Physician medical groups are still hot properties, of course. But the rate of consolidation within the industry accelerated rapidly in the past two years, and it was inevitable the pace would slacken at some point.

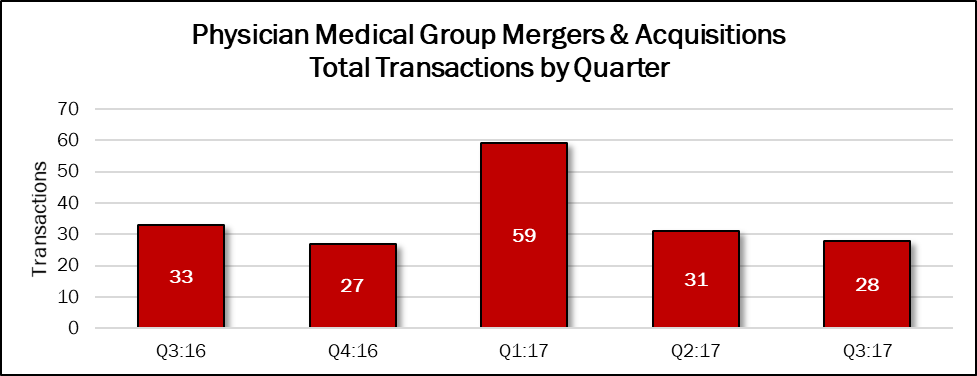

The 28 acquisitions announced in the third quarter represent 19% of the 145 deals announced in the previous 12 months. Deal volume was down 10% compared with the previous quarter, and down 15% versus the same quarter a year earlier.

Longer payment cycles associated with value-based reimbursement is just one reason many physician practices have joined larger groups or health systems. Electronic medical records, revenue cycle management and billing are all necessities for today’s medical practice, but they are costly, as well. Many practice management companies are privately held, as private equity firms continue to build platforms around dermatology, anesthesiology, radiology and ophthalmology, to name a few specialties. Everything is for sale at the right price, and we expect to see more of these companies change hands in the coming year.

Source: HealthCareMandA.com, October 2017

Source: HealthCareMandA.com, October 2017

Only two deals disclosed a price in the third quarter, for $1.4 billion, which represents 12% of the $11.9 billion spent in the past 12 months. That figure also represents a 91% increase from the second quarter. No financial terms were disclosed in the third quarter of 2016.

Dollars Spent on Physician Medical Group Mergers & Acquisitions, by Quarter

| Q3:16 | Q4:16 | Q1:17 | Q2:17 | Q3:17 |

| $0 | $6,411,900,000 | $3,284,901,610 | $760,000,000 | $1,450,915,000 |

The largest transaction in this sector was the $1.45 billion sale of DuPage Medical Group to Ares Management LP. DuPage is the largest independent multi-specialty group in the Chicago area, with more than 600 physicians in more than 80 locations. Boston-based Summit Partners, which made a $250 million minority investment in the practice in 2016, exited. The deal will enable continued support for growth initiatives across the entire organization, including DMG’s practice management company, DMG Practice Management Solutions, and DMG’s subsidiary, Boncura Health Solutions.

It isn’t often a price is disclosed in transactions in this sector, unless they are in the multi-million or billion-dollar range. So, it was interesting to see publicly traded Nobilis Health Corp., based in Houston, announce it had paid $915,000 to acquire DeRosa Medical, P.C. in Phoenix, Arizona.

DeRosa Medical is a primary care practice that specializes in health and wellness, medically supervised weight loss, and chronic health condition management. It has 10,000 active patients, which it serves through its nine primary care providers, comprised of physicians and nurse practitioners. The practice has three locations in Chandler, Glendale and Scottsdale. The DeRosa Medical acquisition represents the most recent addition to Nobilis’ Concertis portfolio. The deal adds Arizona into Concertis’ clinically integrated network, which has begun to contribute significantly to Nobilis’ surgery patient flow in its Texas markets.