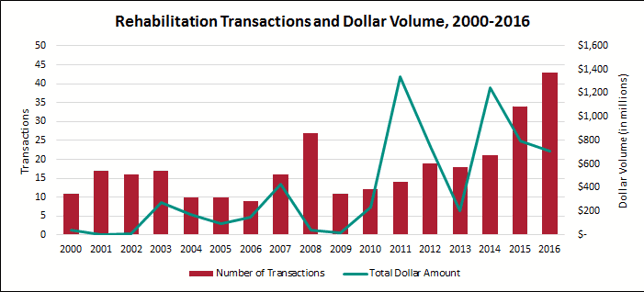

The rehabilitation has historically been the smallest of all the healthcare sectors, typically accounting for the fewest number of deals and lowest dollar volume. Despite an abnormal 27 transactions announced in 2008, the sector generally saw between 10 and 20 deals a year, and minimal spending as well, (see chart below).

Even after the Affordable Care Act was passed in 2010, when most health care services saw an influx in investment, the rehabilitation sector was largely ignored because some reimbursement headwinds at the time. But, as rehab facilities found their place in ACOs, reimbursement eased and large companies began to build their platforms in the highly fragmented sector, investor interest picked up in 2015 with a then-record-34 transactions announced, and reached an unprecedented peak in 2016, with annual acquisitions in the sector surpassing 40 for the first time (at 43, as of this writing).

Rehab even overtook both Behavioral Health Care (41) and Managed Care (20) in terms of number of transactions announced. Spending was not as robust as other years, but still topped $700 million (at $711.9 million), which accounts for the fifth highest annual spend since 2000. However, in three of those years, a single deal featured a price higher than $700 million and each accounted for a significant majority of the annual total (including 97% of 2011’s total comprised of Kindred’s $1.3 billion acquisition of RehabCare Group), while the largest deal in 2016 made up 56% of the year’s total spend. Like physician medical groups, targets in this sector tend to be small, privately held operations and their acquisitions aren’t always publicly announced. So, the 2016’s strength could be understated.

Two of the top five rehabilitation transactions in the past 15 years involved a REIT purchasing the real estate assets of various providers. REITs are relatively new entrants into the space, accounting for just a handful of deals from the early 1990s to 2011, versus about 10% of all acquirers since 2012. One acquisition involved the largest private sector chain of rehab clinics in Germany as the target. Medical Properties Trust and Waterland Private Equity Investments paid $880 million. Medical Properties Trust also accounted for a $400 million takeover of Ernest Health’s eight inpatient rehab hospitals (plus eight LTACs) in 2012 for $400 million, or $660,000 per bed. With their low cost of capital and aggressive buying needs, we can expect to see more REITs purchasing rehab assets in the coming years. Private Equity has also been a major acquirer of rehab facilities, with PE firms as the buyer in 10% of all rehab transactions since 2012. Their biggest splash occurred in 2012 when Court Square Partners acquired outpatient rehab provider Physiotherapy Associates (PA) for $330 million. A couple of PE firms, Water Street Capital Partners and Wind Point Partners, were the sellers. Then in the largest deal of 2016 (dollar-wise), Court Square divested PA to Select Medical Holdings Corporation for $400 million. Traditional rehab companies, like Select Medical, although remain the primary investors in rehab facilities, as they look to expand their portfolios in a highly segmented market.