September is usually a frantic, frenetic transition month, as vacations end, families’ lives kick into high(er) gear, and we face the inexorable onslaught of the winter months in the Northern Hemisphere. On that plane, the healthcare M&A market proved to be remarkably tame for the month.

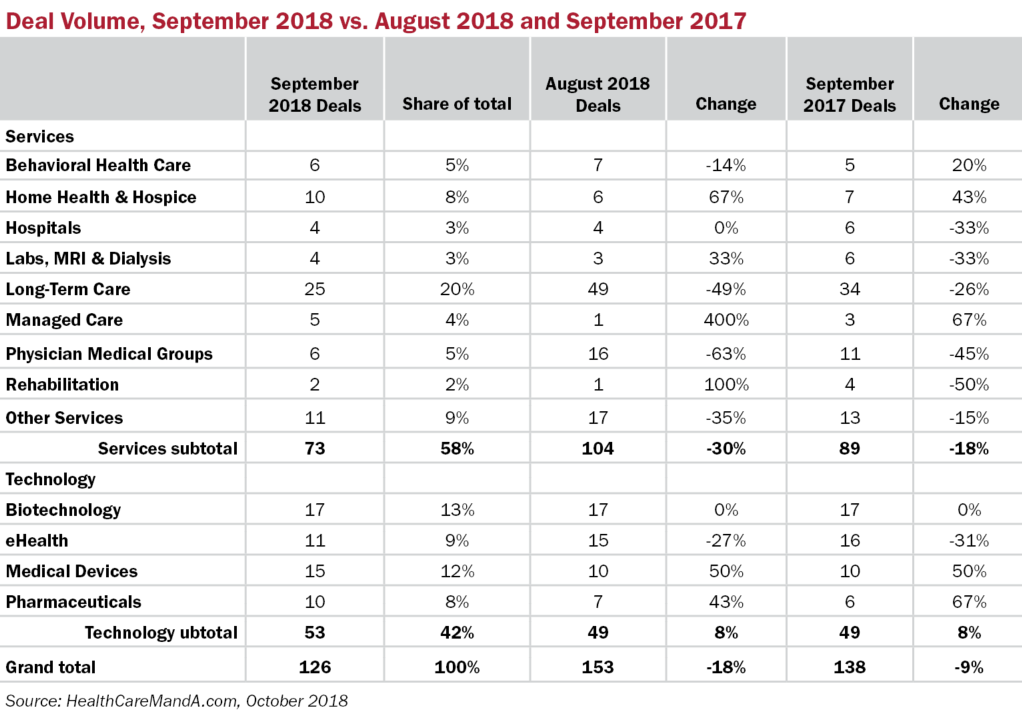

Starting from the high-level view, deal volume currently stands at 126 transactions, slightly lower than the previous month and the year-ago month. But not by a lot. If you can even remember August, it was itself a frantic month, thanks to the Long-Term Care sector, which posted a record 49 transactions. The 25 deals now on record for September are still preliminary, and we expect some revisions upward in the coming weeks. Nothing to rival August’s total, though.

We’re seeing more strength among the Technology sectors lately. While Biotechnology deals don’t seem to have budged, based on the chart below with deal volume stuck at 17 per month, there’s been considerable action among companies licensing or acquiring promising drug candidates, in the early and late stages of clinical trials.

The Pharmaceutical sector, which was expected to spring into an orgy of M&A deals shortly after the Republican tax overhaul was passed last December, has been mostly moot. Yes, Takeda Pharmaceutical (TSE: 4502) is still trying to rationalize its $81.5 billion bid for Shire plc (NASDAQ: SHPG), but honestly, the anticipated mega-mergers haven’t emerged. Pfizer’s (NYSE: PFE) long-time CEO Ian Read is stepping down, having abandoned that $118 billion bid for AstraZeneca (NYSE: AZN) back in 2015 after a protracted hostile stalking process. The Big Pharmas are busying themselves with the biotechs, not big mergers.

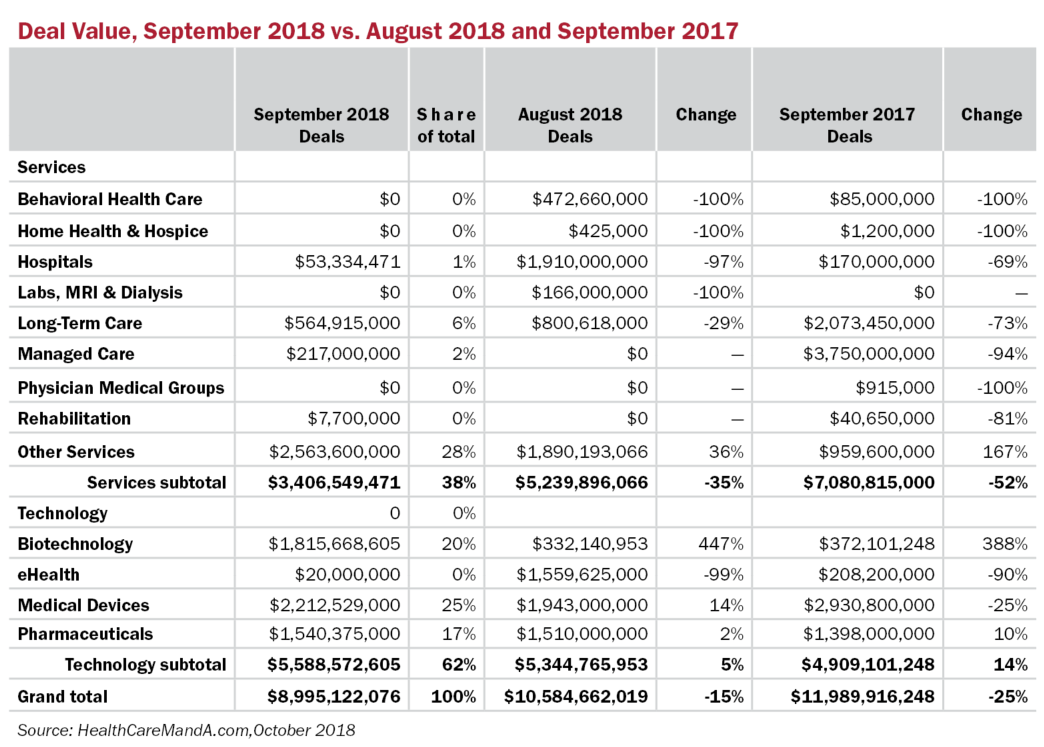

Total spending wasn’t very high in September, either. That’s the way it went in that transitional month, with nearly $9.0 billion in announced spending, and probably billions more left behind the curtain. Looking at August’s $10.5 billion total and September 2017’s nearly $12.0 billion, there’s nothing to do but shrug at the totals.

Digging into the sector totals, though, there’s steady momentum within the Technology sectors. Dollar-wise, Pharmaceutical deals have been steady, as several generics have been licensed for use in various parts of the world. The Medical Devices sector has been helped by the strong comeback of Boston Scientific Corp. (NYSE: BSX) and Stryker Corp. (NYSE: SYK) in the M&A arena, and smaller companies have come off the bench with innovations that have attracted some middle-market firms looking for growth.

There’s still a lot of dry powder waiting to be ignited on the private equity side. Of course, those firms are looking mostly to the Services side for deals that aren’t going to be hurt by a stroke of the pen at the CMS.

That said, we saw smaller deals being done in September 2018, in Long-Term Care to eHealth, based on disclosed prices. As the Federal Reserve moves the Federal Funds rate higher, some of these players may be holding onto their cards. Wait for the next round.