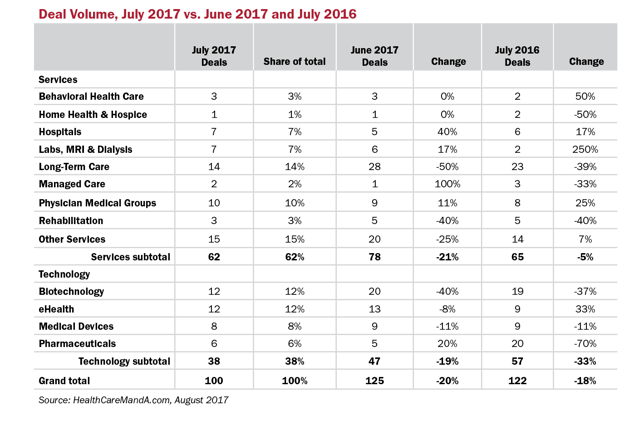

Deal makers took a break in July, judging by the lower deal volume and lower deal value posted in our preliminary data for the month. Compared with the previous month, deal volume dropped 20%, to 100 transactions, and deal value fell 49%, to $8.7 billion.

Third quarters are typically slower for mergers and acquisitions, although there have been a few exceptions. In 2015, a record 411 deals were announced in Q3, which was 17% better than the same quarter in 2014, and 10% better than the third quarter in 2016. With little more than one month into Q3:17, we’ve logged 106 transactions. Not exactly a strong pace, but that could change.

At this writing, the Senate Republicans failed to get the necessary 52 votes to pass the Better Healthcare Reconciliation Act, and measure after measure went down in defeat, 51-49, during a days-long marathon voting session at the end of July.

What’s left is a bipartisan group of senators working to shore up the Affordable Care Act’s most immediate problems, particularly the individual insurance exchanges. Also, Sen. Lamar Alexander (R-TN), head of the Senate Committee on Health, Education, Labor & Pensions (HELP), announced hearings will begin on September 4 to stabilize and strengthen those markets before the September 27 deadline for managed care companies to sign contracts with the federal government to sell policies on those exchanges in 2018. Many companies are saying it’s too late, as they’ve already priced policies and/or announced their withdrawal from some state’s exchanges.

If the HELP committee makes good headway, we may see more strategics making bolder moves in the fourth quarter. But global healthcare players, particularly Big Pharma, are waiting for Congressional action on corporate tax reform. Organic growth is not enough to keep their bottom lines growing, but M&A has been quiet in this sector, with July deal volume down 70% compared with July 2016. Monthly spending totals are down 86%, year over year, too. Unless and until the big players can repatriate cash from overseas with few or no penalties, don’t look for big deal announcements from Big Pharma.

Total spending in July 2017 was off by 49% compared with June’s $17.1 billion total. Year over year, however, July 2017’s total represents a 51% increase compared with the $5.8 billion spent in July 2016.

Two deals exceeded the $1.0 billion mark last month, which certainly helped the total. KKR (NYSE: KKR) subsidiary Internet Brands acquired digital health company WebMD (NASDAQ: WBMD) for approximately $3.6 billion, and LabCorp (NYSE: LH) announced its deal for the global contract research company Chiltern for $1.2 billion. These two deals combined made up 55% of the month’s spending.

August is often a dead-zone of deal making in the healthcare market and, without the impetus of a new healthcare bill or tax reform, we don’t expect that will change in 2017. Congressional Republicans need to get things moving soon, however. We may be surprised.