After a slow first quarter, deal volume picked up again in the second. Pundits predicted a strong end to 2019, but the preliminary results from July’s deal making seem to indicate otherwise.

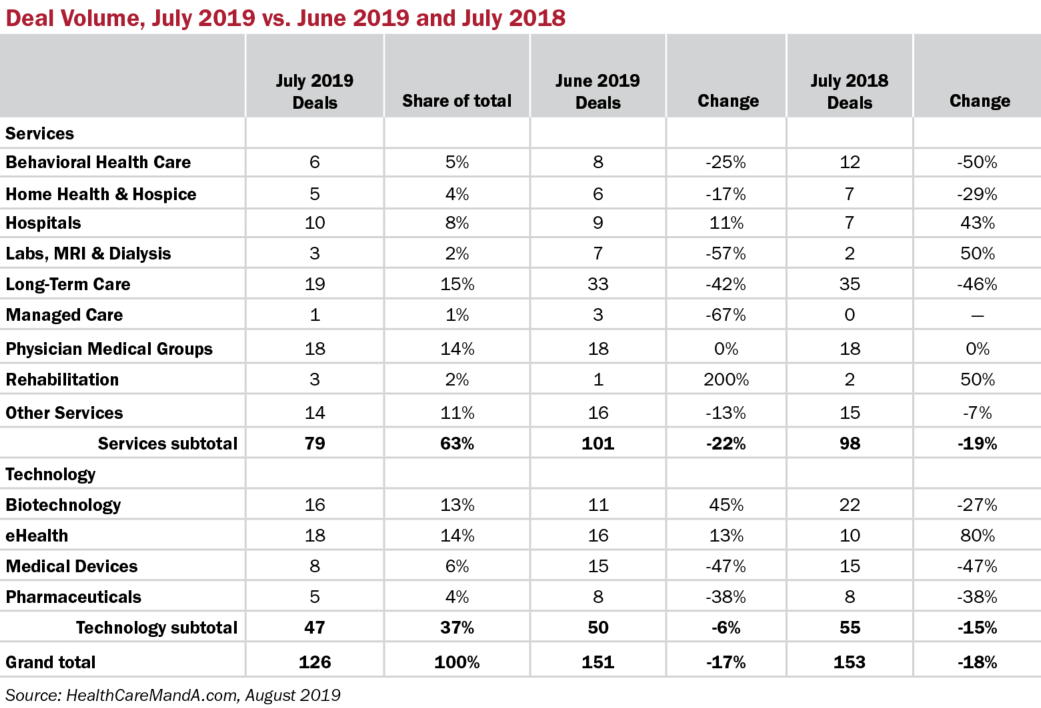

With 126 transactions reported, July 2019’s deal volume sagged 17% compared with June’s and 18% against the same month in 2018. You may recall that 2018 was a hot year for healthcare transactions, ending with a record 1,908. The fact that June 2019 virtually matched that performance shows how strong the healthcare market became in the second quarter, ending with 151 deals. We may see an upward tick in July numbers, of course, as more deals come to light, and may have to rescind our pooh-poohing here.

For one, the Long-Term Care sector, which normally carries the day in deal volume, saw a month-to-month plunge of 42%, from 33 deals in June to just 19 in July. That brought an abrupt end to a years-long streak of 30-plus deals per month. There’s no good explanation (yet) of why the deals dried up. More on that when August’s deals are in.

Among other services sectors, Behavioral Health Care, Home Health & Hospice, Labs, MRI & Dialysis, Managed Care and Other Services all slid by double-digits compared with June’s numbers. The Hospital sector saw stronger volume than it’s had in many months, but that is based on four REIT deals announced by Medical Properties Trust (NYSE: MPW), three in the United States and one in the United Kingdom. On the technology side, Medical Devices and Pharmaceuticals lost ground, both month over month and year over year. The Pharma sector posted only five deals for all of July and a near-record low of only $5 million in spending.

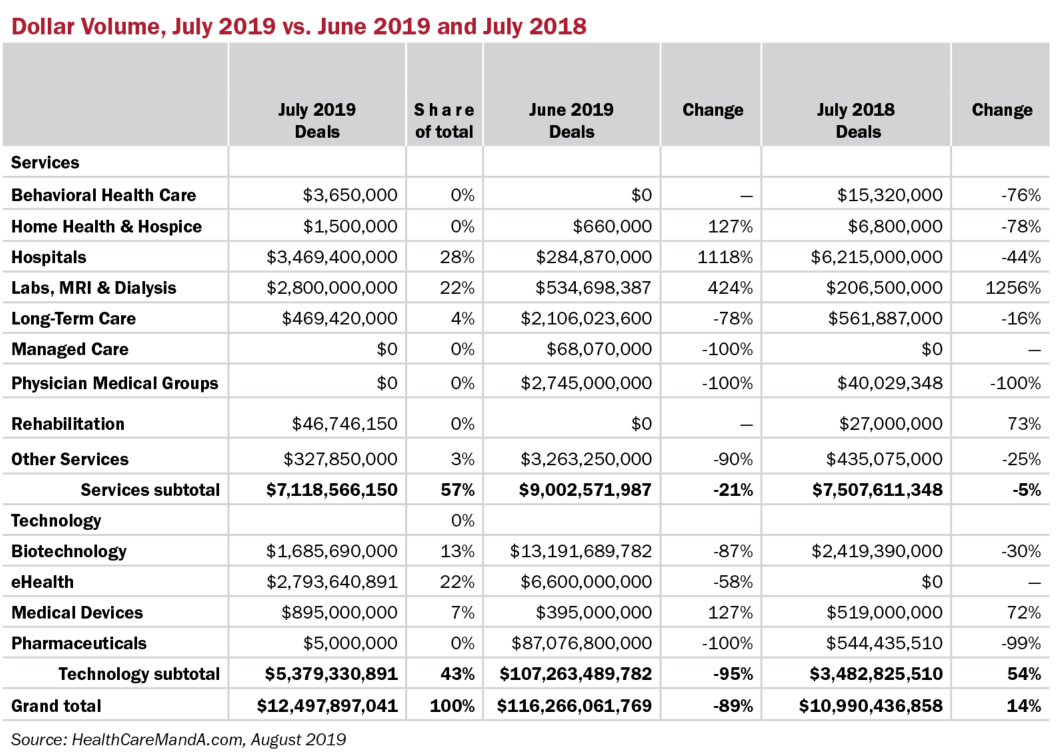

Speaking of spending, the month’s dollar volume returned to a more normal level, now standing at approximately $12.5 billion. That’s up 14% compared with July 2018’s $10 billion, but no comparison with June’s $116 billion. Although five deals posted prices above $1 billion in July 2019, there weren’t any mega-deals to match the $87 billion acquisition announced in June between AbbVie (NYSE: ABBV) and Allergan (NYSE: AGN). So a sharp month-to-month drop of 89% isn’t a shock or harbinger of things to come.

Aside from the REIT deals in the Hospital sector, the billion-dollar-plus deals were spread among some usually quiet sectors. The largest of them, at $2.8 billion, came in the Labs, MRI & Dialysis sector, targeting Genomic Health (NASDAQ: GHDX), a genomic-based cancer diagnostic company. Exact Sciences Corp. (NYSE: EXAS), maker of the Cologuard home screening test, is the buyer. Then there’s the $2.7 billion bid for revenue cycle management giant Waystar, backed by Bain Capital Private Equity. Swedish PE firm EQT and the Canada Pension Plan Investment Board will take over a majority stake.

So it’s not all gloom and doom. Or at least it wasn’t until President Trump abruptly announced another round of tariffs on Chinese imports early in August, and China retaliated by devaluing its currency. Given investors’ fear of uncertainty, we could be looking at a long, slow decline in deal volume through the third quarter. We’ll see what happens, as the president likes to say. □