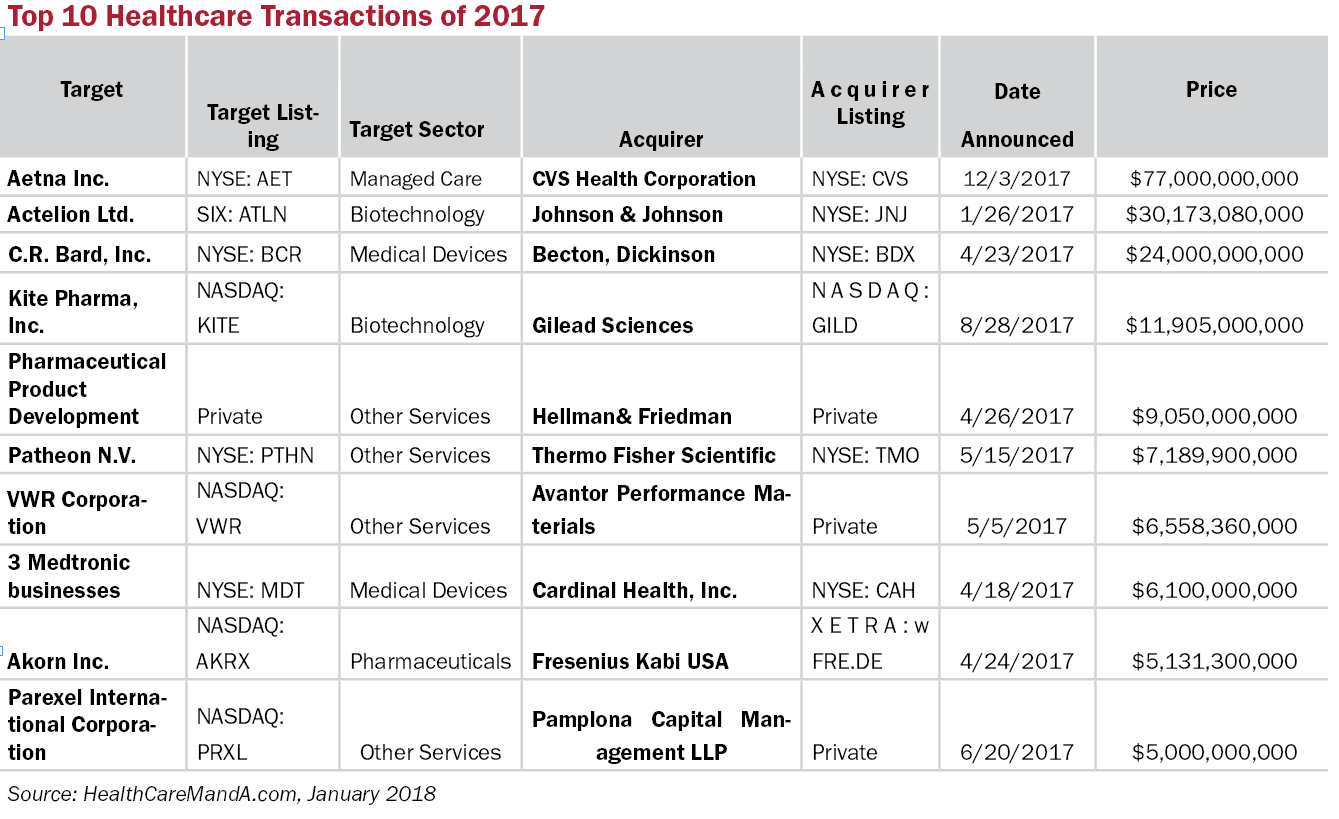

“Variety” best describes the top 10 healthcare deals announced in 2017. The target companies spanned sectors from Biotechnology and Medical Devices to Managed Care and Other Services. You know the healthcare game is changing when just a single pharmaceutical target made the list in 2017, compared with six of the top 10 deals in 2015.

The 10 largest deals total $182.1 billion, and account for 59% of the year’s preliminary deal value total of approximately $310.7 billion. In 2016, the top-10 accounted for 51% of the year’s $256.7 billion in spending.

In 2017, a Managed Care target was again the largest target of the year. Unlike in 2o15, when the Big Five managed care companies tried to merge into the Big Three, we expect this transaction will close. That is CVS Health‘s (NYSE: CVS) $77 billion acquisition of Aetna (NYSE: AET), which came late in the year, but definitely was the biggest game-changer, as well. Although many outlets report the price as $69 billion, Aetna carries a large amount of debt, which CVS assumes at closing.

2017 was a stand-out year for the healthcare industry in many ways, not least of which were the Republicans’ attempts to repeal and replace the Affordable Care Act. Although those failed in 2017, we expect to see renewed assaults in 2018 and beyond.

On the other hand, the recently passed tax legislation, also a solely Republican effort, is expected to benefit multinational companies and thus, mergers and acquisitions. This is just what pharmaceutical companies such as Pfizer (NYSE: PFE) and others have been waiting for, and the floodgates could open up in 2018.

We’ll have more data and analysis in the January 2018 issue of Health Care M&A News, so stay tuned.