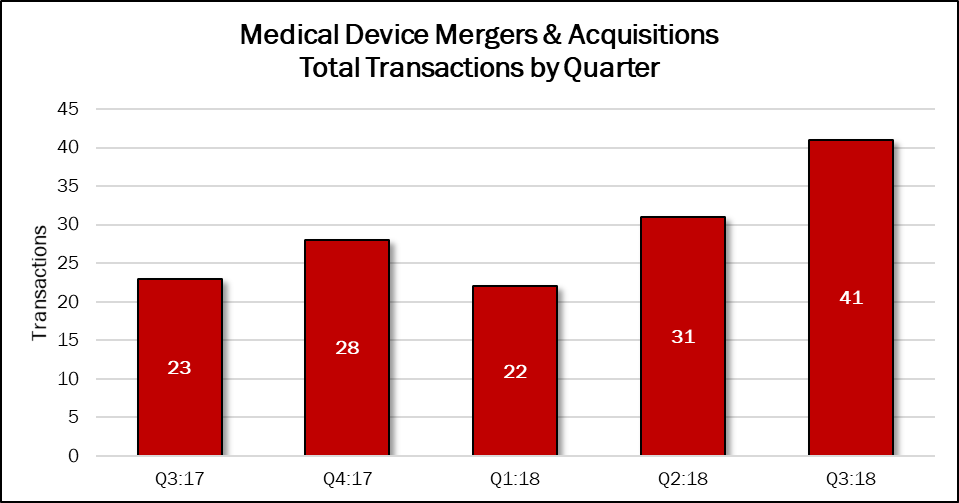

The medical device market is making a comeback in 2018, after several years of steady but uninspiring performance. Through the end of October, 103 transactions have been announced. That’s still below last year’s total, but there are two months to go in the year.

Deal volume in the third quarter reached 41 transactions, up 32% compared with the previous quarter and up 78% over the year-ago period. This quarter’s deals account for 34% of the 122 deals announced in the previous 12 months.

Annual deal volume hit a peak of 194 transactions in 2007, and stayed well above 165 deals per year through 2011 (175 transactions). In 2012, mergers and acquisitions topped out at 145 transactions, a 17% decline. On January 1, 2013, the Affordable Care Act’s 2.3% exise tax on medical device companies kicked in and deal flow dopped another 28%, to 104 transactions that year. Congress suspended the tax in December 2015, and again in January of this year, but the effect on innovation in startups has taken its toll.

Demand for joint replacement surgery has risen, and two companies, Boston Scientific (NYSE: BSX) and Stryker (NYSE: SYK), have been on a deal-making tear in 2018. Boston Scientific has announced eight deals in nine months with a total of $1.5 billion. Stryker’s five deals have totaled $1.8 billion.

Stryker announced the biggest deal in the quarter, buying K2M Group Holdings for $1.4 billion. K2M specializes in complex spine and minimally invasive solutions, offering implants, disposables, and instruments primarily to hospitals for use by spine surgeons to treat spinal pathologies, such as deformity, trauma, and tumor. Post-closing, K2M’s Chairman, Chief Executive Officer, and President Eric D. Major is expected to be appointed as the President of Stryker’s Spine division.

Not to be outdone, Boston Scientific acquired Augmenix, Inc., for $500 million in the third quarter. Augmenix developed and commercialized the SpaceOAR System, a therapy used to reduce common and debilitating side effects that men may experience after receiving prostate cancer radiotherapy. Prior to radiation therapy, the SpaceOAR hydrogel is injected to create additional space between the rectum and prostate during treatment, thereby reducing rectal radiation dose and associated side effects. The SpaceOAR hydrogel is CE Marked, cleared by the FDA and has been used in more than 30,000 patients worldwide.