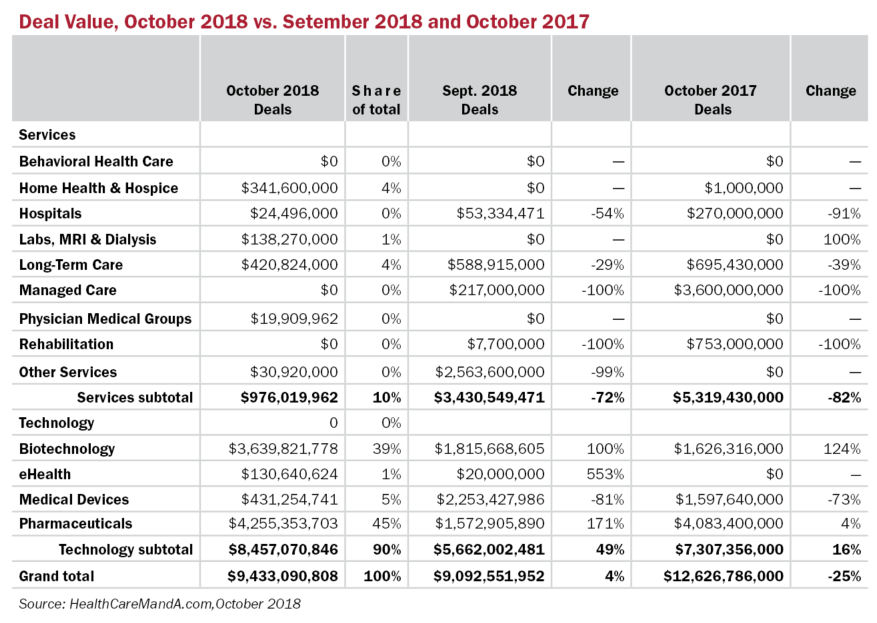

Spending on healthcare deals in the month of October didn’t match the surge in deal volume (see separate post). At $9.4 billion, October 2018 posted a slight 4% gain over September, but was 25% lower than the $12.6 billion spent in October 2017.

Of course, we can only go by disclosed prices, and several transactions that did not disclose financial terms would probably boost the month’s total by at least a few billion dollars. H.I.G. Capital’s acquisition of Correct Care Solutions, is a case in point. Co-owners Audax, GTCR and Frazier Healthcare sold Correct Care, which provides medical and behavioral health services for nearly 250,000 patients in 38 U.S. states and in Australia.

Only two deals with disclosed prices topped the billion-dollar mark. Private equity firm Advent International paid $2.2 billion for Sanofi’s (NYSE: SNY) European generics business, known as Zentiva. Swiss drug giant Novartis AG (NYSE: NVS) paid $2.1 billion for biopharmaceutical company Endocyte, Inc. (NASDAQ: ECYT).

The midterm elections were decided just as this issue went to press, and the results will impact healthcare deal making in several ways. With Democrats in control of the House and Republicans in control of the Senate, the Affordable Care Act remains in effect, if not fully intact. That eliminates some uncertainty, at least.