May is National Mental Health Month, National Bike Month and Asian Pacific Islander American History Month, among other celebrations. This year, it included a lot of global uncertainty, as the Trump administration faced off with two Iranian missile boats in the Persian Gulf, British Prime Minister Theresa May threw in the towel on leading the UK out of the European Union, and President Trump threatened to impose new tariffs on Mexican goods if that country didn’t do something about our immigration problem. We’re glad it’s June.

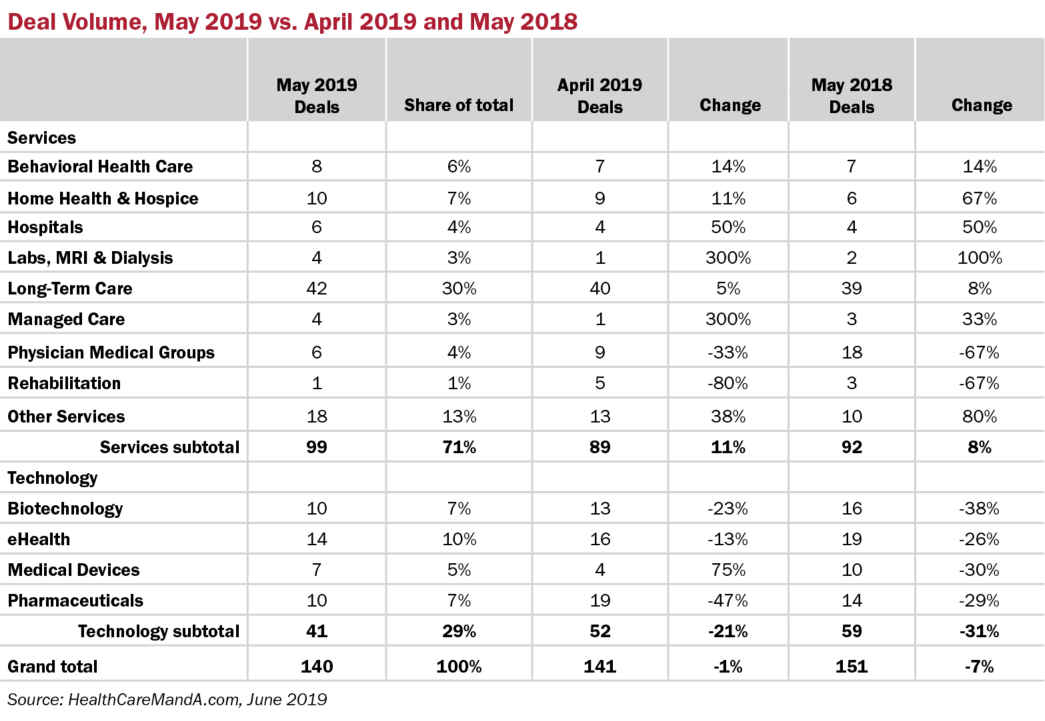

Despite those headlines and many more, healthcare deal volume returned to heady territory, with 140 deals, according to preliminary data. That’s only one deal shy of April’s current total of 141 and 7% lower than the same month in 2018. Spring has finally sprung.

The Long-Term Care sector was the star, once again, with 42 deals and a 30% share of the month’s total deal volume. The sector beat April’s total by 5% and bested May 2018’s total by 8%. Investors appear to be banking on the baby boomers’ arrival in about 15 to 20 years, which is a long time to hold out.

Other services sectors turned in better-than-usual numbers, too. The Behavioral Health Care, Home Health & Hospice, Hospitals, Managed Care and Other Services sectors all posted gains compared with the year earlier, albeit on slim deal volume totals. The technology sectors didn’t have a great month, as year-over-year deal volume dropped across the board. The softening is likely just temporary, although Medical Devices and Pharmaceuticals have had a slow year so far, compared with last year.

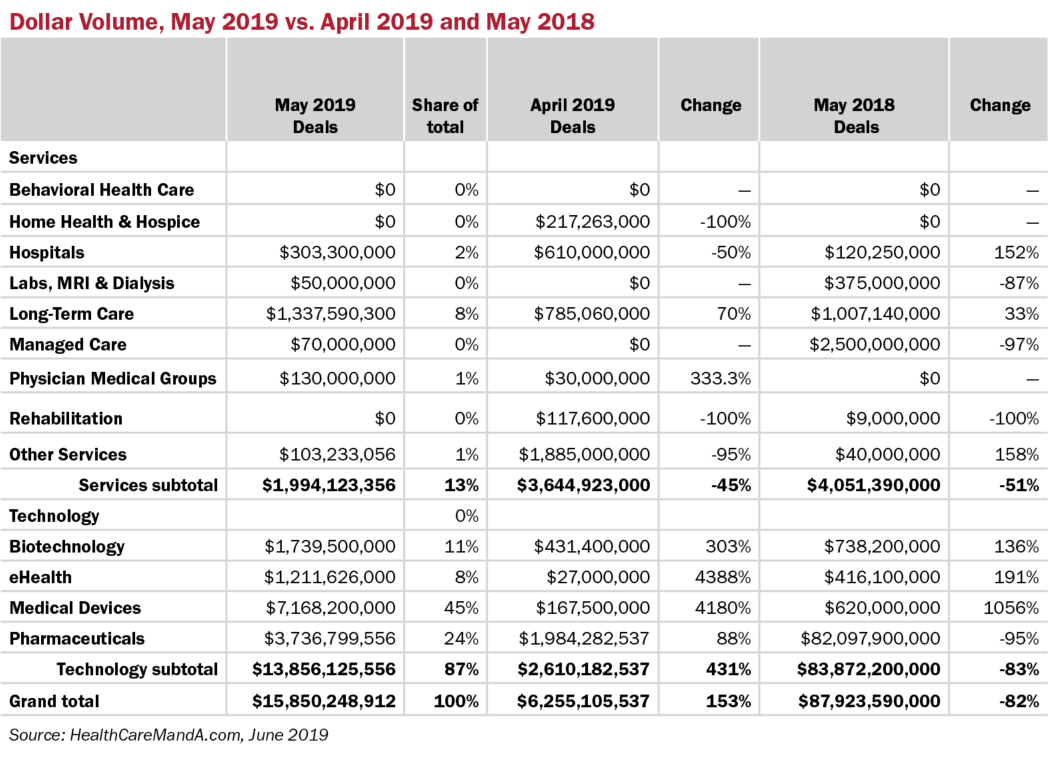

Spending showed an uptick of 153%, to approximately $13.9 billion, compared with the previous month’s $6.2 billion. A year earlier, Takeda Pharmaceutical Company (NYSE: TAK) announced its $81.5 billion bid for Shire plc, which made that month’s total an outsized $83.9 billion. Subtracting that deal from May 2018’s mix, the month would have posted only $6.9 billion in total spending and May 2019 would have trounced that figure by 129%. We can make numbers say anything, which is why we don’t put much credence in disclosed prices as a measure of market strength or weakness.

The largest deal of the month was 3M’s (NYSE: MMM) $6.7 billion deal for medical device maker Acelity Inc., followed by Novartis AG’s (NYSE: NVS) $3.4 billion acquisition of Takeda Pharmaceutical’s dry eye drug, Xiidra. Two other billion-dollar deals were announced in the Biotechnology and eHealth sectors, illustrating that lower deal volume doesn’t corrolate to lower spending. Quite the reverse, considering that the booming Long-Term Care sector (42 deals in May) posted a combined total of $1.3 billion for the month.

Now the energy markets are sinking due to a sudden excess in crude oil supplies and the technology sector swooned on news that Congress plans to explore regulating internet giants Amazon, Facebook and Google. All was made well in the equity markets with a hint that the Fed was watching the tariff situation for signs of negative impact on the economy. Healthcare? It stayed pretty healthy. Until the next big deal, anyway.