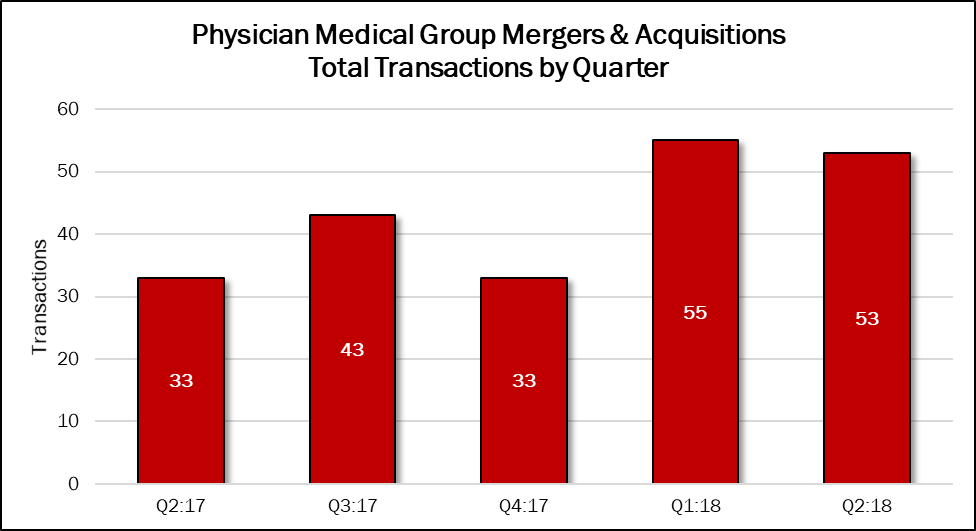

Investor interest in physician medical groups ramped up significantly in 2018, with 55 transactions announced in the first quarter, followed by 53 deals in the second quarter. The second quarter deals represent 29% of the total of 184 announced in the previous 12 months. Deal volume slipped 4% compared with the previous quarter but posted a 61% increase versus the same quarter a year earlier.

Physicians in small practices have been under growing pressure from regulations and legislation, changes in reimbursement cycles and episodes of care. Under MACRA, they may be the lead provider when it comes to bundled payments, which makes primary care and hospital-based physicians of interest to healthcare providers and health systems. Private equity firms are rapidly consolidating within specialties, particularly dermatology and ophthalmology.

Some of the biggest deals ever announced in this sector occurred in the second quarter of 2018, which ended with a combined total of almost $12.8 billion.

The largest was KKR & Co.‘s (NYSE: KKR) $9.9 billion acquisition of Envision Healthcare Corp. (NYSE: EVHC), announced in June. That deal bumped previously largest deal, announced in April, as a consortium of buyers led by Summit Partners and UnitedHealth Group (NYSE: UNH) paid $2.15 billion for Sound Inpatient Physicians, owned by Fresenius Medical Care (NYSE: FMS).

DaVita Inc. (NYSE: DVA) also got in on the action, selling Paladina Health, a provider of primary care clinics that operates 53 clinics in 10 states, to New Enterprise Associates for $1.0 billion.