Did any of you deal makers take a vacation last month? I know for a fact that many of you did, but the pace of deal announcements didn’t slow for a moment in August 2018.

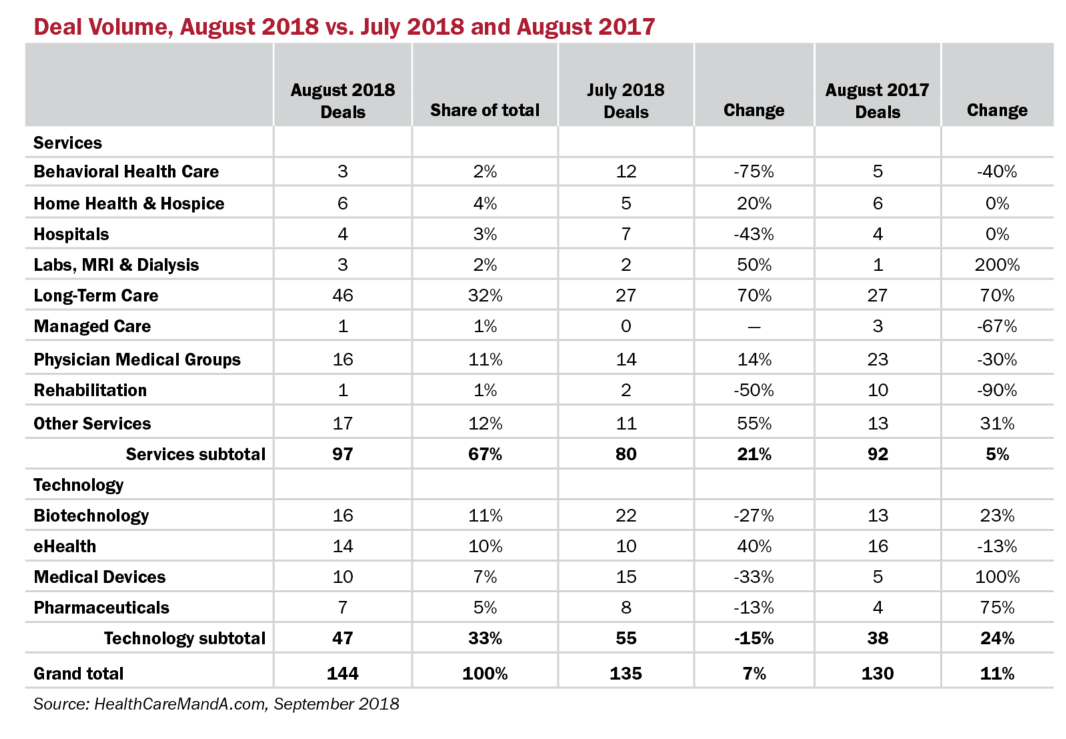

Deal volume reached 144 and still counting, a new record for the month. The total got a boost from a suddenly hot Long-Term Care sector, which logged 46 transactions. That’s a 70% boost compared with the 27 deals reported in both July 2018 and August 2017.

Looking back through our database, August has been fairly quiet for the past 20 years, as far as deal volume is concerned. Way back in August 1997, 113 transactions were announced, and that was before we began tracking the technology sectors—Biotechnology, eHealth, Medical Devices and Pharmaceuticals—beginning in 2000.

August 1998 virtually equalled it, with 112 transactions recorded. Then the bottom fell out of the healthcare market, and August 1999 saw just 52 deals. Deal volume teetered between 53 and 98 transactions every August until 2015, when the technology sectors, led by Pharmaceuticals, and Long-Term Care were at their peak. That month, deal volume hit 140, with 37 deals from the Long-Term Care sector.

Spending in August 2018 was not outsized, nor historic, by any measure. Of the 54 deals that disclosed financial terms, the total came to $10.4 billion, about 3% lower than the previous month, and 53% behind the $22.3 billion reached the year earlier.

Spending in August 2018 was not outsized, nor historic, by any measure. Of the 54 deals that disclosed financial terms, the total came to $10.4 billion, about 3% lower than the previous month, and 53% behind the $22.3 billion reached the year earlier.

Spending is a far less reliable indicator of the market’s strength. The biggest deal last month was just $1.7 billion, as Federal Street Acquisition Corp. (NASDAQ: FSAC), an affiliate of Thomas H. Lee Partners, bought Universal Hospital Services from Irving Place Capital Management. A year ago, the biggest deal was Gilead Sciences’ (NASDAQ: GILD) $11.9 billion acquisition of Kite Pharma (NASDAQ: KITE).

Just for comparison’s sake, July 2018’s biggest deal came from the Hospital sector, as RCCH HealthCare Partners, a portfolio company of Apollo Global Management, took LifePoint Health (NASDAQ: LPNT) private for $5.6 billion.

Looking back to the 1990s, the only discernable pattern when it comes to spending in the month of August is that it kept rising, mostly. In the 1990s, August dollar volume was consistently pegged around $1.4 billion, with an exceptional $3.2 billion in August 1996. August 2000 hit $6.7 billion, then the total dropped to around $2.0 billion for a couple of years, then lurched between $2.0 and $6.8 billion until 2007, when it reached $8.0 billion.

What’s the record monthly spend for August? That would be $33.2 billion, recorded in 2010, when Sanofi-Aventis SA (NYSE: SNY) paid $20.1 billion for Genzyme Corporation (then NASDAQ: GENZ).

Looking ahead to the end of the third quarter, 295 deals are on the books as of the first week in September. We’re aiming for 385, the total posted in Q3:17. Think we can add 90 deals in three weeks? You could bet on it, if you were the sporting sort.