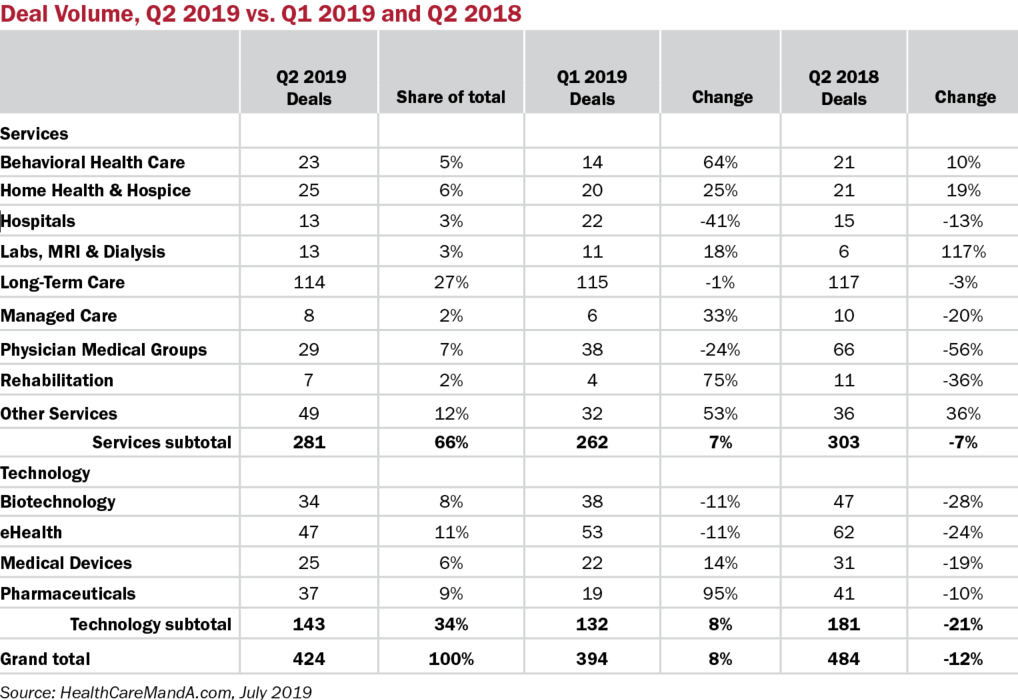

Second quarter deal volume was robust, based on preliminary results. Some 424 deals are on the books for the quarter, representing an 8% increase over the first quarter (394 deals). It’s still a hard comparison with Q2:18 numbers, which had 484 announcements, 12% higher than this year’s period.

Spending remained high in the second quarter, at $138.5 billion, thanks to AbbVie’s (NYSE: ABBV) $87 billion deal for Allergan (NYSE: AGN) announced in late June. Coincidentally, even higher totals were posted in the first quarter and in the second quarter of 2018, also due to mega-deals. In this year’s first quarter, Bristol-Myers Squibb’s (NYSE: BMY) $74 billion deal for Celgene (NASDAQ: CELG) and Danaher Corporation’s (NYSE: DHR) $21.4 billion deal for GE’s (NYSE: GE) biopharma business sent the combined spending total to $149 billion. A year earlier, Takeda Pharmaceutical (NYSE: TAK) announced its intention to buy Shire plc for $81.5 billion, including debt. Combined spending in that quarter reached $144.9 billion.

The Long-Term Care sector posted two quarters of 100-plus deals, although second quarter deal volume was off by 3% compared with Q2:18. Among the services sectors, Behavioral Health Care, Home Health & Hospice and Other Services all posted higher deal volume (+10%, 19% and 36%, respectively) compared with a year ago. On the other hand, the Physician Medical Group and Rehabilitation sectors saw M&A activity slow considerably (-56% and -36%, respectively).

None of the technology sectors bettered their Q2:18 performance. Again, we must point out that 2018 was a record-setting year for healthcare M&A across the board.

As strong as most of the results are, they are also a bit unsettling. The economic expansion that began in March 2009 has continued uninterrupted, posting the longest expansion streak in U.S. history. The Federal Reserve has kept interest rates at extremely low levels and may reverse at least one of the rate hikes made in 2018. The equity markets are back on track to post record highs in 2019, despite the occasional swoon when President Trump tweets about his latest plans for tariffs and trade wars.

Too much good news can be worrisome, and that’s what we’re hearing in healthcare financial circles and business media reports. It’s now common to hear panelists and attendees at healthcare conferences predict the next recession will hit in 12 to 18 months. Even those who admit they don’t have a timeframe for when the economic downturn will start are convinced the music is going to stop sooner rather than later.

If gloom and doom are on the horizon, it makes sense to get deals done before the clouds advance. That may be what’s happening in 2019, although we won’t know until the next recession has been under way for two consecutive quarters. Here’s to a long and busy third quarter!