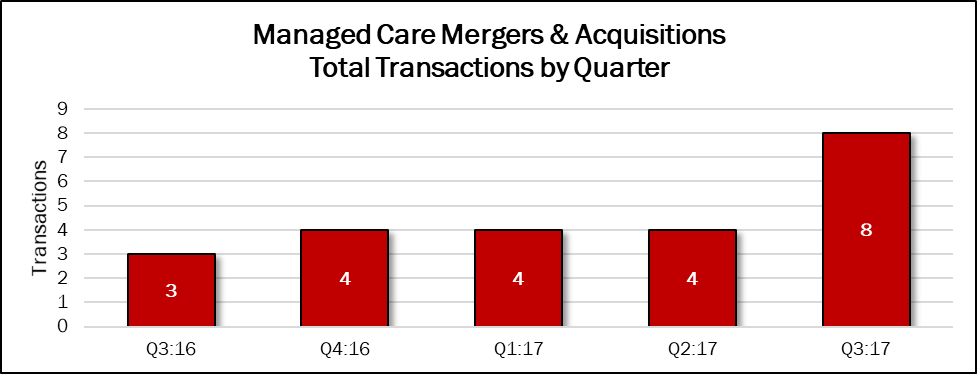

Deal volume in this sector was low in 2016, and through the first half of 2017. Then deal activity doubled in the third quarter, if only to eight transactions. Third quarter deal volume represents a 40% share of the 20 deals announced in the previous 12 months, and a 167% increase over the same quarter in 2016.

We don’t expect this sector to sustain even this level of activity, given recent events. Although the Republican party has control of Congress and the White House, efforts to repeal the Affordable Care Act were unsuccessful, even in a late September push.

President Trump made clear his disappointment, and then issued a pair of executive orders on October 12 aimed directly at the health insurance market. First, he directed the Labor Department to look for ways to enable small businesses and consumers to form associations that could purchase health insurance across state lines. Then he ended the federal cost-sharing reduction (CSR) payments made to health insurers under the ACA.

Nineteen states attorneys general immediately sued the latter order. Insurers had baked this possibility into their 2018 rates, but that won’t soften the blow to lower income families and individuals.

Source: HealthCareMandA.com, October 2017

Source: HealthCareMandA.com, October 2017

Two of the eight deals disclosed prices in the third quarter, for nearly $4.2 billion. That represents 81% of the $5.1 billion in spending announced in the previous 12 months.

Dollars Spent on Managed Care Mergers & Acquisitions, by Quarter

| Q3:16 | Q4:16 | Q1:17 | Q2:17 | Q3:17 |

| $0 | $957,500,000 | $0 | $0 | $4,150,000,000 |

The largest deal was announced by Centene Corporation, an insurer focused on the Medicare and Medicaid marketplaces. The company acquired the not-for-profit Fidelis Care, based in Queens, New York, for $3.75 billion. Fidelis Care provides health insurance coverage through Qualified Health Plans, Child Health Plus, Essential Plan, and Medicaid, available through the New York State Health Marketplace, as well as through the Medicare Advantage, Dual Advantage, and Managed Long-Term Care programs. The deal will expand Centene’s national leadership in government-sponsored healthcare with a leadership position in New York, the country’s second largest managed care state by membership. With the addition of New York, Centene will have a leadership position in the country’s four largest managed care states by membership: California, Florida, New York and Texas.

Magellan Health, which combines health coverage for special populations and pharmacy benefits management, announced its acquisition of Senior Whole Health, a health maintenance organization serving complex, high-risk populations, providing both Medicare and Medicaid dual-eligible benefits to more than 22,000 members in Massachusetts and New York. The price was $400 million.

Private equity firms have been feverishly acquiring ophthalmology practices for some time. Centerbridge Partners followed the theme, but instead acquired Davis Vision, a managed care provider in vision care, from Highmark Health. Financial terms were not disclosed.