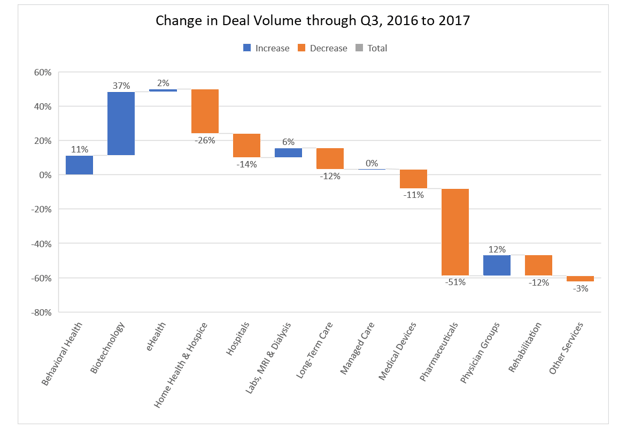

If you thought 2017 has been slow for mergers and acquisitions, you must focus on the Home Health & Hospice or Pharmaceutical sectors. Those two top the list for underperforming sectors through September 27, 2017, compared with the same time last year. If you’re in Biotechnology, however, you’re not getting much sleep.

We pulled data for the years 2016 and 2017, each set through September 27, just to see which sectors are up, and which are down. Overall, deal volume is 8% ahead of the same time last year, when the presidential election was raging. So far this year, we’ve recorded 1,105 transactions, compared with 1.024 in the same period in 2016.

The Pharmaceutical sector is tanking, down 51%, chiefly due to last year’s elections. President Trump campaigned against high drug prices, and championed a “Made in America” theme against manufacturers that had moved jobs elsewhere. While the previous Obama administration had tightened rules against corporate tax inversions and managed to quash a couple of mega-mergers in this sector, the Trump administration swayed effectively stopped virtually all big deals until the president’s promised tax reforms were made law. Why do a multi-billion-dollar deal now, when the tax rate may be so much better in a few months?

Likewise, Biotechnology (up 37%) is reaping the benefits of drug companies with a lot of money in their vaults, but fewer and fewer products in their pipelines. Rather than invest in R&D, drug companies are buying up promising drug candidates and programs, hoping to find their next blockbuster drug.

The healthcare services sectors, with the exception of Behavioral Health (+11%), Labs, MRI & Dialysis (+6%), Managed Care (0%) and Physician Medical Groups (12%), are all showing signs of a slowdown.

Most of those sectors (Hospitals, Long-Term Care, and Rehabilitation, for example) are facing reimbursement headwinds, higher labor costs or just investor jitters over the fate of the Affordable Care Act. The ACA matter looked to be settled in July, but sprang to life again in mid-September, as the deadline to pass it in the Senate with a simple majority loomed on the 30th. As of September 26, the matter was settled once again, but one of the bill’s sponsors, Sen. Lindsay Graham (R-SC), insisted it would return again once tax reform was dealt with. It’s like watching “Groundhog Day” with a cast of zombies. Not looking forward to it.