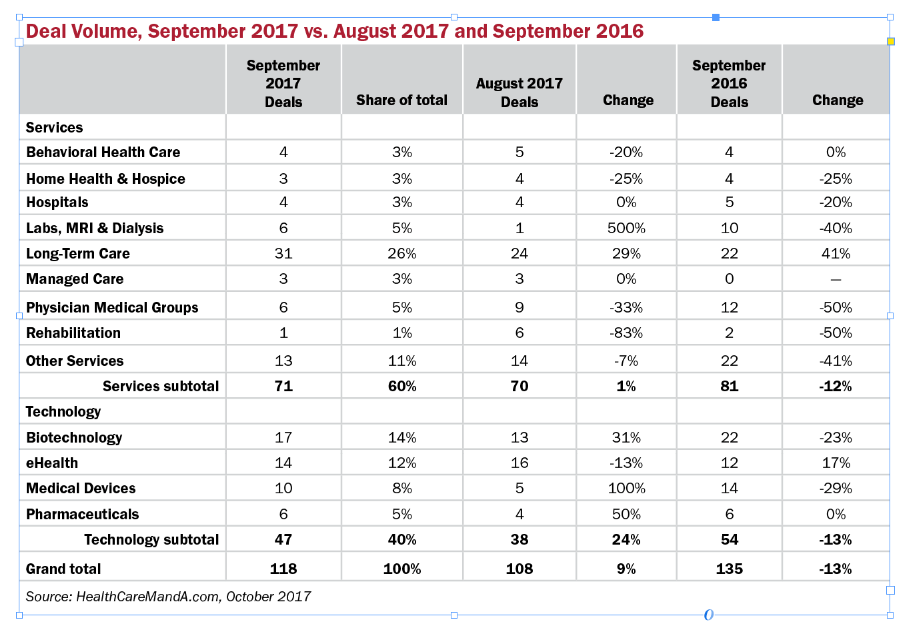

It was business as usual for healthcare deal makers in September 2017. The 118 transactions we’ve captured to this point are 9% ahead of August’s deal volume (108 deals), but down 13% compared with the same month in 2016 (135 deals). If you’ve read this column at all in 2017, you’re not surprised. The market is still transitioning toward value-based care and reimbursement, and that’s boosted a couple of sectors, and given others pause.

One sector that’s seen deal volume wax over the past 18 months is Physician Medical Groups. Only six transactions surfaced in September 2017 (-33% vs. August, and -50% from a year ago), but the deals aren’t over yet. Private physician practices still face the need for electronic medical records and revenue cycle management to help them cope with the slow-but-steady transition to value-based (read: longer payment cycles) care, even as they still cope with fee-for-service cases.

Primary care physicians, or those that are left, appear to have left this field already, signing up with local hospitals or larger independent physician groups. Now it’s the turn for specialty practices, such as dermatologists, gastroenterologists, urologists and the like, to sign on with a management company that also specializes in their area. British Columbia-based CRH Medical Corporation (NYSE: CRH), focused on gastroenterology practices, made its first foray into the United States a couple of years ago and has made several acquisitions since. Two were announced in September 2017, although no prices were disclosed.

Most other sectors are bumping along, volume-wise, neither breaking out of a funk nor sinking to new lows. One example is the Labs, MRI & Dialysis sector, which notched six transactions in September. Big whoop, you say, but that represents a 500% gain over August’s sole transaction. Oh, and a 40% drop from last year’s September romp of 10 transactions. When trading is so light, we can’t break out the pom-poms and noisemakers, even for a 500% gain.

The same goes for monthly spending totals in 2017. The nearly $11.7 billion we’ve logged for September is a decent amount, but pales in comparison with August’s $22.3 billion (-48%) and last year’s $20.4 billion (-43%). That’s because only two transactions announced in September topped the $1 billion-mark, compared with six $1 billion-plus deals in August, and four in the same month in 2016.

Case in point is spending in the Hospitals sector. A year ago, two major transactions contributed $7.7 billion in this sector. They were Fresenius Helios’ (FRE.DE) $6.5 billion deal for Spain’s largest hospital network, Quironsalud, and Medical Properties Trust (NYSE: MPW) $1.25 billion deal for the real estate assets of nine acute care hospitals owned by Steward Healthcare (and Cerberus Capital). Although Steward and Medical Properties Trust have made news earlier this year, the Hospital sector is seeing more not-for-profits joining together, which doesn’t make for high prices.

With the ACA’s fate sort of settled, we may see more movement in this fourth quarter. But not yet. □