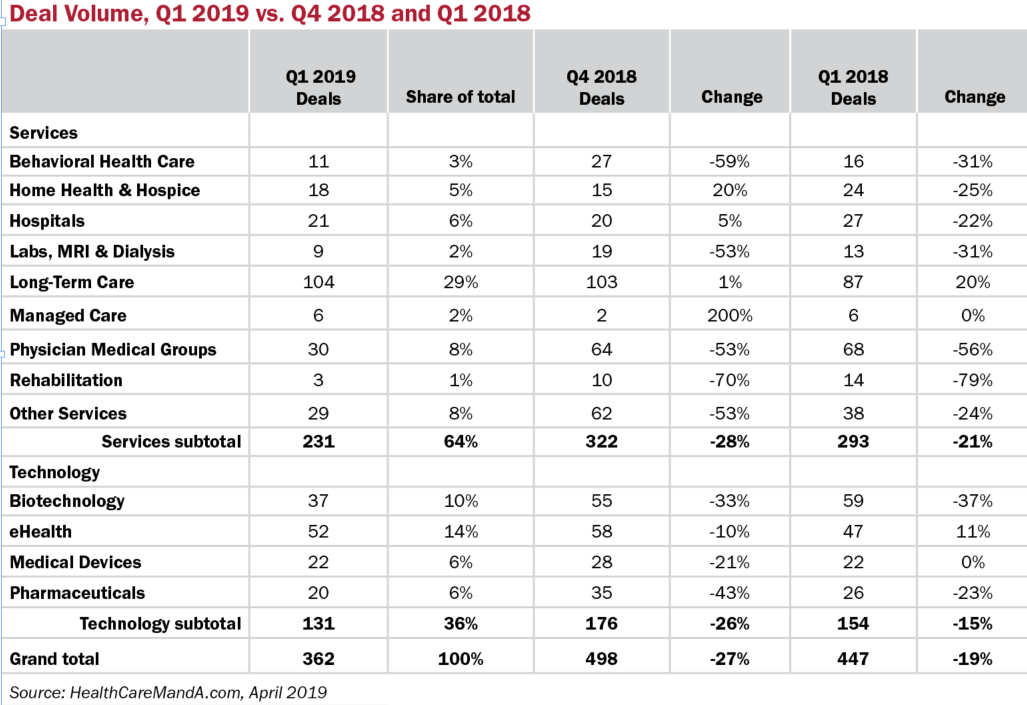

Talk of slowing global economic growth has swirled since late last year, following tariffs, trade wars, Brexit and you-name-it. The healthcare M&A market appeared to reflect the fears, as deal volume in the first quarter of 2019 slid 27% compared with the fourth quarter of 2018, and was down 19% compared with the same quarter a year ago.

Granted, matching the nearly 500 deals reported in the record-making fourth quarter would be a stretch even in better times. But with preliminary data showing just 362 transactions recorded in the first quarter, we’re certainly looking at a slowdown in healthcare deals. Last year in the same period, 447 deals were announced.

We’ve talked with a lot of industry insiders in recent months and have heard a variety of reasons for the sudden downturn. “The first quarter is always slow,” some sources suggest. But last year’s first quarter, with those 447 deals, definitely wasn’t slow.

With nearly 1,600 deals announced in 2018, other sources say the acquirers have hit the “pause” button in order to integrate their latest targets. A corollary argument is that, with all those 2018 deals, “All the good assets are gone.”

Maybe, but billions of dollars in private equity is piling up on the sidelines of the healthcare market and fund managers are anxious to put all that dry powder to use. That gives credence to the next scenario, which is that valuations, particularly in the services and digital health areas, have gotten far too high. Sources tell us that sellers are expecting huge multiples on second- or third-tier entities in second- and third-tier markets. There’s a good reason for fund managers and sponsors to stay on the sidelines until valuations settle down.

The first quarter’s lackluster pace may be an anomaly, however. The U.S. Labor Department reported that hiring in March 2019 beat expectations with a seasonally adjusted 196,000 jobs added. The unemployment rate held steady at 3.8%, just above a 49-year low of 3.7% touched last fall. After February’s startling plunge to just 33,000 new jobs added, the latest report was a welcome sign that the U.S. economy wasn’t on the verge of another recession.

Sources in the services sectors admit that the first quarter was unusually slow, but their pipelines look strong through the next two quarters. And we have to admit, too, that a few short years ago, a quarter with 362 deals looked pretty darn robust. How perceptions change over time.