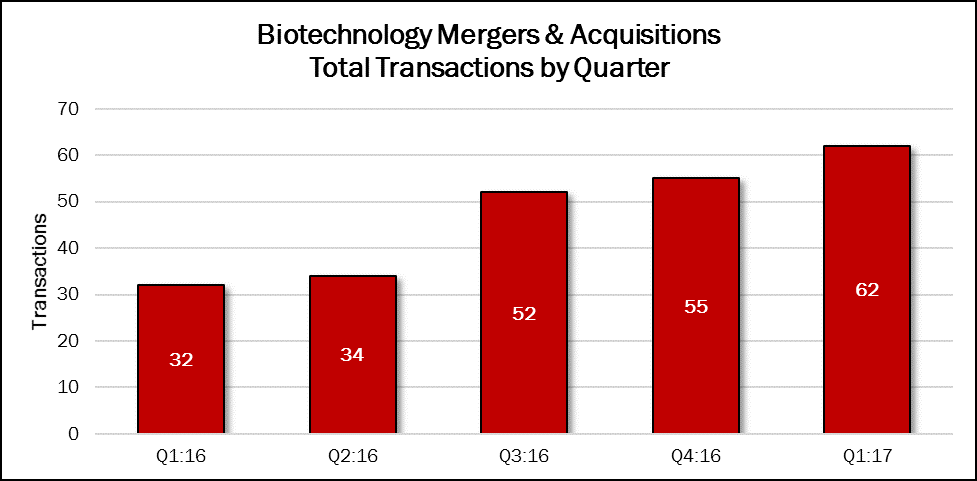

Biotechnology deal activity has climbed steadily over the past five quarters. The sector reached 62 transactions in Q1:17, an increase of 13% over the previous quarter and up 94% year-over-year. The total is 31% of the 203 deals announced in the previous 12 months. M&A in this sector will remain active for years to come, as pharmaceutical companies that have abandoned their own R&D turn to buying up smaller biotechs with promising clinical-stage compounds. The 21st Century Cures Act also benefits this sector, with its billions of dollars in financing for both the “Cancer Moonshot” and the BRAIN Initiative.

In the first quarter, 20 of the 62 transactions involved the purchase of an entire company, while 42 involved the rights or license to a marketed product or a lead drug candidate. The remaining two were research collaboration agreements.

Source: HealthCareMandA.com, April 2017

Source: HealthCareMandA.com, April 2017

Approximately $32.5 billion financed the first quarter’s activity, representing 68% of the $47.6 billion committed in the preceding 12 months. Spending was up 647% compared with the previous quarter, and up 1007% compared with the same quarter a year earlier.

The largest deal of the entire first quarter was announced in January, as Johnson & Johnson acquired Actelion Ltd., Europe’s biggest biotech company, which was spun out of Roche in 1997. The company creates commercially available treatments for rare diseases such as pulmonary arterial hypertension, Tracleer, and a handful of late-stage drugs. The $30.2 billion purchase price did not include Actelion’s R&D unit, which will be spun out of Actelion as a standalone company immediately prior to the closing. J&J will have a 16% minority interest in the new company, as well.

The second largest deal in this sector was far smaller, at $358 million. SELLAS Life Sciences Group, a late-stage biopharmaceutical company, acquired the license to a novel cancer immunotherapy agent and its proprietary delivery technology from Advaxis Inc.

Celgene Corporation announced the third largest deal of the quarter, paying $300 million to acquire Delinia, Inc. from its backers, Atlas Venture and Sofinnova Partners. Delinia develops novel therapeutics for autoimmune diseases. Its lead product candidate, DEL106, will expand Celgene’s inflammation and immunology pipeline.