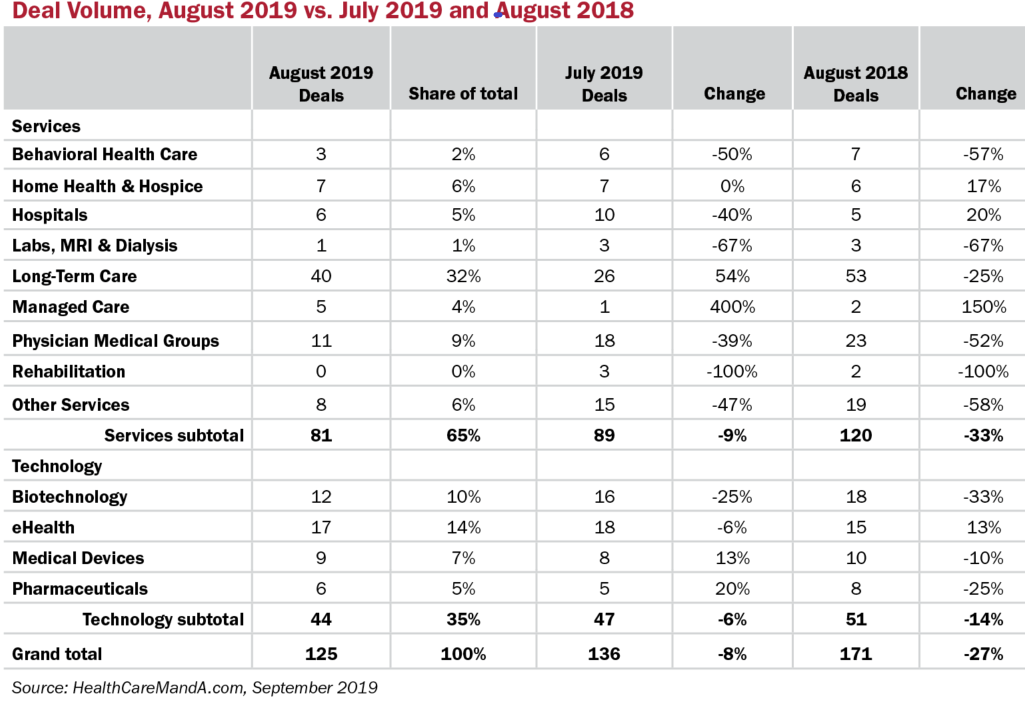

Preliminary data show August’s deal volume wasn’t so bad, considering how most of 2019 has played out. The 125 deals announced in August represent a drop of 8% compared with the previous month’s 136 deals, and a 27% drop compared with August 2018.

After a record-setting year in 2018, with more than 1,900 transactions and $333.3 billion on the books, a repeat would be nearly as scary as a sudden downturn (which may be coming, anyway).

The healthcare M&A market is still pretty strong, relatively speaking. Through August 31, there are 1,126 transactions in our database for 2019, equal to the total deal count for all of 2012 (1,123). Spending this year is virtually equal to 2018’s total, with $330.3 billion recorded so far.

That’s the way this year has gone in the healthcare market. Fewer deals, but much higher spending, starting with AbbVie’s (NYSE: ABBV) $87 billion bid for Allergan plc (NYSE: AGN) and Bristol-Myers Squibb’s (NYSE: BMY) $74 billion deal for Celgene Corporation (NASDAQ: CELG) earlier this year. The average price per deal in the first eight months of 2019 is approximately $864.5 million, while the average price per deal in 2018 is approximately $537.6 million.

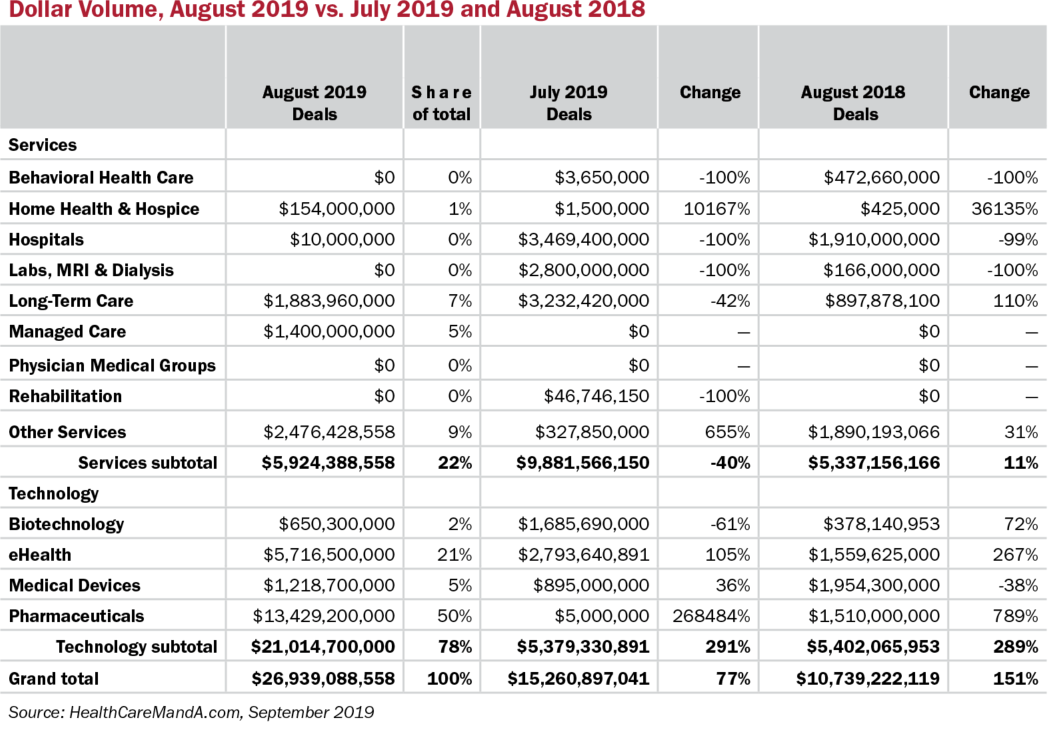

There were some sizable deals announced in August 2019, boosting the month’s spending to nearly $27 billion. Half of that total is the result of one deal, Amgen’s (NASDAQ: AMGN) $13.4 billion acquisition of the global rights to psoriasis drug Otezla, currently owned by Celgene. The FTC ruled Celgene must divest Otzela, which had sales of $1.6 billion in 2018, as part of its regulatory approval process for its merger with Bristol-Myers.

Other big deals were announced during the month and not all were in the Biotech or Pharmaceutical sectors. Parthenon Capital Partners merged its portfolio company, Zelis Healthcare, with Bain Capital’s RedCard Systems to create a new company with end-to-end capabilities in claim cost management and payments and an enterprise value of $5.7 billion. London-based private equity firm Premira paid $2.4 billion to take Cambrex Corporation (NYSE: CBM) private, the largest deal for a contract development and manufacturing organization in 2019. And Centerbridge Partners ponied up $1.4 billion to acquire Norwest Equity Partners’ Medicare Advantage company GoHealth, LLC.

Yes, there’s a lot of action from private equity firms as well as strategics. What isn’t clear is how much debt is being used to finance these deals, even with the super-cheap financing available from the bond markets. As of this writing, the Federal Reserve seems poised to reduce interest rates by another quarter percentage point. Either that stimulates more dealmaking, or hastens a recession. Check back here in a year to see how that worked out.