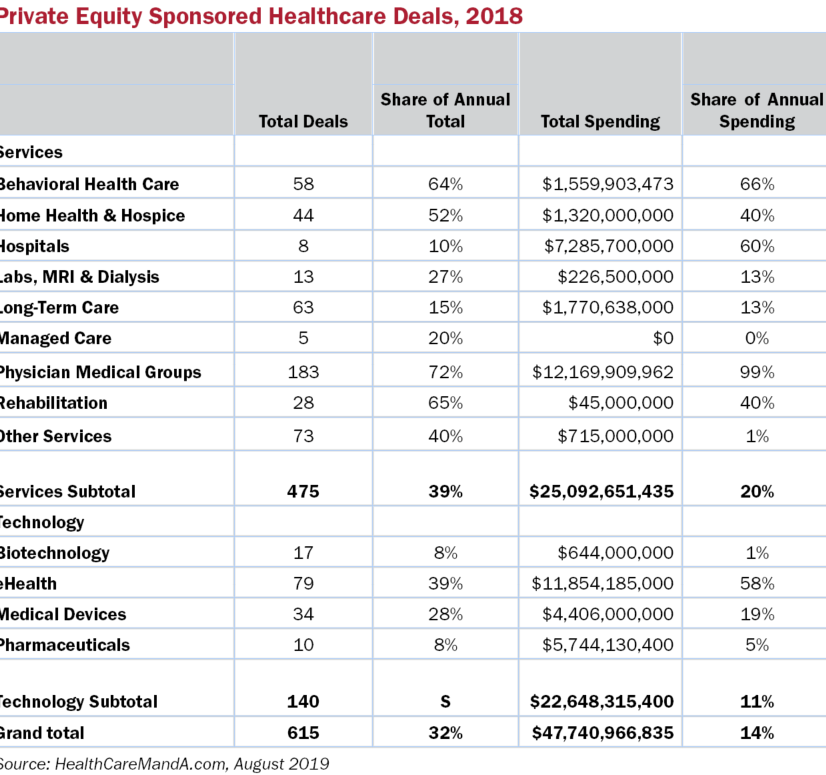

It’s hard to imagine where health care would be today without private equity firms. Since 2013, merger and acquisition activity in all healthcare sectors has soared 80%, to a record 1,908 deals announced in 2018. Private equity sponsors accounted for approximately 32% of those transactions, both direct and add-ons. Of the $333.3 billion spent last year (not a record), these firms contributed 14%, or $47.7 billion. The dollar volume would be much higher if more deals disclosed financial terms.

In the first seven months of 2019, the pace has slowed as global uncertainty has grown. Total deal volume through July 31 reached 989 transactions and private equity accounted for 279 (28%). Spending for the year is already nearing last year’s total. Through July, $300.6 billion is on the books and PE sponsors contributed a mere $10.1 billion (3%), based on disclosed prices.

All health care is local, as the saying goes, and private equity increasingly is trying to stay there, too. In 2018, PE firms accounted for 39% of all deals announced in the nine services sectors we track, compared with 21% of the four technology sectors. In 2019, those trends are holding. Sponsors account for 32% of all services deals announced in the first seven month of the year, compared with 20% of all technology deals.

The interest isn’t expected to subside any time soon. “This [activity] will continue in the near term, probably the next three to five years,” said Angela Humphreys, chair of the Healthcare Practice Group at Bass, Berry & Sims. “Private equity obviously has a lot of capital to deploy and health care is a natural place for PE to look for investments.”

Funds are following demographics and finding many places where investments will likely benefit from the aging baby boomer cohort. Home Health & Hospice, Long-Term Care, Rehabilitation and other post-acute sectors are all being reshaped by partnerships and creative strategies between sponsors and strategics.

The starkest example, of course, is the consortium created in 2017 by Humana (NYSE: HUM), TPG Capital and Welsh, Carson, Anderson & Stowe. The three teamed up to take apart Kindred Healthcare in a $4.1 billion deal that saw Humana acquire Kindred’s home health and hospice operations and left Kindred’s long-term acute care hospitals, inpatient rehab facilities and other operations to TPG and WCAS. While Humana owns a 40% share to the sponsors’ combined 60%, it negotiated a path to eventually acquire 100% of the home health assets.

Then, in April 2018, the consortium struck again, this time acquiring national hospice operator Curo Health Services from Thomas H. Lee Partners for approximately $1.4 billion. Humana again took a 40% stake.

Physician, Sell Thyself

Healthcare services for boomers may present a large, soft target for funds that are now turning to health care. But the biggest magnet for PE acquirers is Physician Medical Groups. The sector hit a recent record of 253 transactions in 2018, and PE funds accounted for 72% of that volume, and 99% of the disclosed $12.3 billion spent on those deals. KKR’s (NYSE: KKR) $9.9 billion acquisition of Envision Healthcare made up most of that total, but Fresenius Medical Care’s (NYSE: FMS) nearly $2.2 billion sale of its Sound Inpatient Physicians group to Summit Partners was no small deal, either.

With so much M&A in the sector in 2018, it’s not surprising that in 2019, at least the first seven months, shows signs of slowing. Through July 31, 86 deals have been announced by PE-sponsored firms, representing 79% of the year’s total to date. Spending based on disclosed prices stands at $2.8 billion, or 94% of the year-to-date total.

Dental, dermatology and ophthalmology are the most popular office-based specialties and have been for several years. Luke Mitchell, partner and managing director at Edgemont Partners, estimates there are more than 30 platforms in the dental space now and more than 20 each in dermatology and ophthalmology.

Bass, Berry’s Humphreys historically has focused on transactions around hospital-based practices and ambulatory surgery centers. Hospitals are still looking to acquire physician practices, she says. “Private equity started out targeting specialties that might not be great targets for hospitals, in areas like outpatient surgery or specialties based around office visits. Now we’re seeing interest in oncology, cardiology and other specialty practices.”

Mitchell has seen ebbs and flows in the popularity of each specialty among PE investors. While dental, dermatology and ophthalomology remain the biggest targets, some firms are building platforms around gastroenterology, urology, audiology, oral surgery and urgent care practices. He doesn’t expect the same level of M&A in 2019, however. “The number of new platforms will probably be lower this year,” he said. “We’ll see a smaller number of add-ons.”

Valuations have continued to rise along with investor interest over the past three to five years. “Multiples have been strong and will continue to increase,” Humphreys predicted. “Some think they’ve peaked, but with CMS’s initiatives around bundled payments, a lot of PE firms may see that as an opportunity.”

All the activity around physician practices could move up the M&A food chain. “It wouldn’t surprise me if there were more take-private deals for hospital chains,” Humphreys said. Now that you mention it … □