It’s been quite a year for healthcare deals in general, with nearly 600 announced transactions in the first four months. That’s 7% more than there were announced in the first four months of 2017.

Dollar volume has soared, too. In 2018, $141.8 billion has already been committed to fund the 588 transactions. Thanks to some mega-billion-dollar deals in 2018, the total is 30% greater than the nearly $109 billion spent in the same period of 2017.

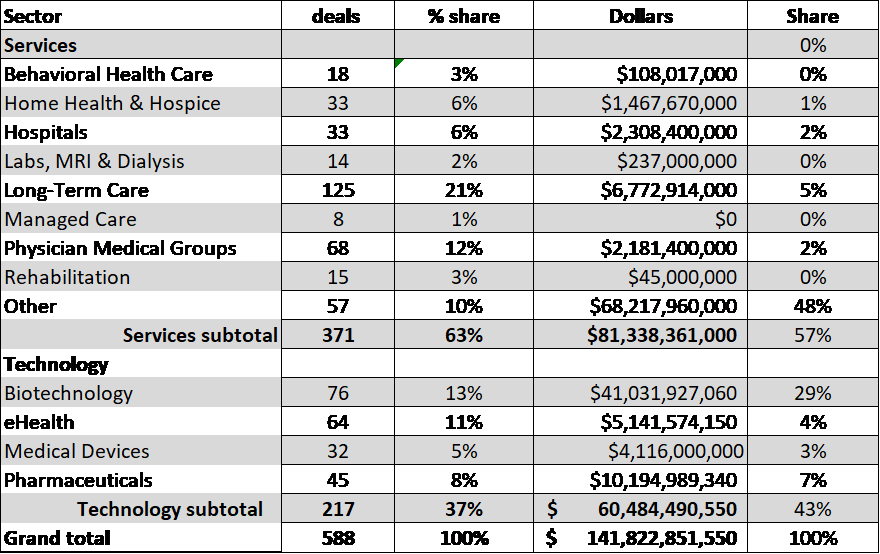

Collectively, the Services sectors are booming, which isn’t always the case. Services deals made up 63% of all deals in the first four months of 2018, and 57% of the disclosed dollars, now at $81.3 billion.

The Technology sectors typically account for the majority of spending, thanks to the transactional nature of the Pharmaceutical and Biotechnology sectors, and investors’ hot pursuit of anything related to digital healthcare. The big boost in Services spending came from Cigna‘s (NYSE: CI) $67 billion bid for Express Scripts (NYSE: ESRX).

Long-Term Care deals slowed considerably in recent months, but suddenly took off again in April, with at least 46 deals reported. Through April, they total 125 transactions, up 29% compared with the 97 reported in the same period in 2017.

Home Health & Hospice deals are back in the limelight, with 33 made public (+27% vs. 2017) in the first four months. The $1.4 billion acquisition of Curo Health Services by Humana (NYSE: HUM), TPG Capital and Welsh, Carson, Anderson & Stowe will create the largest hospice services company in the United States, and more add-on deals are sure to come.