Mergers and acquisitions in the Behavioral Health Care sector are booming in 2018, with 68 transactions made public through mid-October, 21% higher than the total in 2017. Now comes the report that one of the sector’s largest publicly traded companies, Acadia Healthcare Company (NASDAQ: ACHC), is in talks with a few interested parties to sell itself, and most likely go private.

On October 18, Reuters reported the Franklin, Tennessee-based company was fielding interest from the private sector, naming KKR & Co. (NYSE: KKR) and TPG Global as two firms that have approached Acadia.

With a market cap of $3.4 billion and debt of $3.14 billion (less $79.5 million cash), Acadia won’t come cheap. RBC Capital Markets analyst Frank Morgan ran some numbers and suggests a share price of $46.50 (30% premium to the close on October 17) and an enterprise value of $7.2 billion are “feasible and financeable.”

Founded in January 2005 with early backing from Waud Capital Partners, the company operated a network of inpatient psychiatric hospitals and facilities across the country. After it went public on November 1, 2011, acquisitions fueled its growth, with deal activity ramping up to five announced transactions ($472.4 million) in 2012, four ($121.2 million) in 2013, five more ($1.9 billion) in 2014 and another five ($232.2 million) in 2015.

In 2016, Acadia made its biggest purchase, paying $2.2 billion for the UK-based Priory Group, operating more than 300 facilities with approximately 7,200 beds. Later that year, it sold 21 of those facilities and another under construction (approximately 1,000 beds) to BC Partners, a London-based private equity firm, for approximately $395 million to satisfy anti-competition concerns raised by the Competition and Markets Authority.

Its second largest deal added a new segment to its offerings, substance abuse and addiction treatment. In October 2014, Acadia announced its acquisition of CRC Health Group, which operated 36 residential facilities and 84 treatment facilties, in addition to providing 140 programs that treated 44,000 patients per day. Acadia paid Bain Capital approximately $1.2 billion (price/revenue of 2.6x, price/EBITDA of 10.2x).

CRC Health was formerly known as CRC Health Corporation when it was sold to Bain Capital by then-owners North Castle Partners in February 2006. At the time, it operated just 89 facilities in 21 states, with a daily patient load of 22,700. The $723 million price produced multiples of 3.1x p/rev and 11.0x p/E.

Third Quarter Activity

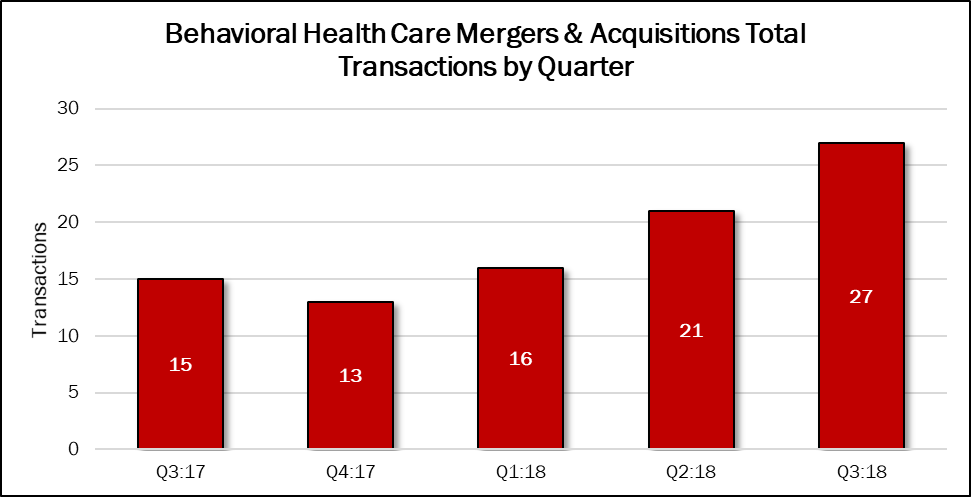

Deal activity in the Behavioral Health Care sector continued its upward surge in the third quarter, up 29% to 27 transactions compared with the previous quarter, and up 80% compared with the third quarter of 2017. This quarter’s transactions represent 35% of the 77 transactions announced in the past 12 months.

Private equity firms made seven acquisitions in this quarter, and an additional six acquirers were portfolio companies of a private equity firm. Four not-for-profits announced mergers with other not-for-profits and three publicly traded companies announced transactions.

Substance abuse/addiction treatment programs were the most popular targets in Q3:18, with 13 deals announced, compared with 11 five deals in the previous quarter. Programs focused on autism spectrum disorders and individuals with developmental disabilities accounted for six transactions in this quarter. Only one target specialized in eating disorders.