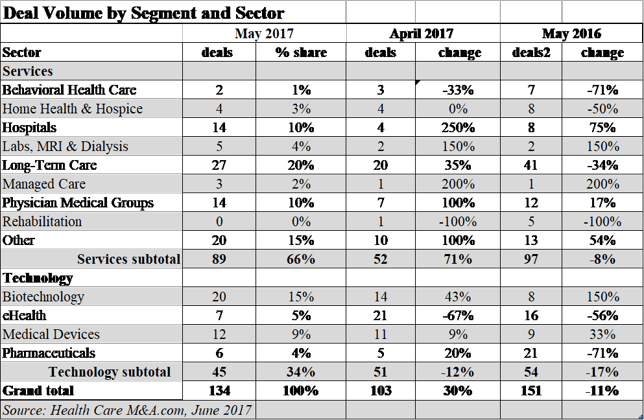

Preliminary data for the month of May shows an encouraging uptick in deal volume, with the services sectors making up 66% of the total. Some 134 transactions were announced last month, a 30% increase over April’s anemic 103 deal volume total. But monthly transaction totals in 2017 are not keeping pace with those in 2016. A year ago, 151 transactions were announced, 11% higher than in May 2017.

There’s no question that the ongoing uncertainty surrounding the American Health Care Act hangs heavily on healthcare investors. The Senate Republicans have been at work behind closed doors to craft a different deal than the one sent to them by the House Republicans in mid-May. From the handful of conferences we’ve attended in the past two months, the fate of the bill is the first topic of discussion, and often, the final one as the conference ends.

Concensus is beginning to form among the expert policy panelists and attendees at these events: The longer it takes for a bill to come out of the Senate, the more it will resemble a “repair” to some of the Affordable Care Act’s more onerous regulations, rather than an outright replacement. Whether the already divided House Republicans will accept such legislation is just as uncertain. As one panelist noted recently, “[Senate Majority Leader] Mitch McConnell (R-KY) chooses his words carefully, and when he says he doesn’t see a path to finding 50 votes in the Senate, the chances for passage of the AHCA aren’t good.”

So investors are shifting their strategies to work with these uncertainties. Private equity firms have a lot of cash they want to put to work, but want to find the safest havens in the healthcare market. That translates to slowing down acquisitions in or selling out of sectors that may be targeted for reimbursement cuts, including Behavioral Health Care and Rehabilitation. Money is moving into the ancillary Other Services sector—most notably to contract research organizations (CROs), or their cousins, contract manufacturing and development organizations (CMDOs).

Rather than bet on pharmaceutical companies, where consumer and political ire is stoked by the mere mention of high drug prices, more investors are choosing specialty pharmacies, which are still charging and getting paid high prices for drugs that treat more narrow conditions and diseases. While pharmacy benefit managers have drawn unfavorable attention for their status as middlemen in the drug-pricing chain, drug distributors have drawn investors in recent months, thanks to their uncontroversial position in that same chain. The Biotechnology sector is still popular with healthcare deal makers, because they are innovating at the front end of the drug delivery system.

Month-to-month spending totals aren’t adequate indicators of investor interest, as one large deal can have an outsized impact. Looking at May 2017’s preliminary total of $32.7 billion and the chart below, it’s obvious that the Hospital sector benefited from the $1.4 billion deal announced by Medical Properties Trust (NYSE: MPT) for 11 facilities owned by IASIS Healthcare, the Long-Term Care sector was pumped up by the nearly $4 billion acquisition of Care Capital Properties (NYSE: CCP) by Sabra Health Care (NASDAQ: SBRA), and Other Services had three billion-dollar deals for CROs, totalling $18.3 billion. We wouldn’t be surprised if deal value for June only reaches $10 billion. See you next month. □