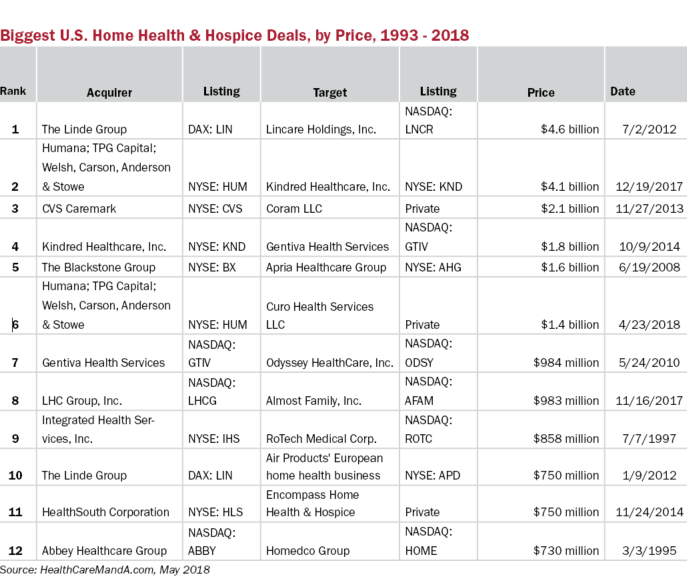

As a prelude to our interactive webinar, “Home Health & Hospice M&A: The Latest Trends,” on May 24, we put together a chart on the largest U.S. deals in the sector since 1993, when our database was created. The result is a map of the mergers and acquisitions that bring us to today’s frenzied home health & hospice market.

Our panel includes Jim Glynn, CEO of Jet Health, Inc.; Mark Kulik, managing director of The Braff Group; and Burk Lindsay, managing director of Raymond James. Join us as we discuss the latest deals, the wild valuations, and what lies ahead in this sector.

The largest transactions, measured as $1 billion or more, were all announced in the past 10 years. The oldest of these is Blackstone‘s (NYSE: BX) $1.6 billion acquisition of Apria Healthcare Group (NYSE: AHG) in June 2008. We should note that Apria was the target of a previous takeover attempt in October 1997, when Transworld HealthCare, Inc. (NASDAQ: TWHH) and Hyperion Partners II, LP bid $1.5 billion to acquire what was then the largest home health company in the United States. The terms were to pay $14 in cash and $4 in stock (a 10.7% premium) for each Apria’s 51,473,919 shares, and to assume long-term debt of about $580,000,000. The price per share was cut to $16 per share in December 1997. The deal was terminated in January 1998 when Apria’s shareholders voted against it.

The Linde Group (DAX: LIN), the Germany-based gases and engineering company, has made two of the top-10 largest deals, beginning with its $750 million acquisition of the European home health business of U.S.-based Air Products (NYSE: APD) in Janaury 2012, and then adding Lincare Holdings Inc. (NASDAQ: LNCR) in July 2012 for $4.6 billion.

We’ll talk about this chart, but much more, on Thursday, May 24. Don’t miss it.