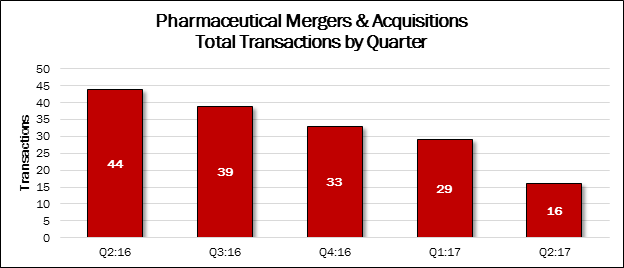

Acquisition data from Q2:17 shows pharmaceutical deal volume continues its steep downward decline. (See chart)

Pharmaceutical deal making slid even further in the second quarter, down 45% to 16 deals, compared with the previous quarter, and down 64% compared with the same quarter a year earlier. This quarter’s deal volume accounts for 14% of the 116 deals announced in the previous 12 months.

This sector enjoyed an M&A heyday in 2014 (188 deals) and 2015 (171). Pharma deals began to dry up in 2016 (156) and are lagging even that slower pace through the first half of 2017 (50 deals). One major reason for the dearth in deal volume this year is that the Big Pharma companies (like all the Fortune 1000 companies) are waiting to see the outcome of President Trump’s tax reform efforts. They are in no hurry to consummate multi-billion-dollar mergers now, if U.S. corporate tax rates are going to plummet in the next 12 to 18 months, and U.S.-based corporations could repatriate billions of dollars to their U.S. coffers.

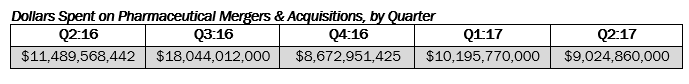

Spending on deals was not hit as hard as deal volume was, however. The $9.0 billion total represents an 11% decline compared with the previous quarter, and a 21% drop compared with the same quarter a year earlier. The second quarter made up 20% of the $45.9 billion spent in the previous 12 months.