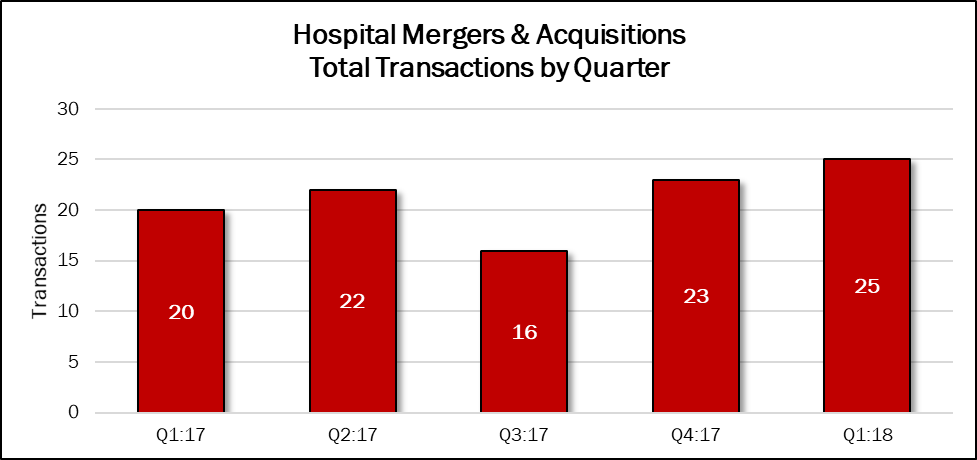

Mergers and acquisitions in the Hospital sector picked up slightly in the first quarter, up 9% compared with the previous one to 25 deals. It was up 25% compared with the same quarter in 2017, and the 25 deals comprise 29% of the 86 deals announced in the previous 12 months.

Some of the activity is still being fueled by divestitures by the publicly traded companies, Community Health Systems (NYSE: CYH), Quorum Health (NYSE: QHC), and Tenet Healthcare (NYSE: THC). All are trying to lower their debt load, and for Community Health and Tenet, activist shareholders are demanding more attention to the balance sheet. In the first quarter, Community Health sold five hospitals (one in Louisiana, four in Tennessee); LifePoint Health (NASDAQ: LPNT) sold three (Louisiana); Quorum Health sold one (Georgia); and Tenet sold two (Arizona and Missouri).

Source: HealthCareMandA.com, April 2018

Source: HealthCareMandA.com, April 2018

Four of the transactions disclosed prices in the first quarter, for a total of $2.3 billion. A single deal accounted for 70% of the spending. This quarter’s total makes up 30% of nearly $7.7 billion spent in this sector in the previous 12 months, and represents a 25% decrease compared with the previous, fourth quarter of 2017. Compared with the same quarter a year earlier, this quarter’s spending was 536% higher.

Dollars Spent on Hospital Mergers & Acquisitions, by Quarter

| Q1:17 | Q2:17 | Q3:17 | Q4:17 | Q1:18 |

| $362,800,000 | $2,129,000,000 | $170,000,000 | $3,089,200,000 | $2,308,400,000 |

The largest deal in the quarter was announced by a Chinese investment firm, IK Healthcare Investment, which was formed by Yunfeng Capital and Alibaba Group Holding Limited to acquire publicly traded iKang Healthcare Group for approximately $1.6 billion. iKang Healthcare Group provides preventive healthcare solutions in the People’s Republic of China. It primarily serves corporate and individual customers through a network of self-owned medical centers and the facilities of third-party providers. As of March 26, 2018, the day prior to the announcement, iKang owned and operated a network of 110 medical centers in 33 cities in China.

HCA Healthcare announced the second largest transaction, as it acquired Memorial Health in Savannah, Georgia. Memorial Health operates the Memorial Health University Medical Center (612 beds) and its employed physicians group, Memorial Health University Physicians. The purchase price was estimated to be $456.7 million, according to the Savannah Morning News. The final price will be determined in about four months, after adjustments are made.

The third largest deal involved two not-for-profit Presence Health hospitals, Presence Convenant Medical Center (206 beds) in Urbana and Presence United Samaritans Medical Center (174 beds) in Danville, Illinois. The buyer is OSF Healthcare, another not-for-profit that is sponsored by The Sisters of the Third Order of St. Francis. It now operates nine acute-care hospitals, one children’s and one heart hospital, 192 clinical departments, 12 urgent care centers and two colleges. The purchase price was $185 million.