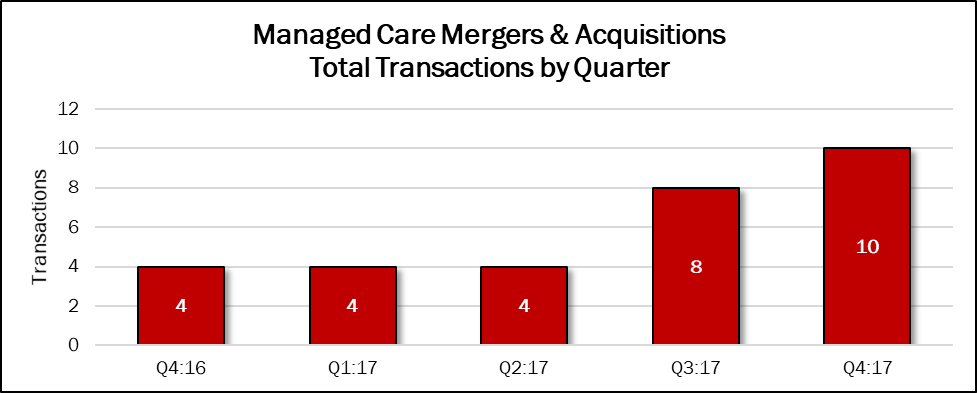

The fourth quarter of 2017 will be remembered for some time to come, thanks to the game-changing deal announced between pharmacy/retailer CVS Health and Aetna, one of the largest managed care companies in the country. That was only one deal, of course, and there were actually 10 transactions announced in Q4:17. Fourth quarter deal volume represents a 38% share of the 26 deals announced in the previous 12 months, and a 150% increase over the same quarter in 2016.

Source: HealthCareMandA.com, January 2018

Two of the 10 deals disclosed prices in the fourth quarter, for nearly $80.6 billion, the highest ever recorded in this sector, or several others. The total represents 95% of the $84.7 billion in spending announced in the previous 12 months.

Dollars Spent on Managed Care Mergers & Acquisitions, by Quarter

| Q4:16 | Q1:17 | Q2:17 | Q3:17 | Q4:17 |

| $957,500,000 | $0 | $0 | $4,150,000,000 | $80,600,000,000 |

The largest deal of the year, and ever in this sector, was announced in early December by CVS Health and Aetna. Not only was the $77 billion price tag a shock, but the vertical integration between a managed care company and a nationwide pharmacy chain surprised many industry watchers, as well as consumers. The combined company will add new health services offerings in many of CVS’ 9,700 pharmacy locations and 1,100 MinuteClinic walk-in clinics, which are intended to function as community-based health hubs to improve consumers’ health while providing prescription drugs and health coverage. CVS also acquired Target’s pharmacy operations a few years ago, giving it even more consumer exposure.

The only other deal to disclose a price came from Express Scripts, the sole independent pharmacy benefits management company. Its target, for $3.6 billion, was eviCore healthcare, a medical benefits management company that develops and operates evidence-based cloud centric healthcare solutions for managed care organizations, self-insured entities, and risk-bearing provider organizations. Its current investors include General Atlantic, TA Associates, and Ridgemont Equity Partners. eviCore began as CareCore National, LLC, which acquired Franklin, Tennessee-based MedSolutions, Inc. in December 2014. The company changed its name to eviCore, and later acquired Boston-based QPID Health in February 2016.

New Mountain Capital announced two transactions in the last quarter, although prices weren’t disclosed. Both targets, Censeo Healthcare and Advance Health, provide prospective health assessments for health plans and healthcare delivery organizations. Advance offers in-home and facility-based health assessments and chronic care management services. It employs a network of nurse practitioners to provide its services and has completed hundreds of thousands of assessments for many of the largest Medicare Advantage programs in the United States.

Censeo’s contracted network of nearly 7,500 licensed physicians performs comprehensive, annual wellness visit-complaint assessments with members in their homes, at network physician offices and in community settings.