Everyone we’ve talked to in recent weeks agrees that the first quarter of 2019 was very slow, even slower than expected. So a slight uptick (+5%) in April’s deal volume was a welcome sign of Spring.

May’s early activity is even stronger than April’s. but we know how quickly that can change. One example: President Trump returned to threatening more and higher tariffs on imported goods from China as trade talks appeared to bog down in the first week of May. The markets held up for a day, then sentiment turned pessimistic and we’re back to the uncertainty that prevailed at the end of 2018. And we know how much investors like uncertainty.

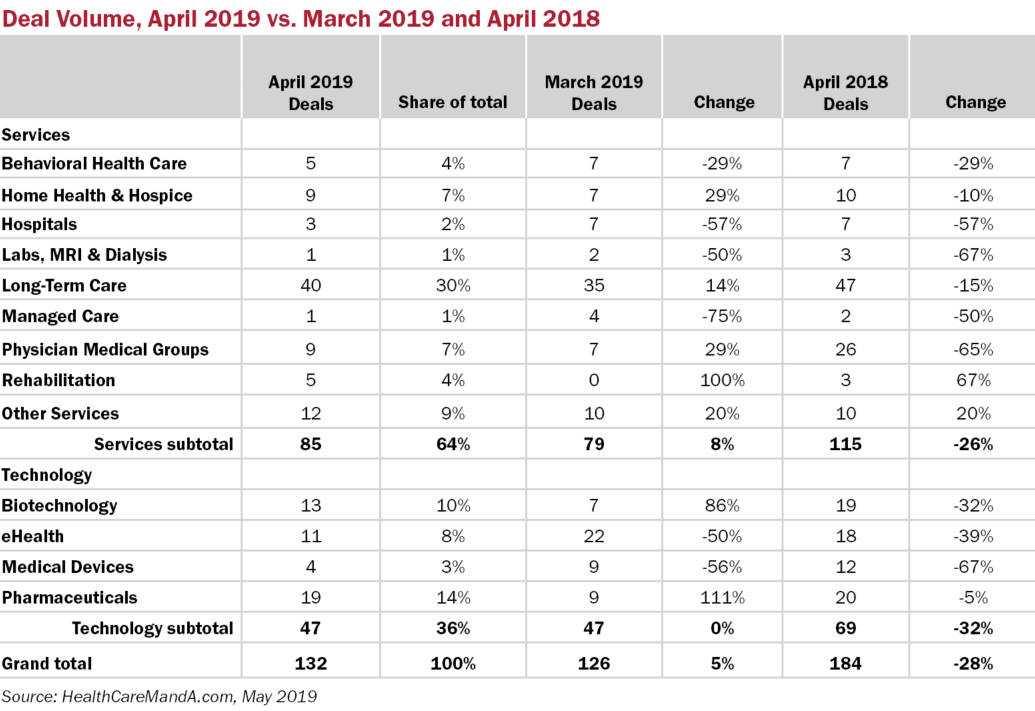

April 2019’s deal volume (132 deals) had a hard comp against last April’s 184 transactions, resulting in a 28% decline year over year. Every sector except Rehabilitation and Other Services posted losses against last year’s numbers. Even the Long-Term Care sector, which had a busy month in April 2019 (40 deals), slid 15% compared with the 47 deals reported in April 2018. We just can’t seem to catch a break this year.

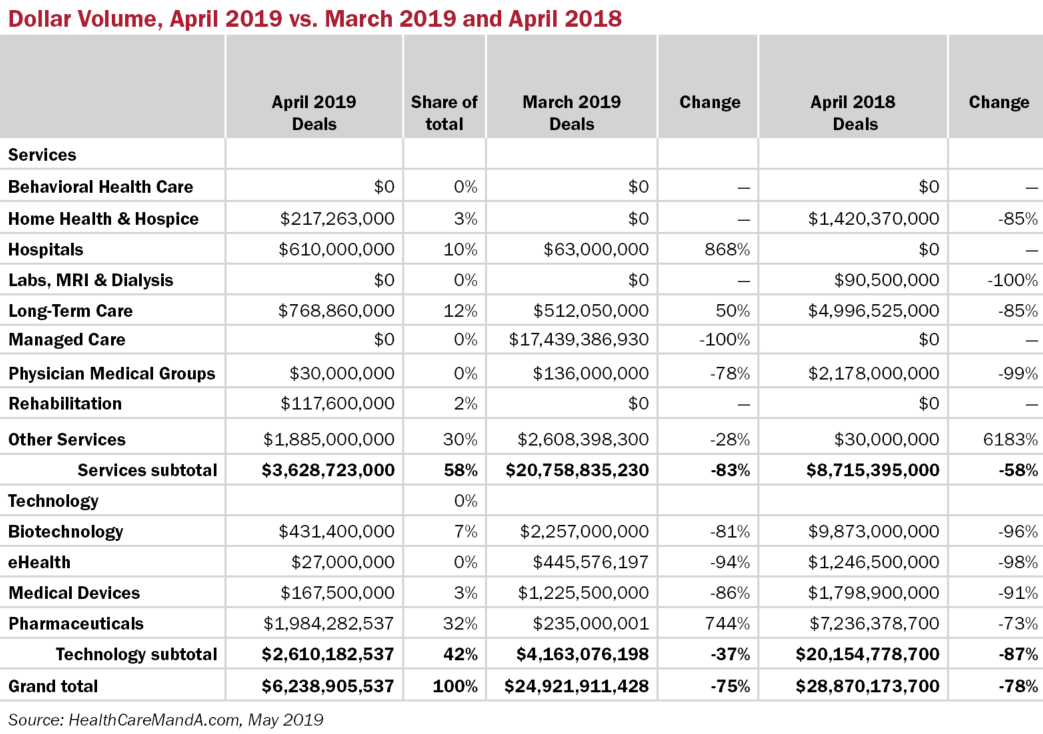

Spending on deals, based on disclosed prices, wasn’t nearly as robust, with just $6.2 billion reported. Just two deals topped the $1 billion mark in April 2019, Catalent’s (NYSE: CTLT) acquisition of contract research organization Paragon Biosciences and CVC Capital Partners’ acquisition of Italian drug maker Doc Generici.

That helps explain the 75% plunge compared with March’s nearly $25 billion of spending, which was dominated by Centene Corp.’s (NYSE: CNC) $17.3 billion bid for WellCare Health Plans (NYSE: WCG). April 2019 slid even lower (-78%) compared with the year-earlier month, when $28.9 billion of spending was disclosed. That crazy month featured eight billion-dollar-plus transactions, the largest of which was Novartis’ (NYSE: NVS) $8.0 billion acquisition of AveXis Inc. (NASDAQ: AVXS) and Procter & Gamble’s (NYSE: PG) $4.2 billion deal for Merck KGaA’s consumer health business.

We haven’t seen transactions like that (yet) in May, but there are a lot of companies shopping around, or being shopped. In the Managed Care sector, Magellan Health (NASDAQ: MGLN) is reportedly being pursued by UnitedHealth Group (NYSE: UNH). Magellan (market cap of $1.6 billion) is something of a specialty shop, with behavioral health services and Medical health plans, as well as a pharmacy benefits management division. If that doesn’t work out Anthem (NYSE: ANTM) is considered a good fit, at least by Forbes.

Then there are rumors that the Centene/WellCare deal could be broken up by hedge fund investors Corvex Management and Sachem Health Capital Management. Although Centene’s CEO publicly stated he is sticking with the WellCare deal, Reuters reported on May 6 that Humana (NYSE: HUM) may be interested in Centene and its 8.6 million Medicaid members, without WellCare. No word from Humana on that one.

The usual raft of pharmaceutical deals are being floated, and surely several portfolio companies are being prepped for exits by their sponsors. The private equity wave may be about to crash this summer. Surf’s up?