It’s broken record time. Every January for the past six years, we’ve led with a story that says the previous year broke the record for healthcare deal volume. Why break a streak? More than 1,850 healthcare deals were announced in 2018, 14% more than in 2017 and by far the most we’ve ever reported. It may be repetitive, but consider the alternative.

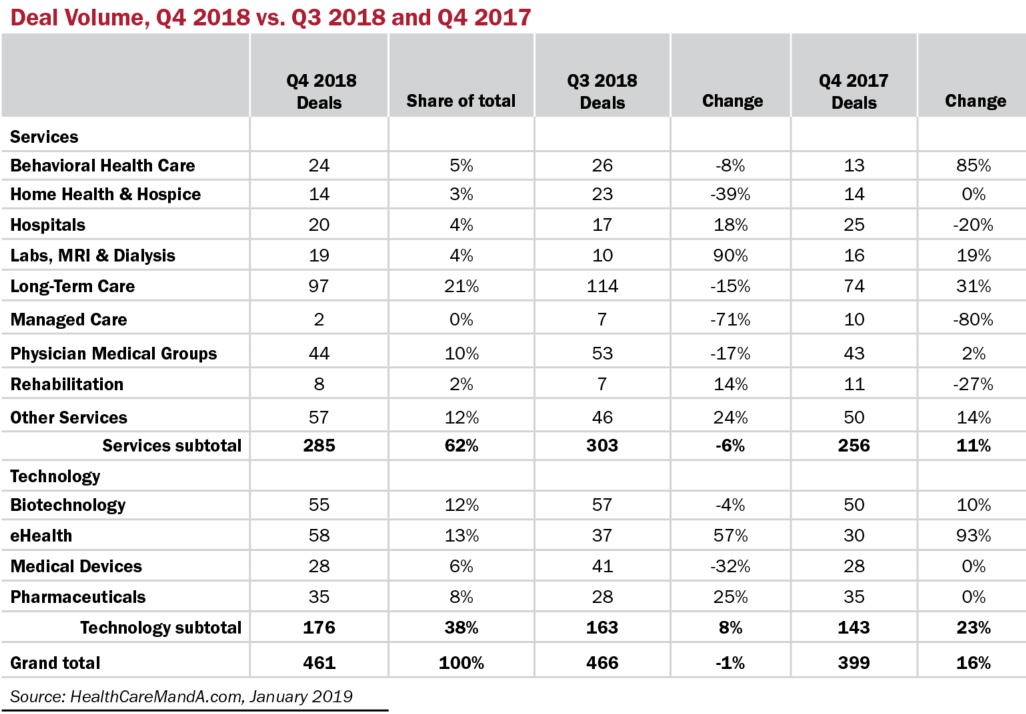

The fourth quarter of 2018 clocked in with 461 deals, a preliminary total for sure, but very solid performance. The total was only 1% behind the third quarter’s total of 466 transactions, and it beat the 2017 Q4 total by 16%.

The Long-Term Care sector was the busiest, with 97 deals recorded so far. Despite the troubles affecting the sector’s publicly traded companies (CEOs are coming and going like restaurant waiters during the dinner rush), the sector accounted for 21% of the fourth quarter’s deal volume.

Squeaking into second place is the eHealth sector, with 58 deals and a 13% share. That result is only a whisker ahead of the Other Services (57 deals, 12%) and Biotechnology (55 deals, 12%) sectors, which demonstrates the breadth of interest investors are showing in the healthcare market. We don’t expect that to end in 2019, particularly if the equity markets continue the gyrations investors endured in late 2018.

Unlike the fourth quarter of 2017, this quarter’s deals didn’t cause the industry to stop and stare, as the CVS/Aetna deal did (and still does). Amazon (NASDAQ: AMZN) hasn’t made any stunning public announcements lately, and the healthcare company formed between Amazon, Berkshire Hathaway and J.P. Morgan in January 2018 has named several top executives, but still doesn’t have a name. Disruption is still just around the corner.