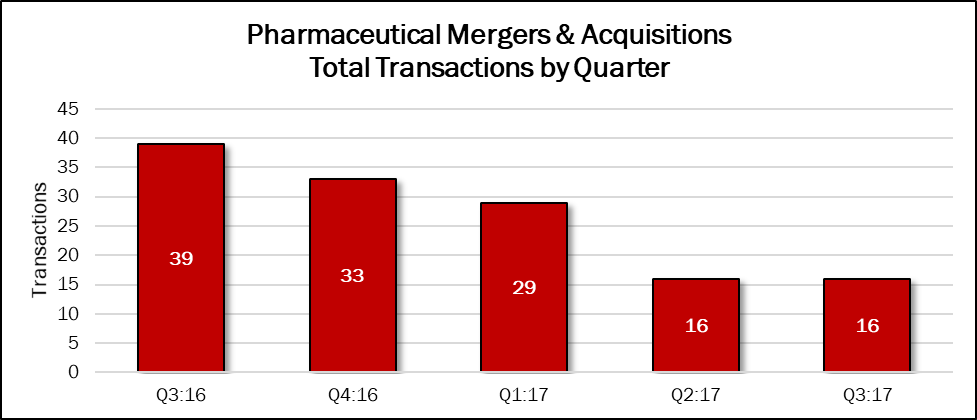

“Sluggish” is the best word to describe deal activity in the Pharmaceutical sector this year. Mergers and acquisitions have dropped every quarter since the third quarter of 2016. In Q3:17, this dearth of deals may have finally bottomed out.

Deal making stayed even with the previous quarter, but that total represented the nadir for deal volume in the previous 12 months. At 16 deals, Q3:17 transactions made up 17% of the 94 deals announced in the past 12 months. The total is 59% lower than in the same quarter in 2016.

As we noted in last quarter’s edition, the global pharmaceutical companies are waiting to see the outcome of President Trump’s tax reform efforts. They are in no hurry to consummate multi-billion-dollar mergers now, if U.S. corporate tax rates are going to plummet in the next 12 to 18 months, and U.S.-based corporations could repatriate billions of dollars to their U.S. coffers. Instead, we’re seeing more bits and pieces of pharma companies being divested, detailed below.

Source: HealthCareMandA.com, October 2017

With the lack of big deals comes lower spending levels. Of the eight transactions to disclose a price, none was higher than $705 million. The approximately $1.8 billion total for Q3:17 represents an 80% decline compared with the previous quarter, and a 90% drop compared with the same quarter a year earlier. The third quarter made up just 6% of the $30.0 billion spent in the previous 12 months.

Dollars Spent on Pharmaceutical Mergers & Acquisitions, by Quarter

| Q3:16 | Q4:16 | Q1:17 | Q2:17 | Q3:17 |

| $18,044,012,000 | $9,047,951,425 | $10,199,770,000 | $9,024,860,000 | $1,775,500,000 |

The largest transaction of the quarter came from Teva Pharmaceutical Industries, which divested a portfolio of pharmaceutical products in its women’s health division to the global private equity fund CVC Capital Partners. The cash price of $703 million is far below the $1.1 billion that Teva received for its Paragard® intrauterine device, which it sold to CooperSurgical in the third quarter. Combined annual sales of the women’s health pharmaceuticals were $258 million in 2016.

Teva also announced the sale of its emergency contraception brands, in tandem with the previous deal. The acquirer in this transaction was Foundation Consumer Healthcare, LLC, a portfolio company jointly owned by affiliates of Juggernaut Capital Partners and Kelso & Company. Foundation paid $675 million for Teva’s Plan B One-Step® and Teva’s value brands of emergency contraception, Take Action®, Aftera®, and Next Choice One Dose®. Combined net sales for the full year 2016 were $140 million. Proceeds from all of these deals, including the Paragard deal, will go to repay Teva’s term loan debt. Teva is also planning to divest its oncology and pain management business in Europe, and will turn its focus on CNS (central nervous system) and respiratory treatments within its Global Specialty Medicines business.

Endo International, now repatriated to the United Kingdom, sold its Mexican generic drug manufacturer, Grupo Farmaceutico Somar, for $124 million. The acquirer was yet another private equity firm, Advent International Corporation. In 2016, Advent acquired inVentiv Health and ATI Physical Therapy from other private equity firms, for undisclosed prices.