The dam broke in the fourth quarter of 2017, and pharmaceutical deal makers began acquiring again. The Republican tax overhaul that lowered the tax rate for corporations’ repatriated cash was approved in December, spurring big drug companies to think about mergers and acquisitions once again.

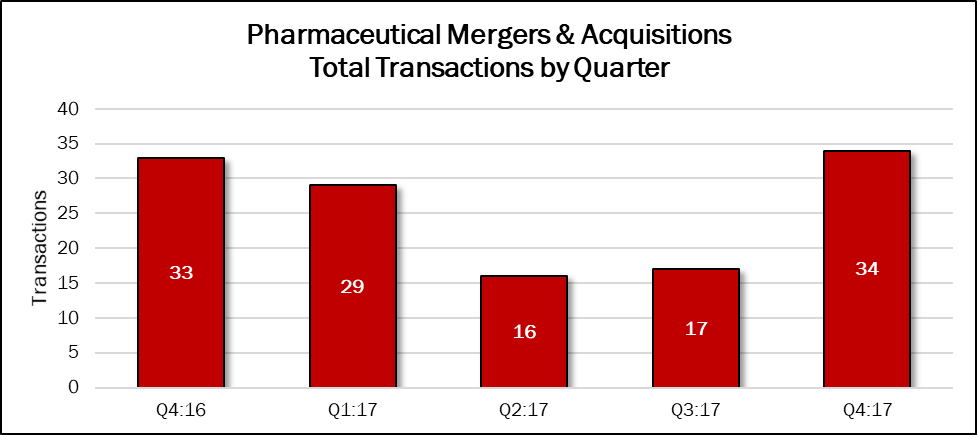

Deal volume in the fourth quarter shot up 100% over the previous quarter, to 34 transactions. Q4:17 basically equaled the same quarter in 2016, when 33 deals were announced. This quarter’s deal volume accounts for 35% of the 96 deals announced in the previous 12 months.

Source: HealthCareMandA.com, January 2018

Source: HealthCareMandA.com, January 2018

Twenty of the 34 announced transactions disclosed a price, making for a total of $6.9 billion spent in the fourth quarter. The combined total for represents an increase of 253% over the previous quarter, but a 23% decrease compared with the same quarter a year earlier. The fourth quarter made up 25% of the $28.1 billion spent in the previous 12 months.

Dollars Spent on Pharmaceutical Mergers & Acquisitions, by Quarter

| Q4:16 | Q1:17 | Q2:17 | Q3:17 | Q4:17 |

| $9,047,951,425 | $10,199,770,000 | $9,024,860,000 | $1,965,500,000 | $6,941,200,000 |

Three foreign-based companies announced the three largest deals of the quarter. Novartis AG, based in Basel, Switzerland, ponied up $3.9 billion for French radiopharmaceutical company Advanced Accelerator Applications S.A. The company develops, produces and commercializes molecular nuclear medicines including Lutathera®, a product for neuroendocrine tumors. Radiopharmaceuticals are unique medicinal formulations containing radioisotopes which are used clinically for both diagnosis and therapy. The transaction strengthens Novartis’ oncology presence with both near-term product launches as well as a new technology platform with potential applications across a number of oncology early development programs.

Mallinckrodt plc, based in Chesterfield, UK, crossed the pond to acquire Sucampo Pharmaceuticals for $1.2 billion. The target has a late-stage pipeline of product candidates in clinical development for orphan disease areas. Mallinckrodt focuses on specialty pharmaceuticals and biopharmaceutical products, as well as nuclear imaging agents.

The third largest transaction was between two Indian pharmaceutical companies. Torrent Pharmaceuticals, based in Ahmedabad, India, paid 36 billion rupees ($558 million) to acquire Unichem Labs’ pharmaceutical business in India and Nepal. The deal involves more than 120 brands in Unichem markets in the two countries, as well as a manufacturing plant in Sikkim.