Ever wonder why February is the shortest month of the year? It didn’t even exist on the old Roman calendar, when there were only 10 months in a year. Later, the calendar was revised to include 12 lunar cycles totaling 355 days and January and February were added, with February as the last month of the year. In Julius Caesar’s day, the calendar was changed yet again to align with the solar cycle, which amounted to 365 days. And because a complete revolution of the Earth around the sun is actually 365-and-one-quarter days, an extra day is tacked onto the end of every fourth year, which we call a Leap Year. You remembered that from third grade, of course.

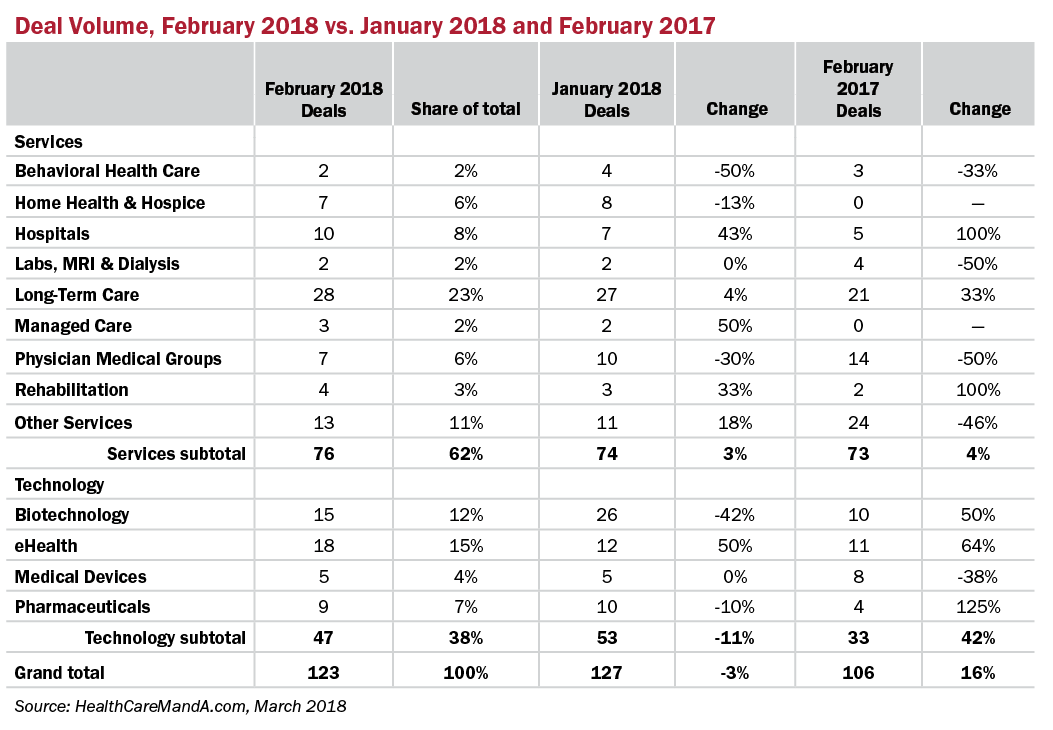

All that brings us to why comparing February results with those from January and March, which have 31 days, are even less reliable than comparing other months. So it was interesting to see 123 deal announcements in the 28 days of February 2018, only 3% lower than the 127 posted in January.

But the real apples-to-apples comparison with the same month in 2017 shows that February 2018’s deal volume is 16% higher than a year ago. We dug deeper into the database, going back to 2014, and found that last month’s 123 total is second only to February 2016, when 130 deals were announced.

What drove the activity in February 2018? Although the Services sectors made up 62% of the month’s deal volume, that is still lower than a year earlier, when they accounted for 69%. Some sectors just perfomed better, year-over-year, including Homes Health & Hospice and Managed Care, which had no deal activity in February 2017.

Dollar volume is a different story. Monthly dollar volume in February 2018 was only $7.4 billion, down 21% compared with February 2017’s nearly $9.4 billion. Looking back to 2014, however, it’s obvious that the month of February has missed its share of big deal announcements in the past two years .

Dollar volume in February 2014 reached $34.8 billion, for example, on the strength of the then-hot Long-Term Care and Pharmaceutical sectors. Both of those sectors have cooled off significantly in the past two years. Long-Term Care, specifically the skilled nursing side, has reached the end of its record nine-year bull cycle. Big pharmaceutical deals dried up in 2016, following the U.S. Treasury’s crack-down in September 2015 on corporate tax inversions that were moving U.S. headquarters overseas. In 2015, February’s 106 deals produced $42.6 billion in dollar volume, with the two largest deals—both Pharmaceuticals—totaling $32.8 billion.

When the Trump administration acted on The Donald’s 2016 campaign promise to overhaul the corporate tax code, Big Pharma sat on the sidelines and waited. That’s changing, only two months after the tax bill was passed. Pfizer (NYSE: PFE) is reported to be courting Shire plc (NASDAQ: SHPG), Novartis (NYSE: NVS) is shopping its U.S. generics business, and Acorda Therapeutics (NASDAQ: ACOR) is drawing interest from Biogen (NASDAQ: BIIB) and UCB SA (UCB.BR), among others. So many days, so many deals to do.