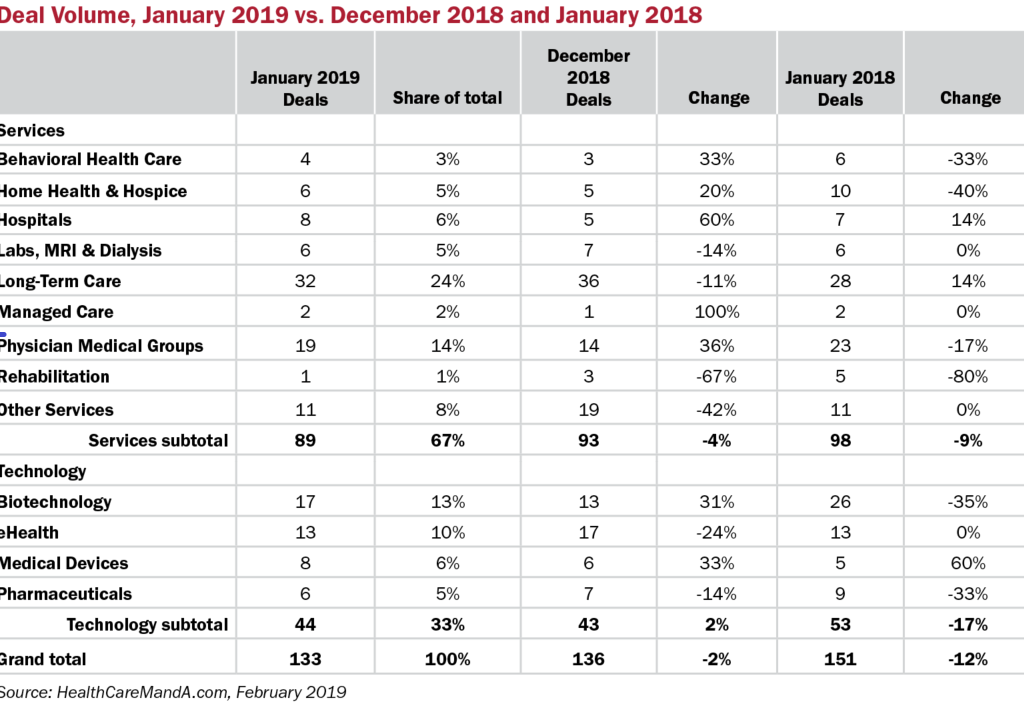

January was a fairly busy month for healthcare M&A. Preliminary data shows 133 deals reported, nearly equal to December’s 136. The momentum coming out of the fourth quarter spilled into the new year and even without a big boost in deal announcements from the J.P. Morgan Healthcare Conference, consolidation in the industry seems to be going full steam ahead.

And yet. Compared with the 151 deals announced a year ago, M&A is off by 12%. Granted, we don’t see that many deals on a monthly basis, which makes for a hard comp here. But as we swing into February, deal flow has slowed noticably. It could be temporary, as investors take stock of the economic and political landscape and acquirers work to integrate their new companies. Let’s say that’s the scenario, for now.

The Long-Term Care sector stayed busy, with 32 deals accounting for 24% of the month’s transactions. That puts it 14% ahead of January 2018. The Physician Medical Group sector showed continued strength, with 19 deals comprising 14% of deal volume. That total is 17% lower than a year ago, but on the basis of four deals.

Similarly, great swings occur in sectors with typically light deal volume. Deal volume in the Rehabilitation sector dropped 80% year over year, but that was also on the basis of four deals. There is a lot of consolidation in this sector, but in many instances it’s taking the form of joint ventures, not acquisitions. For example, Select Medical (NYSE: SEM) has been partnering with hospital systems such as Baylor Scott & White Health and OhioHealth to operate their outpatient physical therapy clinics and inpatient rehabilitation hospitals without taking ownership.