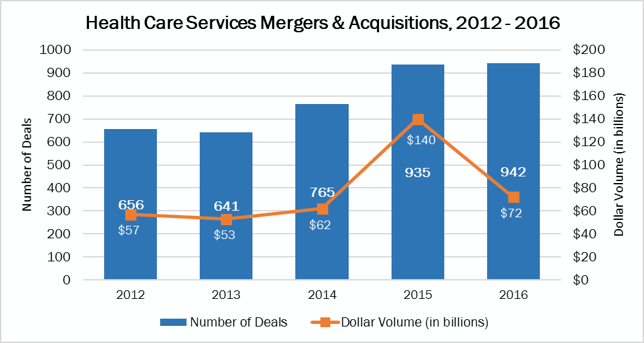

Every spring, we publish myraid statistics on the healthcare services deals announced the year before, in the form of The Health Care Services Acquisition Report. This year’s 23rd edition, which will available in late March, has this examination of what financial buyers targeted in 2016.

Strategic buyers continued to dominate the health care services M&A market in 2016, as they have in the past. Their 683 deals made up 73% of the year’s deal volume. The $45.7 billion spent accounted for 63% of the combined total of $72 billion.

A total of 259 deals, or 27% of the services deal volume in 2016, were carried out by financial buyers, such as private equity firms and real estate investment trusts (REITs). These 259 accounted for $26.3 billion, or 37% of the total dollars committed to services M&A activity. The year before, financial buyers announced 217 deals (23% of the services deal volume) and spent approximately $20.4 billion on those deals (12% of the total dollars committed in 2015).

In 2016, the private equity investors surpassed REITs as the big spenders, thanks in large part to the enormous amount of “dry powder” they’ve accumulated in recent years via exits and successful fund raises. Private funds accounted for 147 deals, or 57% of the 259 transactions, compared with 112 deals in 2015. Spending on those deals reached $18.6 billion, compared with only $8.6 billion in 2015.

Private equity investors spread their interest among all of the services sectors. The most popular by deal volume was Long-Term Care, with 62 deals and $4.5 billion spent. The Other Services sector, which encompasses a variety of ancillary healthcare services, accounted for 32 transactions and $6.6 billion. Physician Medical Groups (14 deals), Behavioral Health Care (11) and Home Health & Hospice (10) were also favorites of these acquirers. The Hospitals and Laboratories, MRI & Dialysis sectors had five deals apiece. Rehabilitation (6) and Managed Care (1) were in the single digits for deal volume, as well.

In 2015, private equity firms often found themselves shut out of auctions, and outbid by larger firms or strategic buyers. The emergence of “tourist-type” healthcare investors—companies or PE firms that were new to the healthcare space—was a common complaint heard at private investment gatherings. That changed in 2016, as these investors managed to find—and pay—for the right target.

REITs posted slightly more deals in 2016 than the year before, (112 vs. 105, respectively), but spent significantly less, just $7.7 billion in 2016 vs. $12.2 billion in 2015.

All of their targets were facility-based, not surprisingly. The Long-Term Care sector was the favorite, as it is every year, with 100 transactions announced and approximately $5.9 billion spent on those deals. Six deals for hospitals were also announced ($1.5 billion), five deals for Rehabilitation centers ($217 million) and one “Other Services” sector transaction for an ambulatory surgery center ($14.3 million).

For more information, check out The Health Care Services Acquisition Report, 2017, 23rd edition.