January was a fairly busy month for healthcare M&A, as regular readers already know. The 136 deals announced last month showed what results from the proverbial “January thaw.” As for February deal activity, the freeze was on.

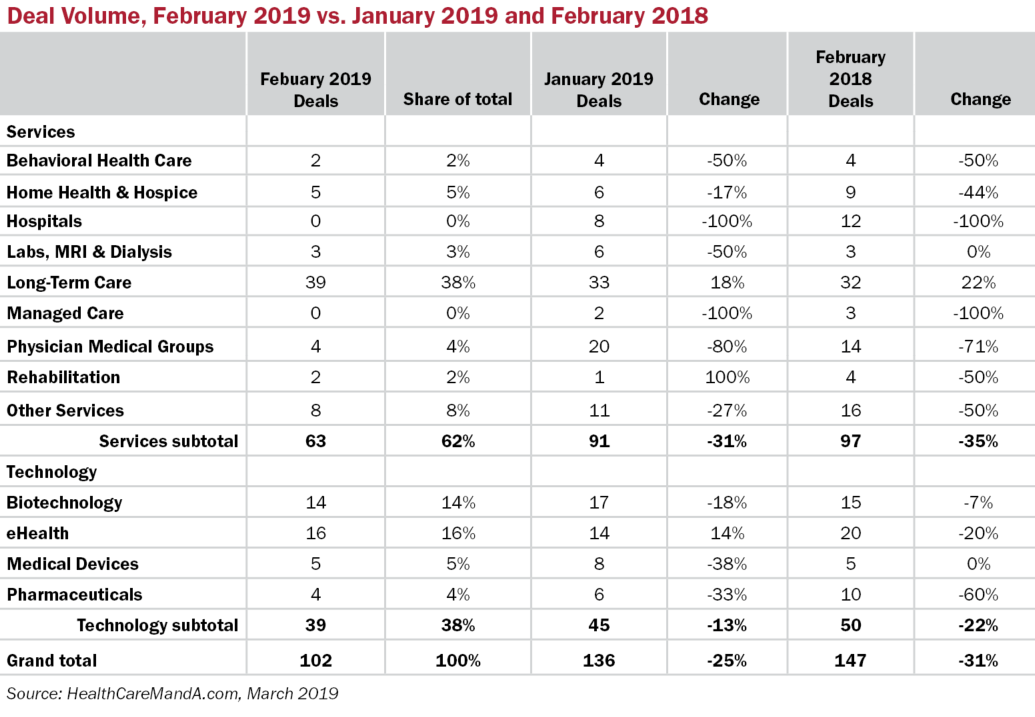

At press time, just 102 deals were on the books, down 25% compared with January and down 31% compared with February 2018, which turned in a scorching 147 deals. What’s going on?

The federal government shut-down that dragged into January certainly had an effect. Some sources tell us that we’re back in the typical annual cycle, where the deal-making momentum from the previous fourth quarter spills over into January but quiets down through the rest of the first quarter. But we’ve also heard laments from some investors that their pipelines ran dry in January and that the quality assets are already taken. Also, sectors such as Hospitals have gone dormant in the capital markets, at least for the moment.

It’s not just Hospitals, however. The gold rush that’s taken place in the Physician Medical Group sector slammed to a halt in February, with only four deals made public. That’s down 80% from January and 71% lower than a year ago. Could it be that valuations have finally hit a peak?

Despite the slowdown in skilled nursing transactions, the Long-Term Care sector just keeps plowing ahead. REITs have yielded the field to buyers in the assisted living and independent living space, and that may be a new normal. However, acuity levels are rising across all subsectors in this space, which means that even independent living community operators may be tapped to handle more falls and other emergencies than they bargained for.

The technology sectors seem poised to lead in the first quarter of 2019, although the sudden resignation of FDA head Scott Gottlieb could dampen some future deals. His public announcement on March 5, scheduled to take effect at the end of the month, surprised (and delighted) some industries. His two-plus-year legacy at the agency brought in speedier trials, higher approval rates, as well as an attempt to curb tobacco use by teenagers. While tobacco sellers rejoiced, pharma and medical device makers are looking for assurances that the pace of those trials and approvals will be maintained.