Perhaps it was the anticipation of the Thanksgiving holiday, or the holiday itself, that caused the sudden slump in deal volume. Too much turkey, too little focus on finishing up those transactions?

Or we could blame the Republicans’ mad dash to pass their tax “reform” legislation before the end of the year. Both houses of Congress have passed separate versions of the bill, and are presently reconciling those into one, for a final vote. How that will look at the other end of the sausage machine is anyone’s guess, but once the bill is passed, we may see the floodgates open on pent-up demand in the more global sectors, such as Medical Devices and Pharmaceuticals.

This is preliminary data, of course, and more deals may be discovered in the coming weeks. Still, deal volume definitely weakened throughout 2017, and October’s spike looks like an anomaly.

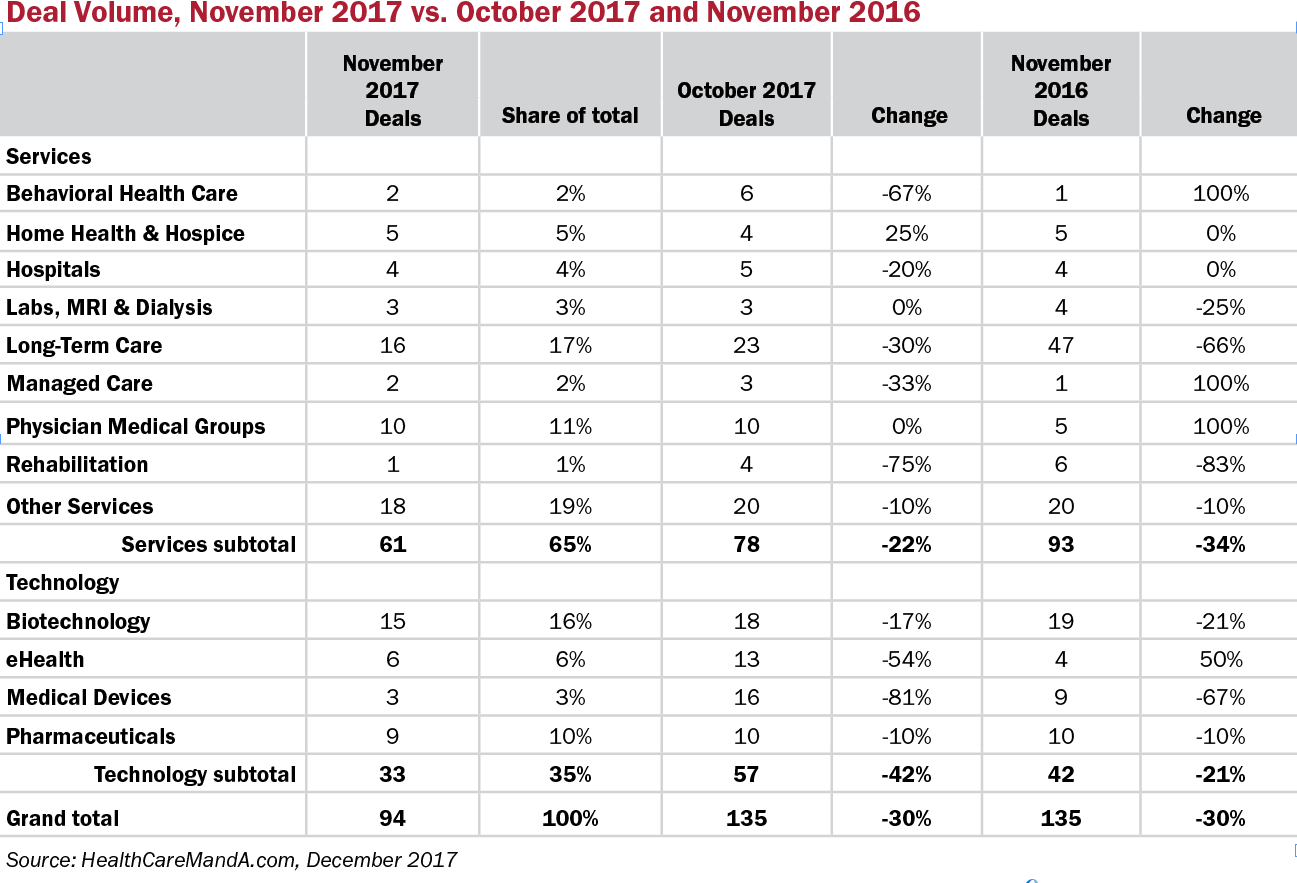

Just 94 transactions were reported in November, a drop of 30% compared with the 135 transactions reported in the previous month, and in the same month a year earlier.

The Long-Term Care sector, which usually leads all sectors in deal volume, hit a hard patch with only 16 transactions, down 30% versus October and down 66% compared with November 2016. The sector had quite a bull run over the last three years, but that appears to have ended.

More on the services side, Behavioral Health Care, Hospitals and Rehabilitation all posted steep drops month-over-month. Rehab was the only sector to see a steep decline (-83%) compared with its performance last year.

Deal volume in all of the technology sectors slipped, with the Medical Device sector plummeting 81%, followed by the eHealth sector (-54%) compared with October.

Dollar volume was not hit as hard as deal volume, posting $7.4 billion for the month. Although it was 35% lower than October’s $11.3 billion, there was only one billion-dollar transaction announced in November, the $1.2 billion sale of Cardinal Health China (NYSE: CAH) to Shanghai Pharmaceuticals (OTC: SHPMY). In October, there were three billion-plus deals totalling $8.5 billion, higher than November’s combined spending.

As of this writing, in the first week of December, deal volume and values have picked up considerably, with the $77 billion acquisition of Aetna (NYSE: AET) by CVS Health (NYSE: CVS), the $4.9 billion sale of DaVita Medical Group (NYSE: DVA) to Optum (NYSE: UNH), and two mergers between major not-for-profit hospital systems, Chicago’s Advocate Health and Wisconsin-based Aurora Health Care, and Catholic Health Initiatives and Dignity Health.

Big changes may be in store in 2018, as value-based payments become more entrenched in the healthcare system. Physician practice management companies such as MEDNAX (NYSE: MD) and Envision Healthcare (NYSE: EVHC) may find it easier to be taken private than to continue posting quarterly earnings. Big Pharma may get back to big acquisitions, if the corporate tax rates fall. In the meantime, we wish you a happy holiday season.