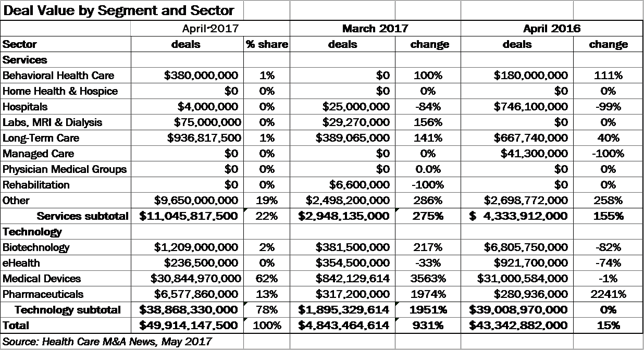

April deal volume disappointed, with 103 deals and a decrease of 29% compared with March 2017 (145 deals). On the spending side, April’s preliminary spending total increased 931% compared with the previous month’s $4.8 billion. Here’s the breakdown.

April’s combined spending hit $49.9 billion, which was 15% higher than the total in April 2016.

This month’s high was the result of a single large deal, the $24 billion spent by Becton, Dickinson and Company (NYSE: BDX) for C.R. Bard (NYSE: CBR), in the Medical Device sector.

Also worth noting is the more than $9.0 billion spent by Hellman & Friedman to buy out the majority stake owned partner, The Carlyle Group (NYSE: CG), in the contract research organization Pharmaceutical Product Development, LLC. CROs are very popular with private equity in recent years, and Carlyle will retain a substantial minority position in PPD.

We mentioned the passing of the American Health Care Act last month by the House of Representatives. Several healthcare organizations have weighed in with the media, giving advice for what their “constituencies” would like to see in the Senate’s version. That version is weeks, if not months, away.

The health care market hasn’t collapsed in the first months of the Trump administration. But as the AHCA progresses in the legislative process, we expect to see more clear winners and losers, on the M&A front. Where are you placing your bets?