Despite all the big deals announced in December, the fourth quarter of 2017 wasn’t one for the record books. Merger and acquisition activity was busy, but compared with the previous quarter and the same period in 2016, the pace wasn’t frenetic.

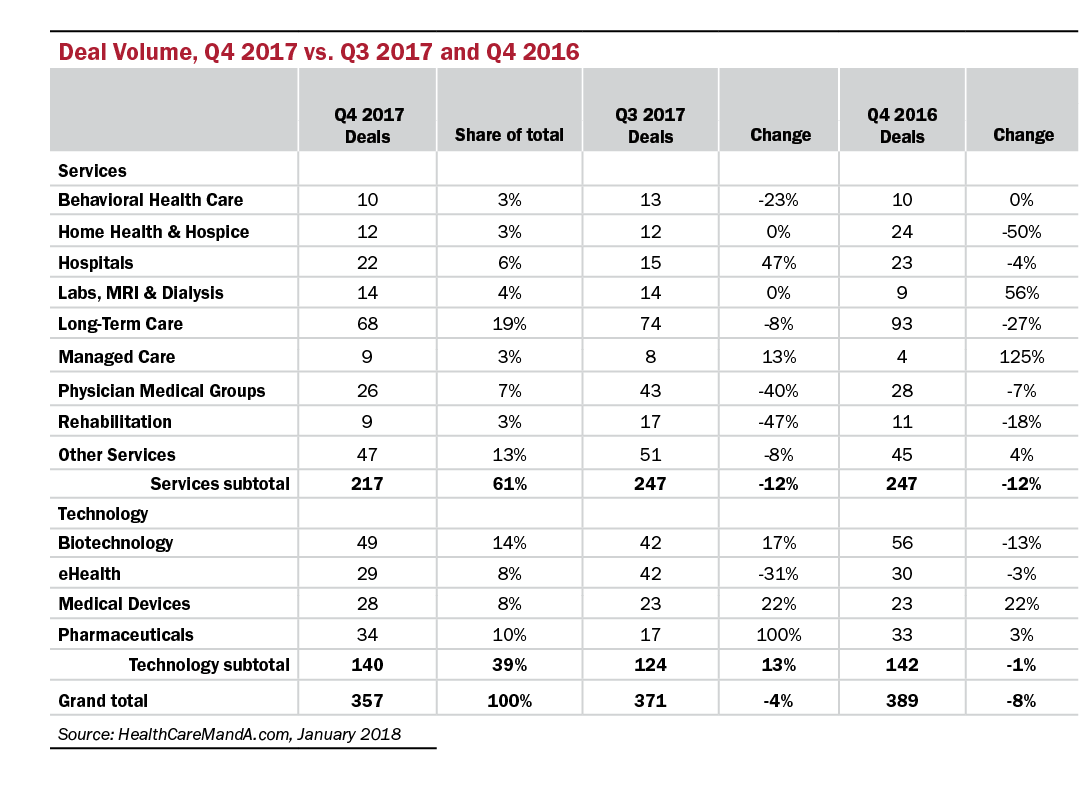

Our preliminary data shows 357 transactions were announced in Q4:17, down a slight 4% compared with the third quarter of 2017, and down 8% versus the fourth quarter of 2016.

Dollar volume, on the other hand, was quite high. Preliminary data (again) shows nearly $114.3 billion was spent in Q4:17, a 165% gain over Q3:17, and nearly 200% over Q4:16.

That total rests largely on the back of a single deal, which you’ve probably heard about: CVS Health‘s (NYSE: CVS) acquisition of managed care giant Aetna (NYSE: AET) for $77 billion (including debt). Without that single deal, Q4 deal volume would still be strong, approximatly $37.8 billion, and close to last year’s $38.7 billion spent in Q4:16.

Frankly, it’s the deals themselves, not the amounts spent, that have excited industry players. If CVS and Aetna close their deal, their goal is to create community health hubs around CVS’s 9,700 pharmacies and 1,100 Minute Clinics. Don’t forget, CVS acquired Target‘s (NYSE: TGT) more than 1,660 in-store pharmacies and nearly 80 clinics across 47 states back in June 2015 for $1.9 billion. Even if consumers never set foot in a CVS pharmacy, they may still encounter this new model in a local Target store.

Then there were two major not-for-profit health system mergers. Dignity Health (39 hospitals and 250 ancillary care sites) agreed to merge with Catholic Health Initiatives (101 hospitals and 29 critical-access facilities). Their combined revenue will exceed $28 billion, creating the largest nonprofit health systems in the U.S. It will span 28 states, with more than 700 locations, 139 hospitals and employ more than 25,000 physicians.

The second announced merger, bewteen Chicago’s Advocate Health Care (10 acute care hospitals, one children’s hospital and more than 250 care sites) and Milwaukee-based Aurora Health Care (15 hospitals, more than 150 clinics and 70 pharmaceies), would create a regional powerhouse much like those growing in Pennsylvania, Georgia and other states.

Going into the first quarter of 2018, the annual J.P. Morgan Health Care Summit will likely spawn a few large biopharmaceutical deals. Now that the corporate tax laws have been changed to “level the playing field” for U.S. corporations, we expect this category to wake up from a year-long sleep. More on that in the January issue of Health Care M&A News.