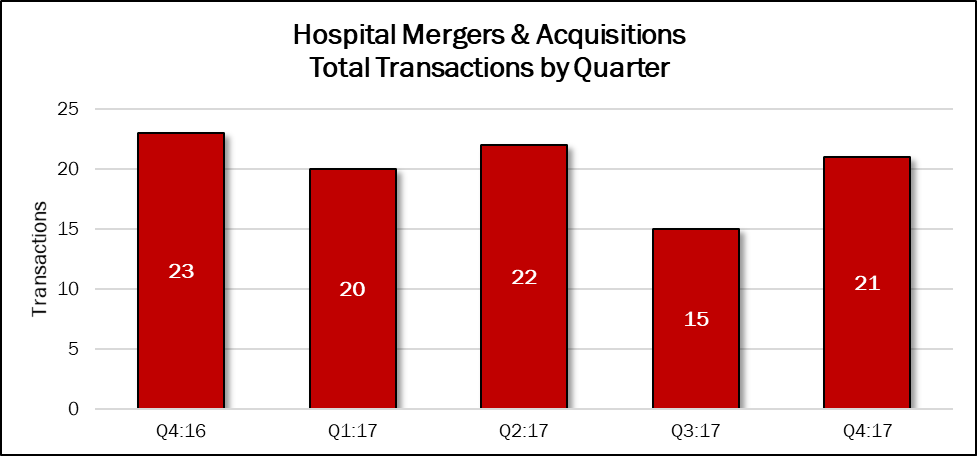

Despite a weak third quarter, the Hospital sector’s merger and acquisition activity stayed relatively consistent, with deal volume ranging between 20 and 23 deals per quarter. The fourth quarter of 2017 posted 21 transactions, accounting for 27% of the 78 announced in the prior 12 months. Deal volume was up 40% compared with the previous quarter, but 9% lower than the same quarter in 2016.

Some of the activity has been fueled by divestitures by the publicly traded companies, Community Health Systems (NYSE: CYH), Quorum Health (NYSE: QHC), and Tenet Healthcare (NYSE: THC). All are trying to lower their debt load, and for Community Health and Tenet, activist shareholders are demanding more attention to the balance sheet. Tenet’s CEO Trevor Fetter left the company last August, and Community’s CEO Wayne Smith is under pressure to depart his post, as well.

In the fourth quarter, Community Health sold two hospitals, and Tenet and LifePoint Health (NASDAQ: LPNT) each sold one. The acquirers were all not-for-profit healthcare providers.

Source: HealthCareMandA.com, January 2018

Source: HealthCareMandA.com, January 2018

Four of the transactions disclosed prices in the fourth quarter, but one deal accounted for 99% of the spending of $2.8 billion. That total makes up 53% of $5.3 billion spent in this sector in the previous 12 months, and represents a 22% increase compared with the same quarter in 2016. There were no prices announced in the third quarter.

Dollars Spent on Hospital Mergers & Acquisitions, by Quarter

| Q4:16 | Q1:17 | Q2:17 | Q3:17 | Q4:17 |

| $2,312,147,505 | $362,800,000 | $2,129,000,000 | $0 | $2,819,200,000 |

The largest deal in the quarter was announced by UnitedHealth Group (NYSE: UNH), the largest managed care provider in the United States. Its target was the Chilean healthcare provider Banmedica SA, which operates hospitals, sells health insurance and provides other services. It generated approximately $2.1 billion in revenue in 2016, and has operations in Chile, Columbia and Peru, which makes UnitedHealth’s $2.8 billion payment seem reasonable.

At $11.5 million, the quarter’s second largest deal was far lower. UNC Health Care bid $11.5 million in cash for Morehead Memorial Hospital in Eden, North Carolina. Morehead Memorial’s operations include a 108-bed hospital, a 121-bed skilled nursing facility and several medical offices. The hospital filed for bankruptcy protection in July 2017 and attracted several suitors. UNC Health Care also committed to invest $20 million over a three-year period, and to keep the hospital open for five years.

Pioneer Hospital of Patrick County, located in Stuart, Virginia, was also involved in bankruptcy proceedings. The 25-bed hospital was owned by Mississippi-based Pioneer Health, which filed for bankruptcy protection in 2016. This hospital posted a net loss of $379,200 at the end of 2016. It was acquired in December by Virginia Community Capital for $5.7 million.