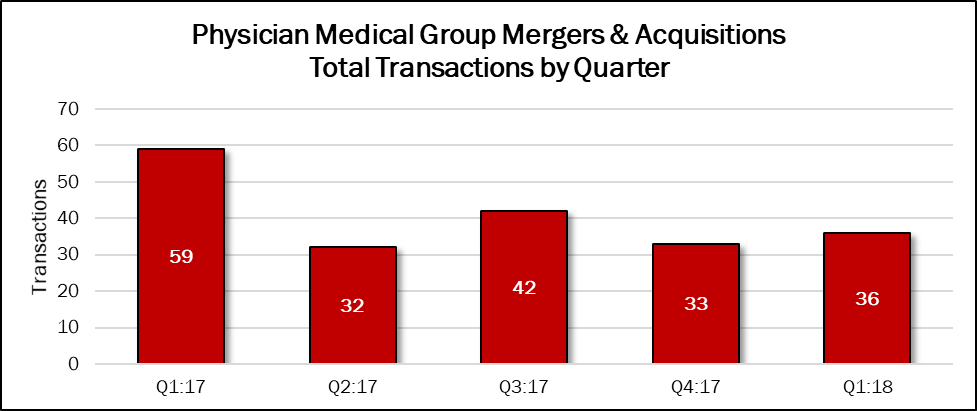

Physician medical group M&A activity was strong in the first quarter of 2018, according to new acquisition data from HealthCareMandA.com. The number of physician medical group acquisitions increased to 36 in the first quarter, up 9% from the 33 publicly announced acquisitions in the fourth quarter of 2017. Compared with the year-earlier quarter, when a recent record of 59 deals were reported, deal activity was down 39%. None of the transactions disclosed a purchase price.

The most prolific buyers were MEDNAX, Inc. (NYSE: MD) and Eye Health South with three acquisitions each, followed by Anne Arundel Dermatology, Gauge Capital, Platinum Dermatology and Team Health, with two deals each.

Four private equity firms made five acquisitions, and 10 portfolio companies made 15 deals in this sector. “Private equity firms have made big moves into the Physician Medical Group sector in the past three years. They’re investing primarily in free-standing dermatology and ophthalmology practices,” said Lisa Phillips, editor of the Health Care M&A Report, which publishes the data. “With so many firms building platforms across the country, it will be interesting to see how their exit strategies play out.”

Only one not-for-profit hospital announced an acquisition in the first quarter, as Fairview Health Services in Minnesota took on a five-physician neurology practice. “Hospital-based specialties such as cardiology and neurology are not as active as the free-standing specialty practices,” commented Phillips.