Healthcare deals just keep coming. For the third consecutive quarter, deal volume topped the 400 mark, and those are just preliminary results.

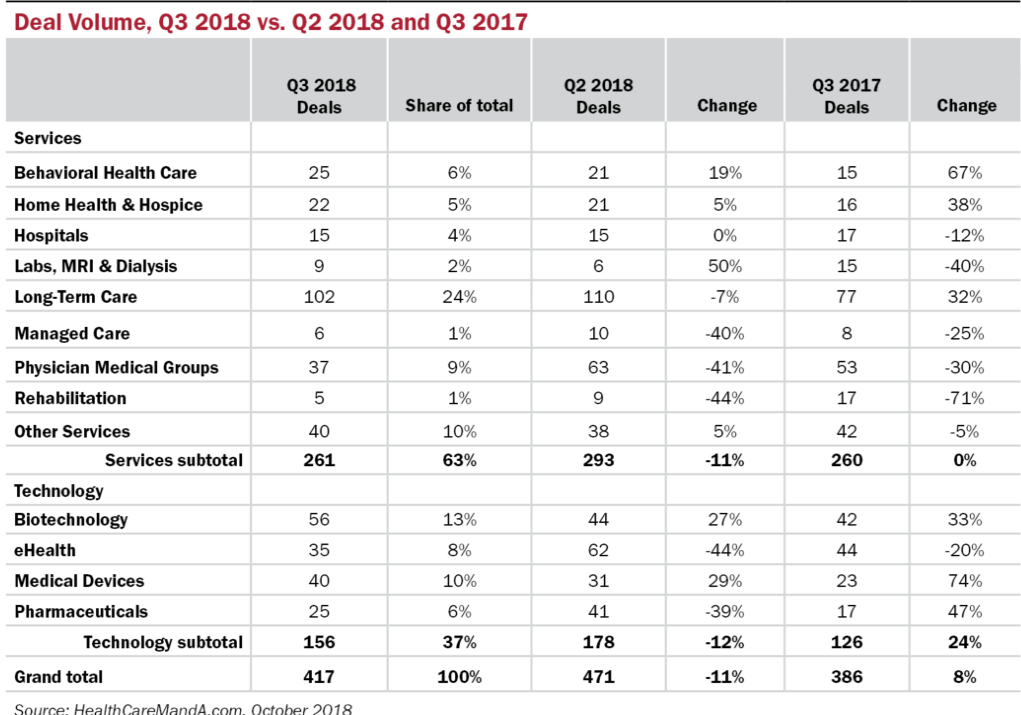

As we went to press, 417 deals are on the books, and more will be added as they come to light. Although that total is down 11% compared with the scorching results from the second quarter (471 deals), it’s 8% higher than the same quarter in 2017 (386 deals), and 5% better than the fourth quarter in 2017 (396 deals).

The Services sectors showed their usual strength, making up 63% of Q3:18’s deal volume. Once again, the Long-Term Care sector dominated the chart with 102 deals reported, and more to come. Some 110 Long-Term Care deals were reported in the second quarter, a record for the sector. We’ll see if it’s still standing at the end of this year, or if the third quarter takes the title.

Still, we saw some softening in a few sectors. Only five deals were announced in the Rehabilitation sector, far lower than in the first (17 deals) and second (nine) quarters. Only 37 deals were announced in the Physician Medical Group area—we say “only” because there were 63 deals announced in the second quarter and 53 in the first quarter of 2018.

Managed Care transactions slowed, too, but some of the biggest players in that area—Aetna (NYSE: AET) and Cigna (NYSE: CI)—are caught up in their own transactions and have little incentive to deal with anything else. Aetna’s acquisition by CVS Health (NYSE: CVS), announced last December, has spawned at least one deal. On September 27, the company announced the sale of its Medicare Part D business to WellCare Health Plans (NYSE: WCG) in order to satisfy federal antitrust concerns. Cigna’s takeover of pharmacy benefit manager Express Scripts (NYSE: ESRX) is moving ahead, but no downstream deals have occurred. Yet.

Among the Technology sectors, Biotechnology’s dominance heightened, moving from 42 deals a year ago to 56 deals in the recent third quarter. Silicon Valley investors have long buoyed this sector, but now bigger players are making moves. As we went to press, Blackstone (NYSE: BX) agreed to acquire life sciences investment firm Clarus, to scale up its investments in healthcare and especially the life sciences. Big biotech players, including Roche (SIX: RO), Novartis (NYSE: NVS) and Sanofi (NYSE: SNY), have made several licensing and collaboration deals through this year. The sluggish Medical Device sector has perked up of late, too.

More Deals, Fewer Dollars

Deal volume is one thing—and for us, the more important element—but dollar volume didn’t follow the tsunami of deals. Spending in the quarter now stands at approximately $30.4 billion, a relatively modest amount that is 30% lower than the $43.4 billion spent in the quarter a year ago. Comparison with the previous quarter is irrelevant, given the $81.5 billion deal between Takeda Pharmaceutical (TSE: 4502) and Shire plc (NASDAQ: SHPG), which inflated that total to $144.7 billion. That’s more than was spent on healthcare deals in all of 2012.

Rather than compare and contrast quarterly totals, a look at the biggest deals in the quarter underscores trends we’re expecting will continue to play out. The largest deal in the period was the take-private acquisition of LifePoint Health (NASDAQ: LPNT) by RCCH HealthCare Partners, a portfolio company of Apollo Global Management, for $5.6 billion.

Going private, rather than face the unending, potentially punishing quarterly earnings reports, is a route that’s become well-trodden recently. Kindred Healthcare (formerly NYSE: KND) is now largely controlled by Humana (NYSE: HUM), but dealing with Welsh, Carson, Anderson & Stowe and TPG Capital as minority stakeholders.

LifePoint had a market cap of $2.4 billion, revenue of $6.2 billion and $661 million in EBITDA. Not hurting, but with their positions in non-urban and rural markets, we’re not seeing a big upswing in the near future. Community Health Systems (NYSE: CYH) has been struggling to pare down debt by selling off hospitals in non-core markets since 2016. The result may be a takeover deal from a private equity fund that sees potential, but won’t have to deal with the equity markets.

On the other hand, the second largest deal of the quarter, announced in the last week, had the largest publicly traded health insurance company, UnitedHealth Group (NYSE: UNH), pay $2.5 billion for a pharmacy chain focused on behavioral health, Genoa Healthcare, a portfolio company of Advent International and the fifth largest pharmacy chain in the country. It’s an not out-of-the-frying-pan-into-the-fire situation, obviously, since UNH will fold Genoa into its OptumRx pharmacy benefit division. Given UnitedHealth’s $2.5 billion market cap, Genoa has little to fear from exposure to the harsh winds of Wall Street and other equity markets.